According to the BLS, the economy added 428k jobs in April. This exactly matched the March number after it was revised down by 3k. The unemployment rate stayed flat at 3.6%. The Labor Force Participation rate dropped from 62.4% to 62.2%. YoY, this April is up 165k jobs compared to last April.

The Treasury reduced the total debt by $27B in April. This is not atypical since Tax Day falls in April. In April 2016 and 2018, the debt shrunk $78B and $21B respectively. April 2017 and 2019 were both flat due to a debt ceiling saga. 2020 and 2021 were exceptions because the tax deadline was extended.

The Fed hiked rates 0.5% this week in an effort to stem the inflation tide. But the economy already looks shaky and the central bank has barely started this inflation fight. Friday Gold Wrap host Mike Maharrey breaks down the messaging that came out of the Fed meeting and concludes the central bank is getting closer and closer to a crossroads. What will the central bank do? And what will it mean for the economy?

The March trade deficit came in at -$110B. This obliterated the February record trade deficit of $90B. As the chart below shows, the trade deficit has set a record in each of the last 4 months. It was creeping upwards from -$80B to -$90B before exploding in the latest month.

This analysis focuses on gold and silver physical delivery on the Comex. See the article What is the Comex for more detail.

As reported last week, Comex May’s open interest activity was looking weak in silver while gold showed a mixed picture. May has been weak so far, but June continues to look strong.

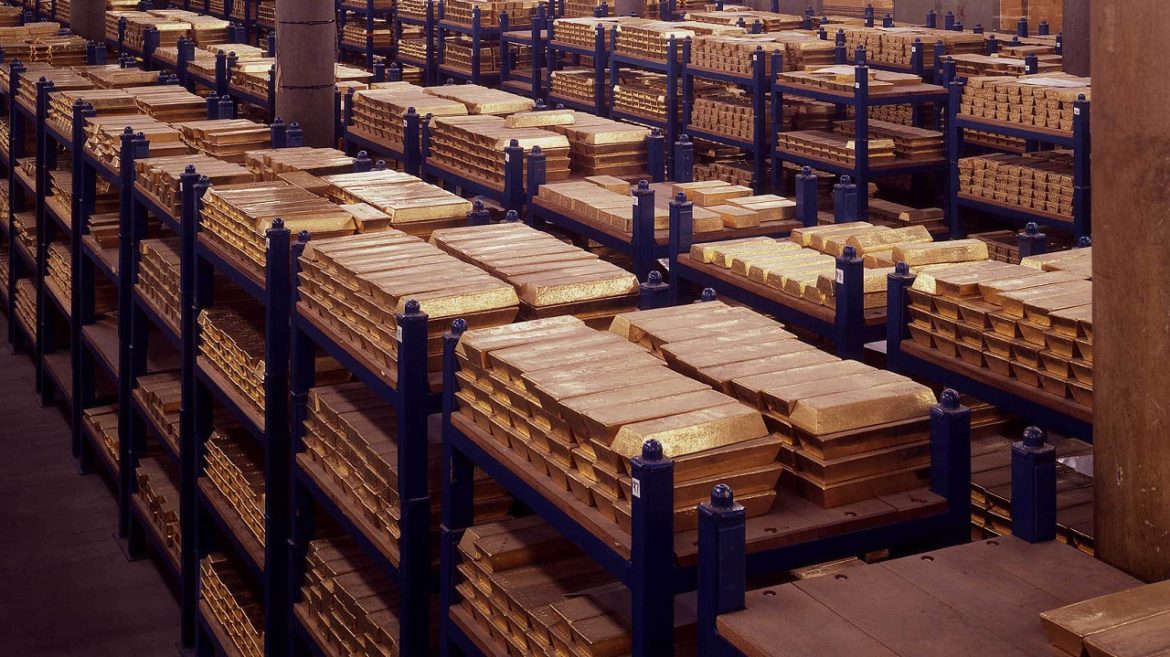

Despite a number of big sales, global central bank gold demand remained brisk as net holdings increased by 83.8 tons in the first quarter of 2022.

That more than doubled the 41.2-ton expansion of central bank gold reserves in the last quarter of 2021 but was 29% lower than the first quarter of last year.

Since the peak on March 8, Managed Money has reduced its Net Long positions by 60k contracts or 43%. Despite massive selling, the gold price has actually held up fairly well. The last time Managed Money net longs dropped this low in February, gold was struggling at the $1800 level, versus the struggle at $1900 now.

Please note: the COTs report was published 4/29/2022 for the period ending 4/26/2022. “Managed Money” and “Hedge Funds” are used interchangeably.

For the second month in a row, the Fed held true to its word and kept the balance sheet relatively flat. In aggregate, the balance sheet expanded by only $2B, though it did reach an all-time high mid-month. The drop to close out the month came as a result of $15B in mortgage-backed securities rolling off in the latest week.

Jerome Powell and other policymakers at the Fed keep telling us they can raise interest rates and slay the inflation dragon because the economy is strong. But these central bankers have a long history of being wrong. And as host Mike Maharrey explains in this episode of the Friday Gold Wrap podcast, the recent GDP numbers undercut this latest Fed narrative. He also talks about a startling confession from the IMF director and Q1 gold demand.

Gold demand surged to kick off the year, up 34% year-on-year in the first quarter of 2022.

Total demand came in at 1,234 tons in Q1. That was the highest quarterly demand since Q4 2018, according to the World Gold Council’s Gold Demand Trends report. Demand in the first quarter of this year was 19% above the 5-year average.