The markets seem to think that everything is fine. They believe the Fed has effectively beat price inflation and it can mop it up without crashing the economy. In his podcast, Peter Schiff said in reality the Fed is at a fork in the road, and there is an imminent disaster waiting no matter which way it goes. He also warned that the biggest crisis is the one nobody sees coming.

The economy is great! Inflation is dead! We’re on our way to a soft landing! We keep hearing messages like this over and over again from Fed officials, the Biden administration, academics, and financial news pundits. But doesn’t the spin seem a little detached from reality? In this episode of the Friday Gold Wrap, host Mike Maharrey exposes the political class’s gaslighting operation. He also talks about the big selloff in gold this week.

With the Asian hegemons undoubtedly able to introduce gold standards, where does that leave the dollar?

This article describes just how precarious the fiat dollar’s position has become.

The Federal Reserve has pushed interest rates to over 5%. At the most recent FOMC meeting, it indicated that it may have to hold rates higher for longer. But the mainstream remains unconcerned. The narrative is that the Fed has successfully raised rates to fight inflation and is now guiding the economy to a “soft landing.”

In a nutshell, the mainstream financial media seems convinced the US economy has dodged a recession. Meanwhile, the average American seems less than convinced.

So, who’s right?

All eyes are on the Federal Reserve, and people are wondering, what will it do next? The messaging coming from the central bankers is that they will need to keep interest rates higher for longer. But is that possible given the economic conditions and all of the debt in the economy?

Investment and economics writer Jim Grant appeared on CNBC’s Squawk Box to discuss the Fed’s inflation fight and its impact on the economy. He said we ask too much of the central bankers. After all, they are only human.

Everybody knew that the Federal Reserve wasn’t going to hike rates at the September FOMC meeting. And yet everybody waited with bated breath to hear what Jerome Powell would say. In his podcast, Peter Schiff explained why people hang on Powell’s every word. It’s not because they think he knows what inflation or interest rates will be next year. They realize that Powell is just guessing. So, why do people care what he thinks?

Meanwhile, inflation is strong — not the economy.

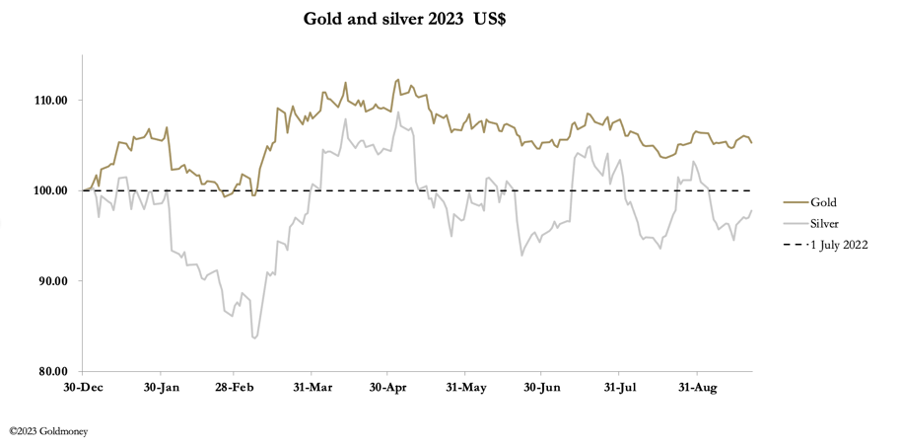

The FOMC and the Bank of England stood pat on interest rates this week. Following the FOMC’s decision, gold and silver fell on the back of its hawkish statement before recovering slightly. In Europe this morning, gold was $1926 up a net $2 from last Friday’s close. Silver fared much better at $23.68, up 65 cents. Silver is obviously in a bear squeeze, while hedge funds have become disinterested in gold.

The Federal Reserve held interest rates steady at the September FOMC meeting, but the committee indicated that it plans to hold rates higher for longer than originally projected.

As you digest the Fed meeting, it’s important to remember that there is a big difference between “saying” and “doing.”

The Federal Reserve continues to bail out US banks as the financial crisis that kicked off last March continues to smolder behind the walls.

Banks borrowed an additional $2.2 billion from the Federal Reserve’s bank bailout program in August. This was on top of the $3.7 billion they borrowed in July.

After the August CPI data came out, Paul Krugman declared that the inflation war was over. The Biden administration and the Fed won the fight. In his podcast, Peter Schiff said he actually agrees with Krugman, at least in part. The inflation war is over. But who really won?