We talk a lot about how the Fed keeps its big fat thumb on the Treasury market. But it also has its big fat thumb on the housing market. And if the Fed really does follow through with its taper and its plans to shrink its balance sheet, it will have a big effect on the housing market.

If you’ve ever held something under tension down with your thumb and suddenly release it, you know what happens.

Pop!

The Federal Reserve is talking about raising interest rates. Well, that’s going to be a big problem for American consumers who are running up debt at a torrid pace. This is yet another reason why the Fed can’t do what it’s claiming it will do.

Consumer debt jumped 11% year-on-year in November, according to the latest data released by the Federal Reserve. It was the biggest single-month jump in consumer debt in 20 years.

The Fed FOMC minutes came out last week, signaling tighter monetary policy. Peter Schiff talked about the minutes in his podcast, arguing that the Fed can’t do what it says it’s going to do. If it does, it will crash the markets and the economy. And it won’t lower inflation.

The Federal Reserve released the minutes from the December FOMC meeting this week. They were even more hawkish than expected. That sparked a big taper tantrum in the markets. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey gives an overview of the minutes and then asks seven poignant questions they raise that aren’t being asked by the mainstream.

The Fed has a difficult choice to make.

Will it crash the economy? Or will it crash the dollar?

Whichever way this coin flip turns out — you lose.

Peter Schiff and Santiago Capital CEO Brent Johnson got together on the Rebel Capitalist podcast to debate the trajectory of the dollar in 2022. Johnson is bullish on the dollar. Peter thinks the greenback is going to tank.

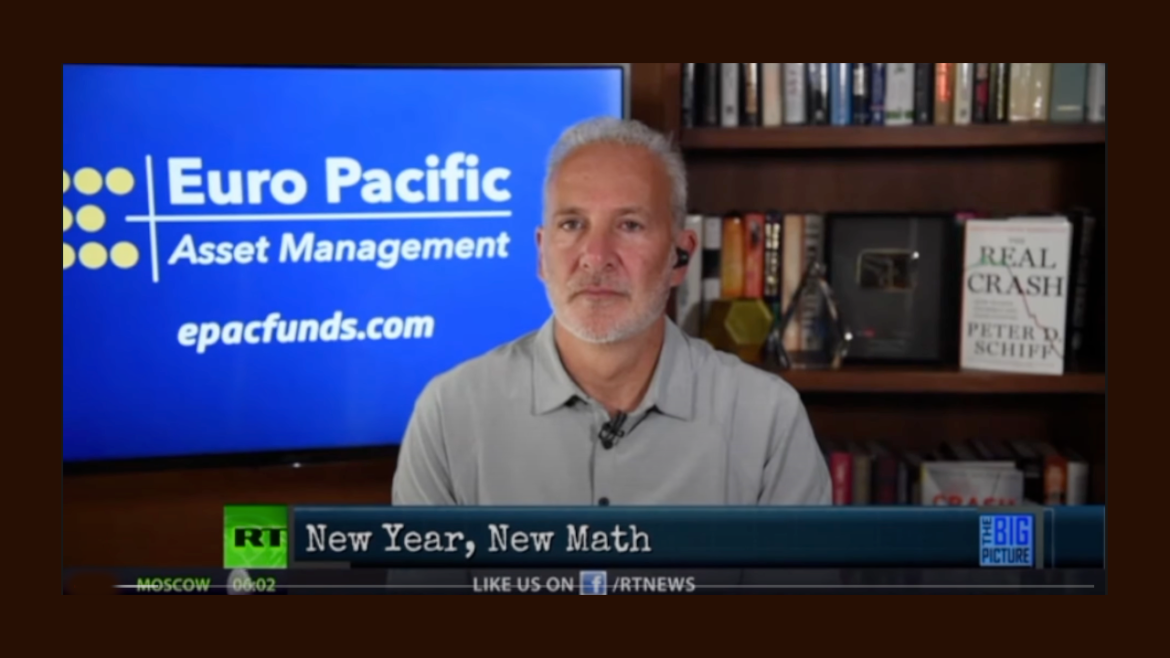

How are the dollars and cents of your life changing as we move into 2022? Peter Schiff joined University of Miami Business School Dean John Quelch and host Holland Cooke on RT’s “Big Picture” to talk about the year ahead. Peter left us with an ominous warning. 2022 will be worse than 2021 as inflation continues to mount.

As 2021 goes into the history books, Peter Schiff looks back over what he calls “a year of peak speculation.”

Of course, the big story of the year was inflation.

Inflation is running rampant. Even Jerome Powell has been forced to acknowledge that this bout of rising prices isn’t “transitory.” As Peter Schiff put it, there is no ceiling on inflation.

The Federal Reserve has sped up its timetable for tapering its asset purchases and raising interest rates. Many in the mainstream have called this a “war” on inflation, but the central bank is bringing a pea shooter to a bazooka fight. A real fight against inflation would require interest rate hikes that would crash a US economy built on debt.

We’re on the cusp of a new year. We certainly had a wild ride in 2021 with continuing coronavirus drama, inflation that turned out to be not so transitory, and a record-breaking stock market bubble. So, what was the biggest story of 2021? Friday Gold Wrap host Mike Maharrey thinks it was a story that wasn’t told – the story of real interest rates. He wraps up the year by telling that story.