The Dow Jones and the S&P 500 hit new all-time records on Tuesday (Oct. 26). In his podcast, Peter Schiff focused on a few speculative stocks that have had meteoric rises (and in some cases crashes) over the last few days. He said this is evidence of the speculative fervor in this massive bubble.

When talking heads and politicians talk about inflation, they tend to make distinctions between “food inflation,” or “energy inflation,” or “wage inflation.” In this clip from his podcast, Peter Schiff explains that this isn’t the right way to look at inflation. In fact, there’s only one type of inflation. And the Federal Reserve is the source of it.

Both gold and silver are seeing quieter activity in Comex contracts. This is not atypical for October and November which are slow months in the lead up to December.

This analysis focuses on gold and silver physical delivery on the Comex. See the article What is the Comex for more detail.

The inflation that we were emphatically told would be transitory and unmoored continues to persist and entrench. As the troubles gather momentum Washington is doing its best to ignore the problem or actively make it worse.

As governments shut down the economy in response to COVID-19 and the Federal Reserve put money printing into hyperdrive, we warned that it was a recipe for stagflation. Today, it looks like stagnation is here.

Stagflation is an economic environment with rapidly rising prices, a weak labor market, and low GDP growth. It’s looking more and more like we have all three elements.

Gold and bonds are both considered to be safe havens. But in a recent podcast, Peter explained why bonds are not a safe haven in an inflationary environment. In fact, bonds – including US Treasuries – are risk assets when inflation is running hot. If you want safety from inflation, you need to buy gold.

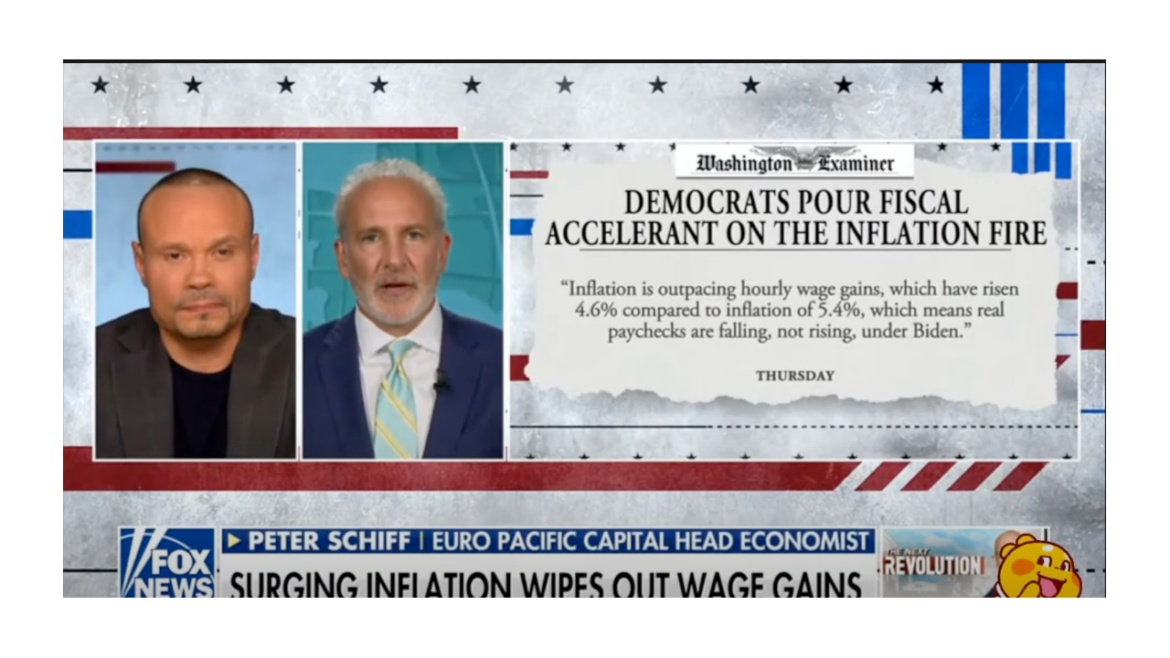

The price of pretty much everything is rising precipitously. The CPI for September came in above expectations with a month-on-month increase of 0.4%. Peter Schiff appeared on Unfiltered with Dan Bongino to talk about inflation in Joe Biden’s America. Peter said you should stock up now because things could get ugly really quickly.

Bongino pointed out that while wages are rising, they aren’t rising as fast as prices. Wages have risen 4.6% while inflation has surged by 5.4% — according to government numbers. Peter said that is typically the trend.

Last week’s jobs numbers came in weaker than expected. September’s CPI came in hotter than expected. That puts the Federal Reserve between a rock and a hard place. Does it tighten monetary policy to fight inflation? Or does it keep stimulating to boost the economy? In this episode of the Friday Gold Wrap, host Mike Maharrey breaks down the data and says it’s about time for the central bank to pick its poison.

The CPI data for September came in hotter than expected at 0.4%. That pushed the yearly gain to 5.4%. But an honest CPI calculation would come in even hotter.

I am doing something different this month. In past reviews of the CPI, I typically take the BLS data and recalculate the values to get a more detailed number that is rounded to two decimal points instead of one. This methodology also allows me to show the impact of each component on the top-line number.

With CPI data once again coming in hotter than expected, it’s getting harder and harder for the mainstream to swallow the “transitory inflation” narrative.

And some people are starting to worry.

During an earnings call, JPMorgan Chase CEO Jamie Dimon expressed concerns about higher than expected and persistent inflation ahead.