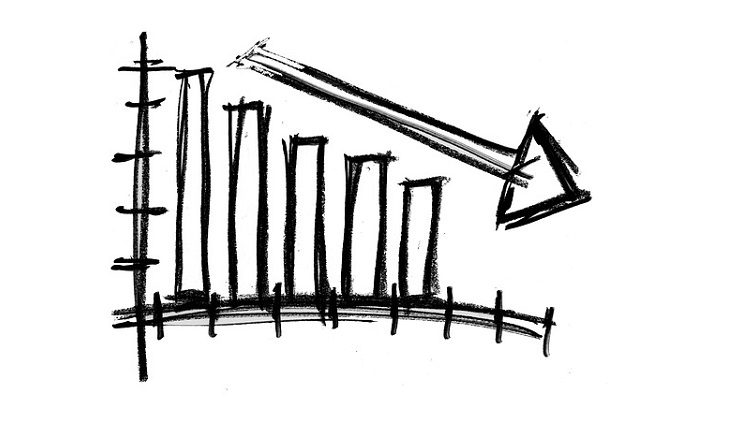

Negative-yielding debt surged to over $15 trillion earlier this month. This pile of negatively-yielding paper includes government and corporate bonds, along with some euro junk bonds.

In a recent episode of the Wolf Street Report, Wolf Richter called this “NIRP absurdity.” And it could be coming to America.

Negative interest rates started out as a short-term emergency experiment during the Great Recession. Now it has turned into the new normal. How will this end?

The bond market flashed a major recession warning sign as the yield curve inverted this week. Meanwhile, Trump whipsawed markets when he appeared to blink in the never-ending trade war with China. That made for an interesting week for gold. In this week’s Friday Gold Wrap podcast, host Mike Maharrey breaks down the events of the last few days and their impact on precious metals. He also remembers an important day in history that went mostly unnoticed in the mainstream.

Economist Art Laffer owes Peter Schiff a penny after losing a 2006 bet.

Now Peter is ready to go double or nothing.

Peter won the penny on a bet he made with Laffer on Larry Kudlow’s TV show back in 2006. Peter said the economy as going to crash. Laffer said the economy was doing great and there was nothing to worry about.

As we know, Peter was right.

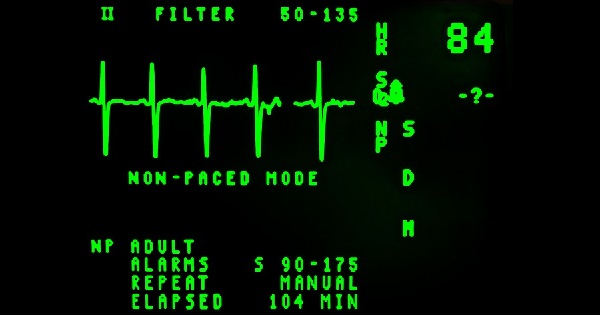

The Federal Reserve has the US economy on monetary life support and Daily Reckoning managing editor Brian Maher says it will never again breathe on its own. As hedge fund manager Kyle Bass put it, the economy is trapped within the inescapable tractor beam of zero percent interest rates.

The price of gold surged this week, breaking all-time records in a number of currencies. It also did pretty well in dollar terms, hitting six-year highs and pushing above the key $1,500 level. Meanwhile, silver had its best single day in over three years. What drove this week’s precious metals rally? And can we expect it to continue? Host Mike Maharrey talks about it in this week’s Friday Gold Wrap.

The Federal Reserve FOMC met this week. When it was all said and done, the Fed did nothing. We’re stuck in neutral.

As expected, there was no rate hike. Fed Chair Jerome Powell indicated that the central bank would likely maintain this neutral stance into the foreseeable future, staying patient, neither raising nor lowering rates. So, why in the world did markets react like the Fed just jacked up interest rates? On this episode of the Friday Gold Wrap, host Mike Maharrey talks about it. He also gives an overview of the most recent World Gold Council demand report.

The Commerce Department released the first estimate of Q1 GDP growth on Friday. It came in higher than expected at 3.2%.

Somewhat surprisingly, the price of gold rose on the news and the dollar showed some weakness. The primary reason was presumably lower inflation. This means the Fed still has the excuse it needs to continue the Powell Pause.

There was also some data in the Commerce Department’s report that reveals shakiness in that growth number. In fact, Peter Schiff said he thinks this will likely be the strongest growth of the year.

Peter Schiff recently appeared on RT to talk about rising oil prices, how they relate to inflation and what it could mean for the US economy.

The mainstream pundits and economists keep telling us inflation is “tame.” But is it really? Or are they just not looking in the right place? In this episode of the Friday Gold Wrap, host Mike Maharrey talks about inflation and how it factors into the bubble economy. He also covers the week’s activity in the gold market and gives you your daily dose of dumb.

When the Federal Reserve artificially manipulates interest rates, it’s messing with our minds by distorting important signals that prices provide in a free market. As investment guru Jim Grant put it in a recent article in Barron’s, central bank interest rates are nothing but crude price controls.

Like all price controls, the Fed’s interest rate mechanizations create some winners and some losers. But in the long run, the distortions caused by the central bank’s interventionist monetary policy makes us all losers.