Ben Bernanke served as the chairman of the Federal Reserve from 2006 to 2014. He famously told Congress the Fed was absolutely not monetizing the debt in 2008. He said the difference between debt monetization and the Fed’s policy was that the central bank was not providing a permanent source of financing. He said the Treasurys would only remain on the Fed’s balance sheet temporarily. He was obviously wildly mistaken or outright lying.

In this clip from his podcast, Peter Schiff wonders out loud if Bernanke has ever told the truth.

When Federal Reserve Chairman Jerome Powell appeared on 60 Minutes recently, he was asked what it takes to become the head of the central bank. In a clip from podcast episode 679, Peter Schiff said that when you think about the actual qualifications, Bernie Madoff would have made the perfect Fed chairman. Or perhaps the secretary of the US Treasury department.

So, what does qualify one to head up the Federal Reserve? Peter said that apparently, being clueless about economics helps.

CPI came in even hotter than expected signaling rising inflation. The US government is running a massive record budget deficit. But we’re told these things aren’t a problem. Budget deficits don’t really matter. Inflation is transitory. But how can we be so sure? On this episode of the Friday Gold Wrap podcast, host Mike Maharrey talks about it.

Federal Reserve Chairman Jerome Powell keeps telling us not to worry about rising prices, assuring us that any increase in price inflation is “transitory.” It appears most of the mainstream is buying this hook line and sinker.

The March CPI number was expected to come in hot due to a much lower baseline. Prices tanked last March as governments locked down their economies. As a result, economists expected the year-on-year CPI comparison to show a big increase. But the increase was even bigger than expected. Peter Schiff talked about it in a recent podcast.

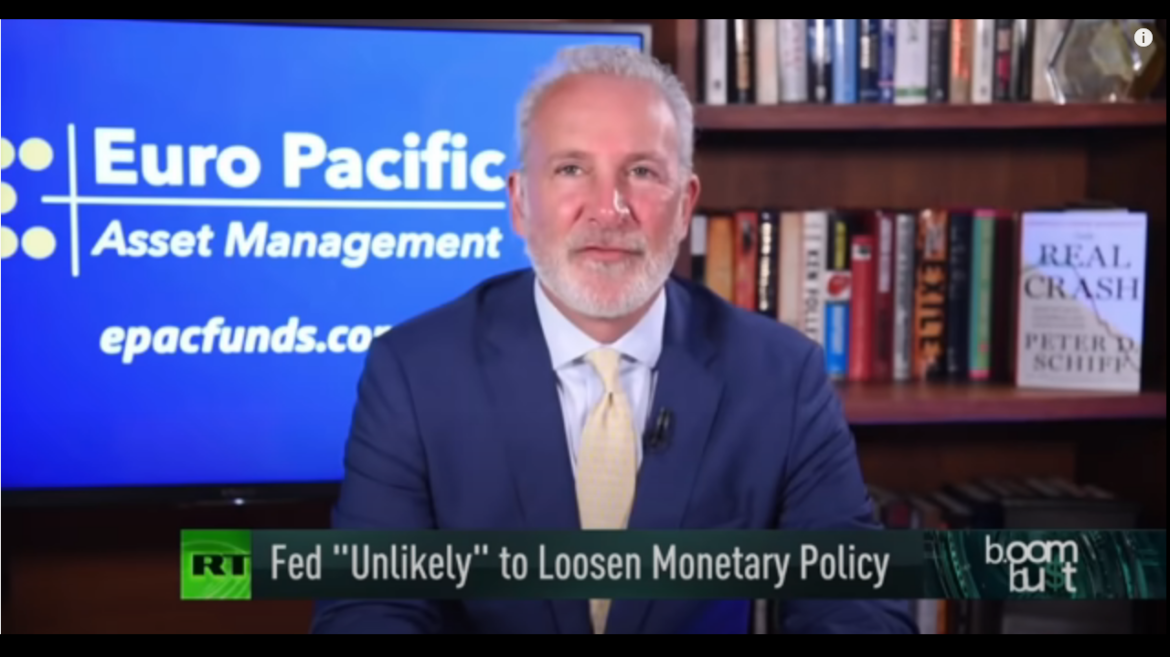

During his recent 60 Minutes interview, Federal Reserve Chairman Jerome Powell reiterated that he thinks any spike in price inflation will be transitory. As he put it during the interview, we may see “temporarily higher prices but not persistent inflation.” Peter Schiff appeared on RT Boom Bust to talk about Powell’s view on rising prices. He called the Fed chair’s position, “laughable.”

Jerome Powell was on 60 Minutes Sunday to reassure us that everything is great and the economy is in fine shape thanks to the Fed. He went on to guarantee the Fed’s indefinite economic support while downplaying inflation. Powell made a lot of promises, but as Peter Schiff breaks it down in his podcast, it becomes clear they are promises the Fed can’t keep.

Apparently, those stimulus checks weren’t enough. American consumers pulled out their credit cards and ran up big balances in February.

According to the latest numbers from the Federal Reserve, consumer debt unexpectedly spiked in February, growing at an annual rate of 7.9%. Economists had expected a small uptick in consumer debt after a flat January, but the sudden surge in credit card spending came as a surprise.

Gold hit its highest price in five weeks after the release of the March Federal Reserve meeting minutes and comments by Jerome Powell both reiterated the central bank’s dovish position. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey talks about the Fed’s dovish cry and how this could play out. He also discusses a strange dichotomy in the unemployment numbers.

Prices are going up. The Federal Reserve is printing money at an unprecedented rate. The US government continues to borrow and spend at a torrid pace. As Peter Schiff put it in a recent podcast, we’re adrift in a sea of inflation. Gold is supposed to be an inflation hedge. So, why isn’t the price of gold climbing right now?

In a nutshell, rising bond yields have created significant headwinds for gold. And the mainstream is reading rising yields and their relationship to gold all wrong.

A bill introduced in Congress would repeal capital gains taxes on gold and silver.

Alex Mooney (R-WV) introduced HR2284. Titled the Monetary Metals Tax Neutrality Act, the legislation would eliminate capital gains, losses and all other federal income calculations on gold, silver, platinum, and palladium bars and coins.