Prices are rising throughout the US economy. Federal Reserve Chairman Jerome Powell keeps telling us this inflationary surge is “transitory.” But transitory doesn’t mean what you think it means. The truth is higher prices are forever.

Here’s just a sampling of the price increases we’ve seen over the past few months.

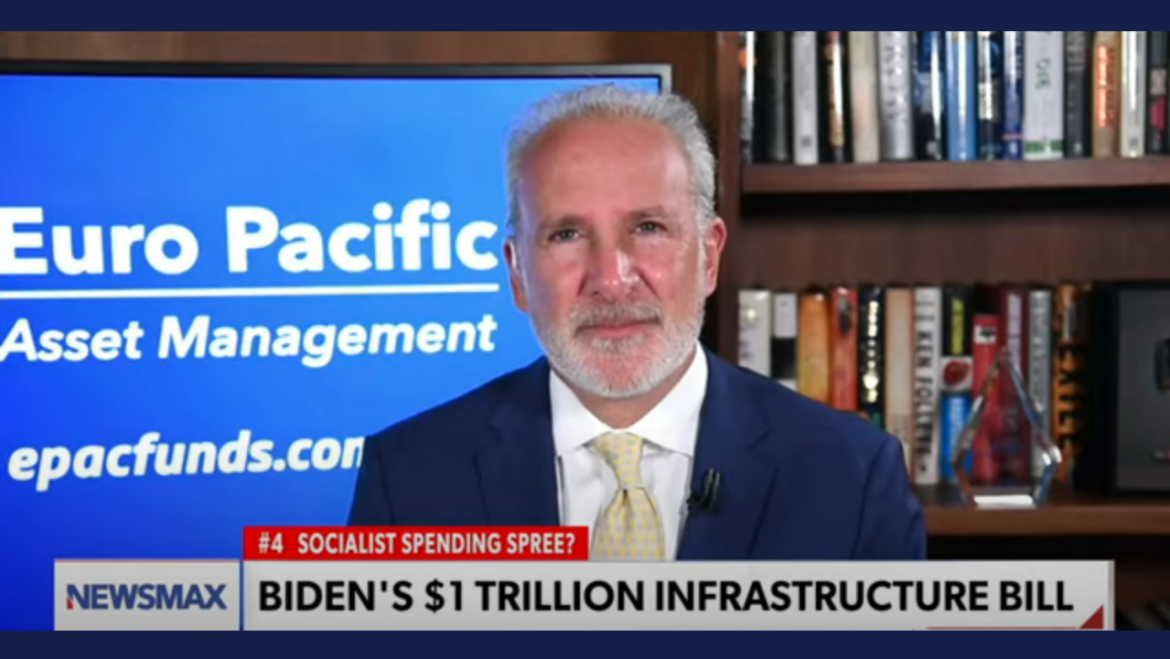

Congress is moving toward finalizing a $1 trillion infrastructure bill. Peter Schiff appeared on Newsmax “The Count” with Jenn Pellegrino to talk about the spending spree.

Biden said spending billions on government projects will help America to “build back better.” Politicians have been promising this for decades. But Peter said it’s the wrong approach. We should get government out of the way and let the free market work.

After posting a 10.4% increase in May, consumer debt continued to expand, growing by a record rate in June.

Consumer credit grew by $37.69 billion in June, according to the latest data from the Federal Reserve. That represents a 10.6% increase. The Fed also revised the May number up from $35.3 billion to $36.6 billion.

We’ve seen a sharp selloff in both gold and silver. Gold was down over $40 an ounce Friday. Meanwhile, the US dollar saw a sharp increase, along with a rise in long-term Treasury yields. The catalyst for these sharp moves was a better-than-expected jobs report and expectation that it will spark a quick pivot to monetary tightening by the Fed.

The markets are moving on fantasy, not economic reality.

“Just because something is inevitable, does not make it imminent, but eventually the future arrives”

The US Government is on an unsustainable debt trajectory. Even though the Federal Reserve has acknowledged this fact, most mainstream pundits consider it a distant problem or even not an issue at all. They argue that debt fears have raged since the debt crossed $1T decades ago and no negative consequences have materialized.

Gold was solidly above $1,800 an ounce this week until Fed Vice Chair Richard Clarida mentioned the economy reaching the Fed’s goals earlier than expected and raised the specter of monetary policy tightening. But is the economy really improving as much as everybody seems to think? In this week’s Friday Gold Wrap, host Mike Maharrey digs into some of the economic numbers and determines they’re faking it.

The Federal Reserve and other central banks around the world have pumped trillions of dollars into the global economy and depressed interest rates to artificially low levels to blow up the mother of all bubbles. The recent acquisition of Afterpay by Square reveals the extent of this global bubble economy that will inevitably have to pop.

Inflation continues to run rampant and it’s distorting the entire economy.

Rising prices create the illusion of economic growth. And they are also allowing the US government to stealthily default on its massive debt. This is not a sign of a strong economy.

We’ve been talking a lot about rising prices. The CPI has come in hotter than expected every month this year. We’re paying more to buy less.

We see the impacts of inflation on price tags, but sometimes it squeezes us more subtlety. It’s known as “shrinkflation.”

The Federal Reserve has three primary tools to conduct Monetary Policy: reserve requirements, the discount rate, and open market operations (Quantitative Easing). Open market operations are how the Fed uses its balance sheet to provide liquidity to the market. More details can be found here. The Fed defines Open Market Operations as: