Keynesian central planners suffer from what Peter Schmidt calls “fatal conceit.” Paul Krugman serves as the poster child for central planning arrogance. But it’s the Federal Reserve that gives the central planners power, as Schmidt highlighted in the first article in a series highlighting this fatal conceit. Schmidt built on this theme in the second article, telling the story of Benjamin Strong and his role in blowing up the 1920s stock market. In this third installment of the series, Schmidt tackles the question no one dares to ask.

The Reserve Bank of India (RBI) bought gold for the first time in nearly a decade during its last fiscal year.

The Indian central bank added 8.46 tons of gold during the fiscal year ending June 30, according to its latest annual report. The additional yellow metal brings India’s total gold reserves to 566.23 tons.

The last time the RBI bought gold was in November 2009. The Economic Times of India called the central bank’s decision to add to its gold reserves “significant.”

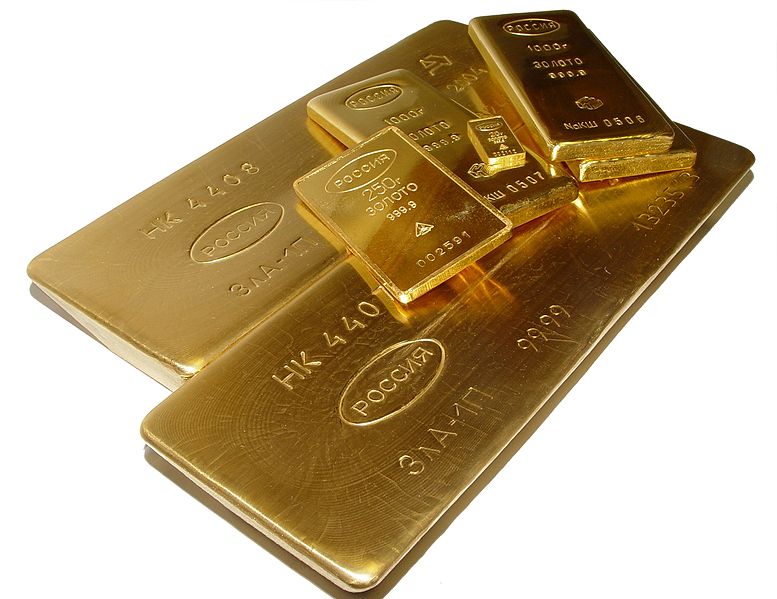

Russia’s gold holdings have topped 1,800 tons.

To put that into perspective, between 2000 and 2007, the Russian central bank held just 400 tons of gold. At that point, the country launched an aggressive gold acquisition program. In October of this year alone, the Bank of Russia bought 21.8 tons of gold. At 1,801 tons, the yellow metal now accounts for 17.3% of the country’s reserves. In the second quarter of 2017, Russia accounted for 38% of all gold purchased by central banks. Russia ranks sixth in the world in gold holdings behind the United States, Germany, Italy, France, and China.

Russia’s growing gold hoard is helping to establish economic and political stability and independence for the country.