Since pushing above $1,300 in late August and then falling back below that level again in September, gold has been trading within a very narrow range and volatility in the market has remained low. But during an interview on CNBC Futures Now, metals expert Michael Dudas of Vertical Research said he sees a breakout on the horizon.

Earlier this month, Mint Capital strategist Bill Blain warned that the bond bubble is about to burst.

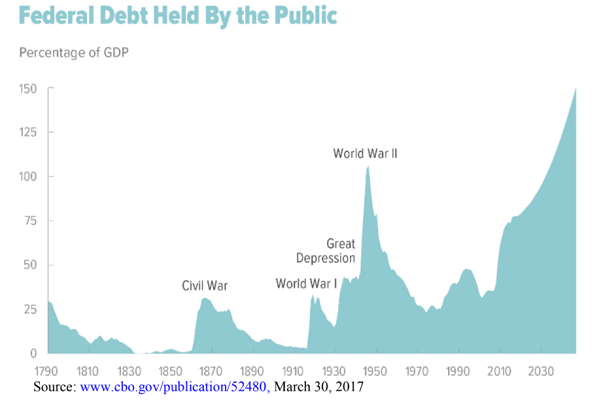

A crash in the bond market would likely take stocks down with it, but there is another impact that is less obvious. It could have a huge impact on the United States’ ability to finance its massive debt.

Some people were predicting Bitcoin would push through the $10,000 level before the end of the year. At the rate it’s going, it may happen before the end of the month.

Bitcoin is on a roll. The cryptocurrency broke $9,000 over the Thanksgiving holiday and quickly pushed up to $9,700. There are also increasing signs of mainstream adoption. CME Group plans to list Bitcoin futures beginning in mid-December, and Coinbase says it added more than $100,000 new users over the Thanksgiving holiday.

Some analysts look at all the action in the world of cryptocurrency and predict the demise of gold. But there are plenty of reasons to believe gold will be just fine.

2017 may well go down in history as the year of the bubble.

We’ve talked a lot about the stock market bubble in recent months, but there are a whole slew of bubbles floating around out there – most of them created by loose monetary policy that has dumped billions of dollars of easy money into the world’s financial systems over the last eight years.

Over the last couple of months, we’ve focused a lot of attention on the stock market bubble. But some analysts say we should be watching the bond market bubble. Last summer, former Fed chair Alan Greenspan issued an emphatic warning: Beware, the bond bubble is about to burst. And when it does, it will take stock prices down with it.

Last week, Mint Capital strategist Bill Blain issued a similar warning.

The truth is in bond markets. And that’s where I’m looking for the dam to break. The great crash of 2018 is going to start in the deeper, darker depths of the credit market.”

As we reported last week, investors are in an era of “irrational exuberance.”

The US stock market is at all-time highs. Meanwhile, market volatility is at lows not seen since the 1990s. In an odd juxtaposition of seemingly contradictory points of view, investors realize the market is overvalued, but at the same time, they believe it will continue to go up. According to a Bank of Ameria survey, 56% of money managers project a “Goldilocks” economic backdrop of steady expansion with tempered inflation.

In an article published at the Mises Wire, economist Thorsten Polleit adds some further analysis and asks a critical question.

Credit spreads have been shrinking, and prices for credit default swaps have fallen to pre-crisis levels. In fact, investors are no longer haunted by concerns about the stability of the financial system, potential credit defaults, and unfavorable surprises in the economy or financial assets markets.

“How come?”

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.

Financial guru Jim Rickards weighed in on the Bitcoin vs. gold debate and came down firmly on the side of the yellow metal. In fact, he’s said there really shouldn’t be a debate. Bitcoin and gold are two totally different things.

Rickards responded to a recent note published by Goldman Sachs declaring that Bitcoin is not the new gold in a column published at the Daily Reckoning. He said he doesn’t really like talking about Bitcoin and doesn’t think there is any real comparison between the cryptocurrency and gold.

The SchiffGold Friday Gold Wrap podcast combines a succinct summary of the week’s precious metals news coupled with thoughtful analysis. You can subscribe to the podcast on iTunes.