As expected, the Federal Reserve raised interest rates by 50 basis points at the December Federal Open Market Committee (FOMC) meeting. That pushed the federal funds rate to 4.5%. The last time rates were this high was in 2007. That’s bad news for an economy addicted to easy money.

While the pace of rate hikes slowed, the messaging coming out of the Fed was substantially the same as the November meeting.

The US government ran a massive $248.5 billion deficit in November, according to the latest Monthly Treasury Statement. There was only one month in fiscal 2022 with a bigger budget shortfall. This is bad news for the Federal Reserve as it tries to raise interest rates and shrink its balance sheet to fight price inflation.

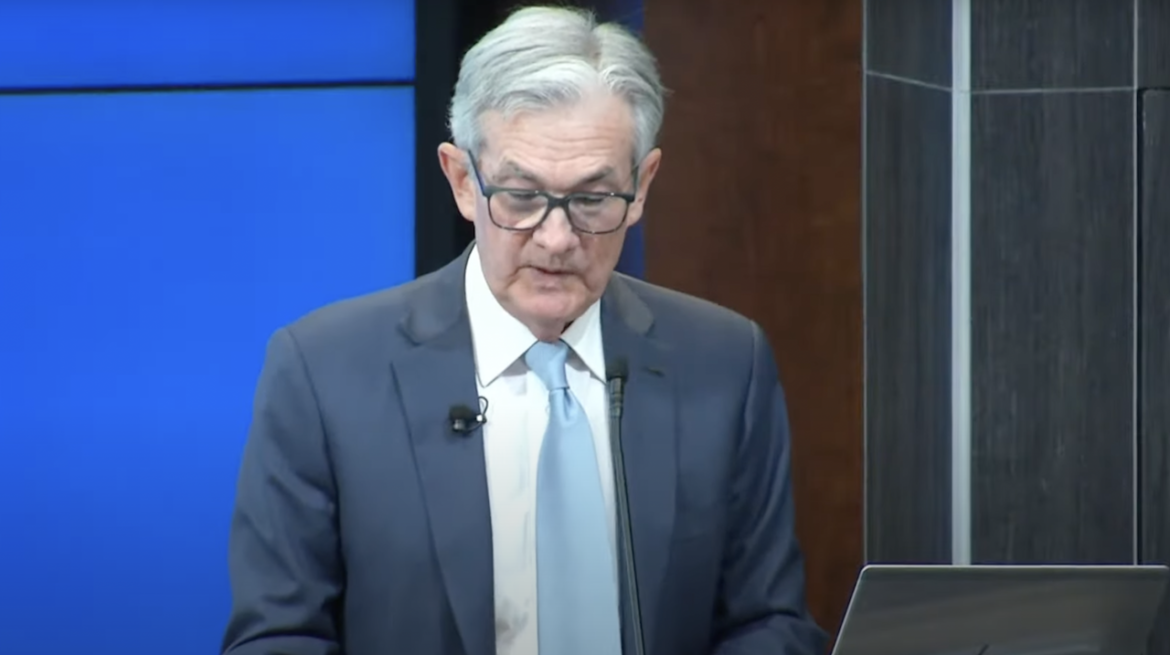

Federal Reserve Chairman Jerome Powell came out this week and indicated the central bank is set to pivot away from its aggressive rate hikes. But he couched the announcement in hawkish terms. The markets bought the pivot and ignored the hawkishness. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey puts Powell’s remarks in a broader context and speculates about what might be coming down the pike.

Federal Reserve Chairman Jerome Powell all but confirmed a soft pivot by the central bank in its inflation fight on Wednesday, while trying to maintain a hawkish demeanor.

The markets appear to be buying the pivot, but they are ignoring Powell’s “tough guy” spin.

In another bad sign for a housing bubble that is quickly deflating, investor purchases of single-family homes tanked in the third quarter.

Meanwhile, overall home sales continue to tumble and prices are falling.

After running a $1.3 trillion deficit in fiscal 2022, the US government took up right where it left off to start fiscal 2023 — running a big budget deficit.

The October budget deficit came in at $87.8 billion despite another month of healthy government receipts, according to the latest Treasury statement.

With prices rising and real wages falling, many Americans are struggling to make ends meet. They are increasingly turning to credit cards and other debt to fill the gap. But that creates other problems. Debt has to be repaid and a growing number of Americans are struggling to keep up with payments.

Auto loan delinquencies have risen to the highest level in over 10 years, according to TransUnion.

American consumers continue to dig deeper into debt as they try to cope with rising prices using credit cards. Americans added another $25 billion to their record levels of debt in September, according to the latest data from the Federal Reserve.

Last week, the Federal Reserve delivered a 75-basis point rate hike, but Fed Chair Jerome Powell failed to deliver the more doveish rhetoric that many expected. The messaging did not indicate much softening in the stance on the future trajectory of rate hikes, despite an apparent “soft pivot” the week before.

In his podcast, Peter broke down Powell’s messaging and pointed out a number of very scary admissions that came out of the Fed meeting.

Another debt ceiling fight is looming on the horizon and it appears the US Treasury Department is preparing for the drama. Meanwhile, rising interest rates are rapidly increasing the cost of the massive national debt.