After pulling back slightly in February, Americans went back to borrowing on credit cards in March — despite record-high interest rates. This indicates that consumers continue to struggle to make ends meet in this deteriorating economy. It also reveals that the Fed’s monetary tightening is not cooling spending as promised.

The Federal Reserve raised rates yet again during its May FOMC meeting. Now everybody is trying to decipher the messaging coming out of the Fed to figure out what’s next. But what if the words Powell and Company are saying don’t really matter? In this episode of the Friday Gold Wrap podcast, host Mike Maharrey talks about the latest moves by the Fed and suggests we should focus on the realities over the rhetoric.

Is the rate hike pause in play?

That question remains up for debate after the May Federal Reserve Open Market Committee meeting.

But when you break it all down, the underlying economic reality is far more important than the messaging coming from Powell and Company. And the underlying economic reality is that inflation isn’t beat and the economy is heading toward a cliff.

The failure of First Republic Bank reveals that the banking system isn’t nearly as sound as Treasury Secretary Janet Yellen and Federal Reserve Chairman Jerome Powell would have us believe. But as Peter explained in a recent podcast, it’s not just the banking system that’s messed up. The Fed has screwed up everything that is a function of interest rates by keeping rates at zero for so long.

Treasury Secretary Janet Yellen keeps insisting that the banking system is “sound.” Is it though? Because it doesn’t look particularly sound.

In fact, we just witnessed the second-largest US bank failure ever.

American consumers continued to pile on debt in February, but the pace of borrowing slowed significantly, another sign the economy could be heading toward a recession.

Overall, consumer debt grew by $15.3 billion in February, a 3.8% annual increase, according to the latest data from the Federal Reserve. That compares with an upwardly revised 19.5 billion increase in January.

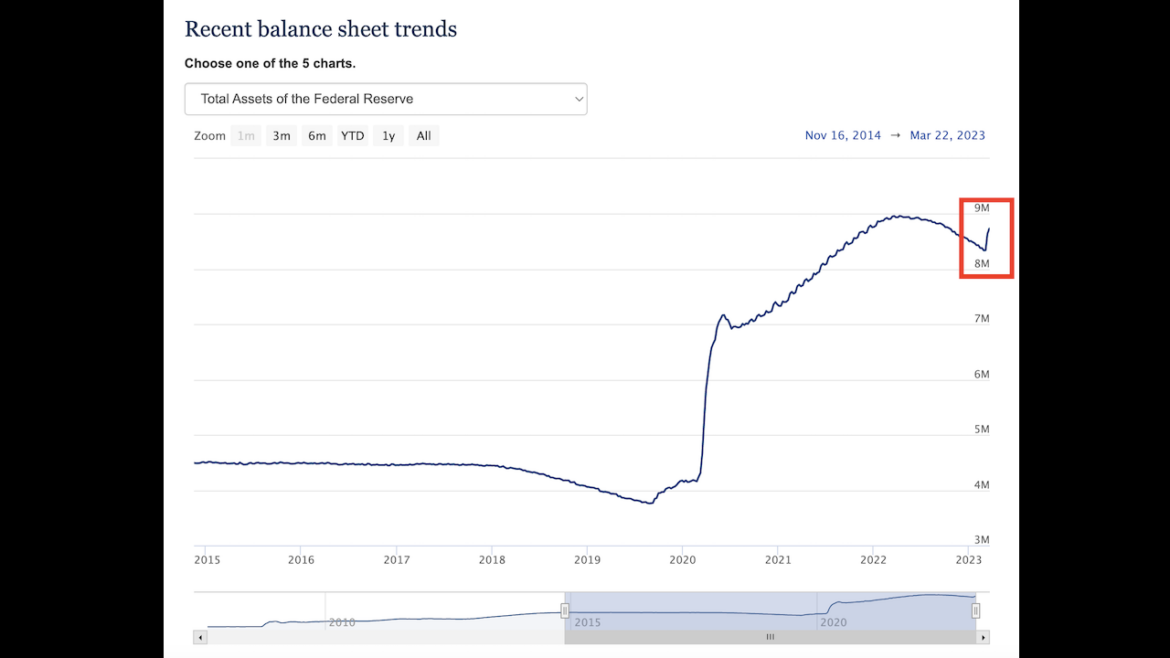

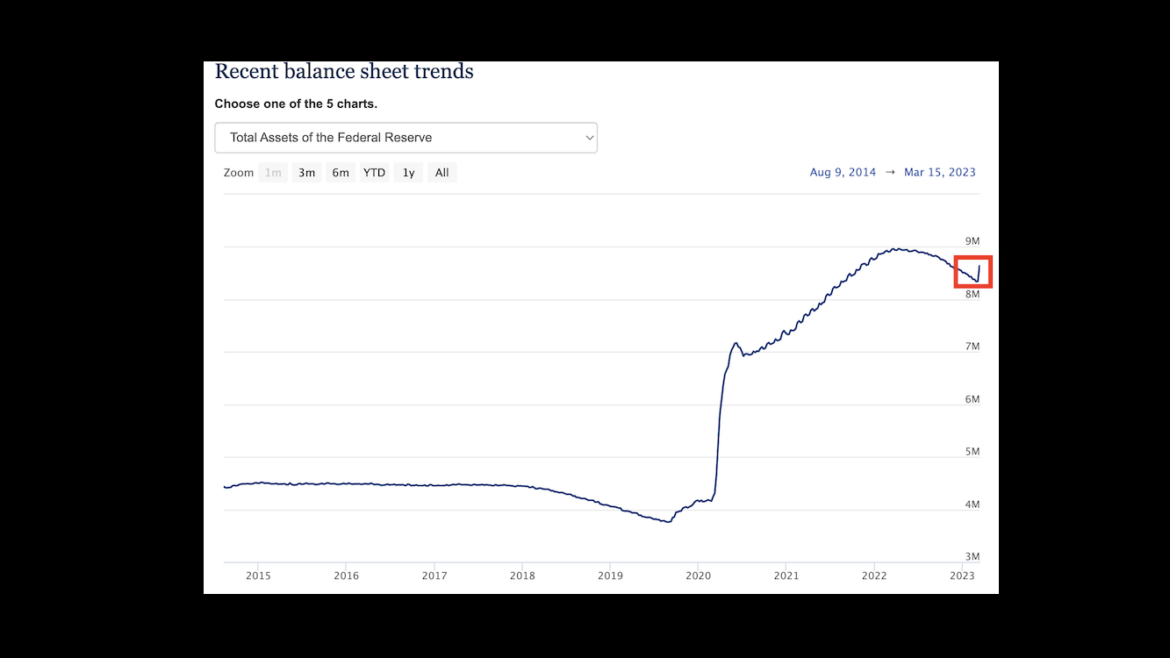

In the week before it raised interest rates another 25 basis points to fight inflation, the Federal Reserve added more than $94 billion to its balance sheet. This was on top of the nearly $300 billion it piled onto the balance sheet in the first week of its bank bailout.

The balance sheet reveals that Fed has loaned banks nearly $400 billion in money created out of thin air in just two weeks.

The Federal Reserve added nearly $300 billion to its balance sheet in a single week as it kicked off its loan bailout program for banks.

In effect, the Fed loaned troubled banks $300 billion of new money that was created out of thin air.

In other words, we got $300 billion in inflation in a single week.

The annual rise in the Consumer Price Index (CPI) for February came in at 6%. This was down from the 6.4% annual increase charted in January. The eighth straight monthly decline in CPI seems to have restored faith that the Federal Reserve is winning the inflation fight. But everybody should probably stop and remember that the target is 2%.

Six percent is a lot bigger than 2%.

On June 14, 2022, Peter Schiff appeared on Ingraham Angle, and he said, “Thanks to the Federal Reserve, everybody has so much debt that we can’t afford to pay an interest rate high enough to fight inflation. But it is going to be high enough to cause a massive recession and another financial crisis that’s worse than the one we had in 2008.”

On March 13, 2023, Peter was on Ingraham Angle again, this time to talk about the beginning of that financial crisis.