As was widely expected, the Federal Reserve Open Market Committee (FOMC) put rate hikes on pause at the June meeting, although it indicated we should expect additional hikes before the end of the year.

The question is how long will the pause last and will the next Fed move actually be a rate cut?

The Federal Reserve raised rates yet again during its May FOMC meeting. Now everybody is trying to decipher the messaging coming out of the Fed to figure out what’s next. But what if the words Powell and Company are saying don’t really matter? In this episode of the Friday Gold Wrap podcast, host Mike Maharrey talks about the latest moves by the Fed and suggests we should focus on the realities over the rhetoric.

On Wednesday, the Federal Reserve raised interest rates again despite the problems in the banking system. In this episode of the Friday Gold Wrap, host Mike Maharrey talks about the Fed’s inflationary efforts to paper over the problems in the financial system while still keeping up the pretense of an inflation fight. He says it’s like trying to thread a needle with rope.

The Federal Reserve is trying to walk a tightrope — in a hurricane.

After rate hikes resulted in the collapse of Silicon Valley Bank and Signature Bank, the Federal Reserve and the US Treasury stepped in with a bailout. With that hole in the dam seemingly plugged for the time being, the Fed pushed forward and raised interest rates by another 25 basis points at its March meeting.

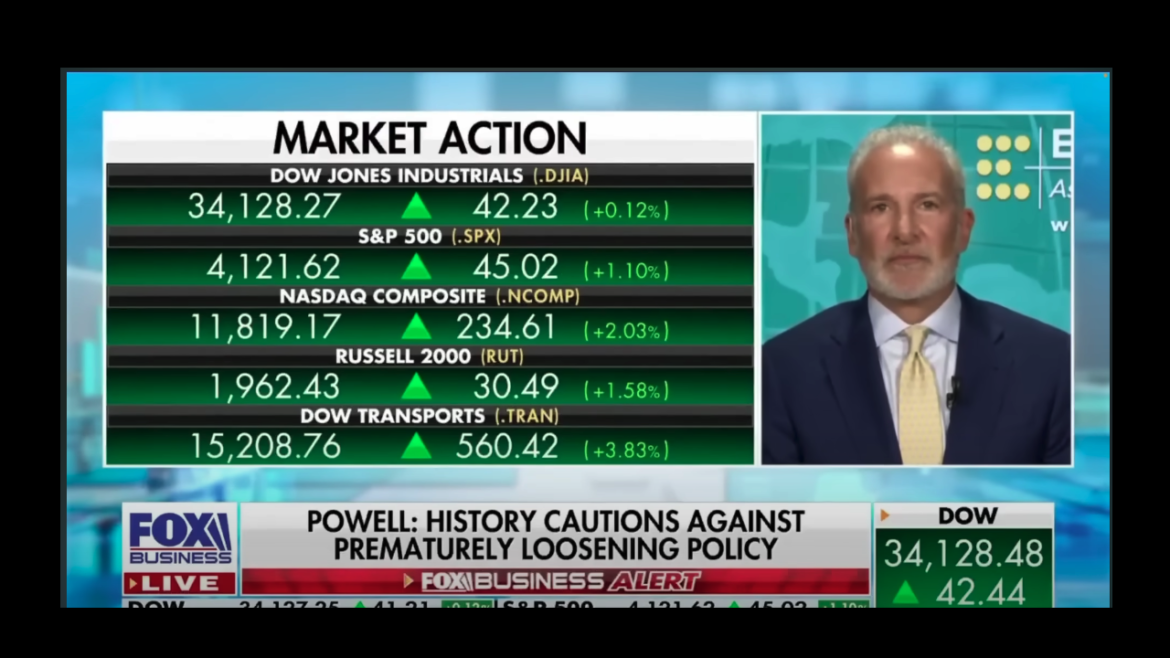

The mainstream seems more and more convinced that the Federal Reserve can bring inflation back down to 2% without creating any significant problems in the economy. After the February FOMC meeting, Fed chair Jerome Powell even suggested that the economy would avoid dipping into a recession. But in an interview on Fox Business with Liz Claman, Peter Schiff argued that the Fed won’t beat inflation or get a soft landing. He said the looming economic slowdown will fuel the inflation fire.

Do you believe your eyes? Or do you believe your ears? That’s the dilemma you face as you try to make sense of the latest Federal Reserve meeting and Jerome Powell’s messaging. It’s also a question to ask yourself if you’re evaluating the performance of gold over the last year. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey explores this dilemma in both contexts.

Is the Federal Reserve easing off the accelerator on its inflation fight?

The answer depends on whether you believe your eyes or your ears.

Last week, CPI data came in cooler than expected but Jerome Powell’s rhetoric remained hot. The Federal Reserve raised rates by 50 basis points and the Fed chair maintained a hawkish tone. Peter talked about the CPI data and the Fed meeting in his podcast. He said the bottom line is the Fed is still completely oblivious to the disaster it has created.

As expected, the Federal Reserve raised interest rates by 50 basis points at the December Federal Open Market Committee (FOMC) meeting. That pushed the federal funds rate to 4.5%. The last time rates were this high was in 2007. That’s bad news for an economy addicted to easy money.

While the pace of rate hikes slowed, the messaging coming out of the Fed was substantially the same as the November meeting.

The Federal Reserve sent out mixed messages after its November FOMC meeting leaving markets wondering just how much more the central bank will tighten monetary policy.

As expected, the Fed delivered another 75 basis point rate hike, pushing the Fed funds rate to between 3.75 and 4%. The last time interest rates were this high was in January 2008.