Peter leads off this week with an episode covering last Friday’s stock catastrophe, Bitcoin’s recent performance, and the start of President Trump’s so-called “hush-money” trial.

Peter’s back in Puerto Rico this week for his podcast after another week of record gold prices. In this episode, he discusses media coverage of inflation, this week’s CPI report, and Bitcoin’s weakening price relative to gold.

This week Peter recaps another stellar week for precious metal. He also discusses Friday’s jobs report, commodity prices, and Bitcoin.

This week Peter returned from vacation, and he was just in time for a surge in the price of gold. He discusses the factors contributing to gold’s record prices, the similarities between today and the 1970s, and data pointing to future inflation in America.

This time Peter tackles Jerome Powell’s speech from Wednesday, in which he announced that the Fed is holding the federal funds rate between 5.25 and 5.5%. He also briefly discusses Bitcoin’s pullback and the media’s lies about Donald Trump.

In this episode, Peter reacts to a hotter-than-expected CPI report, big trades in Bitcoin, and the federal bill that would ban the popular social media app TikTok. He also notes silver’s historically low price, which is nearly 50% of its 2011 high.

On Sunday, Peter recapped a stellar week for gold. He also provided an analysis of President Biden’s State of the Union Address and criticized Fed Chair Jerome Powell’s perspective on the economy.

This week, Peter reacts to politicians’ sophomoric views on inflation and explains the recent surge in the price of gold. He also comments on the first day of Jerome Powell’s congressional testimony. Be sure to watch Peter’s special extra episode from earlier this week if you missed it.

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold prices was notably recorded without the typical surge in public buying that usually accompanies such milestones. Instead, there has been a consistent outflow from gold ETFs, suggesting that the retail sector has been selling rather than accumulating during this rally.

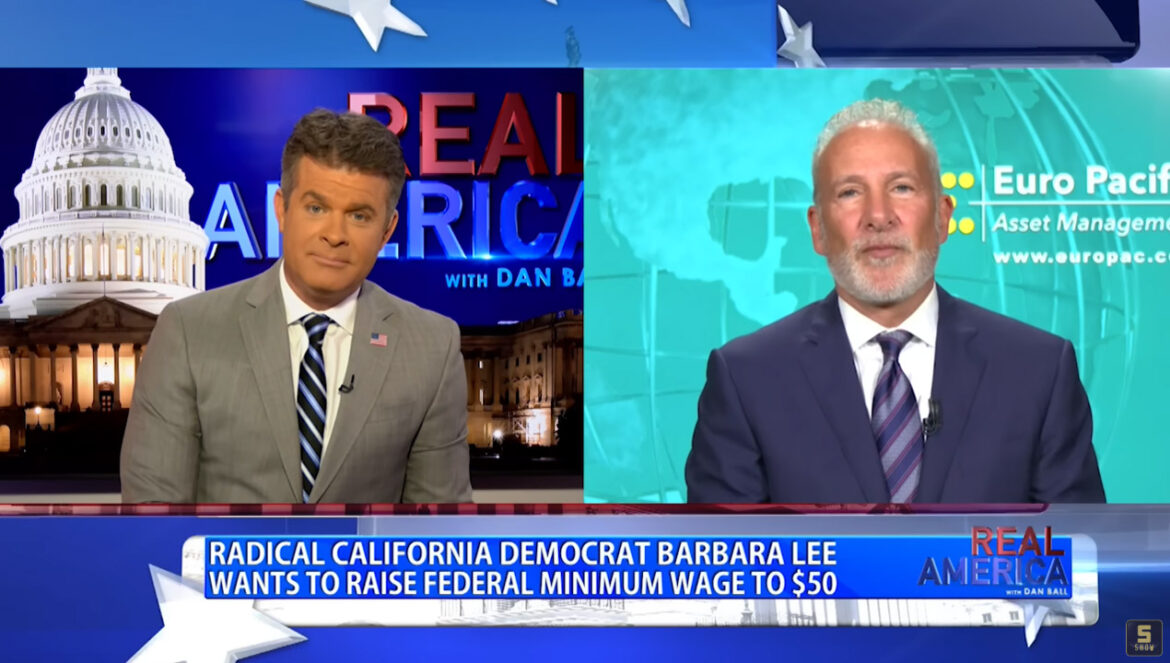

Peter recently appeared on OAN’s Real America with Dan Ball to discuss the minimum wage, government spending, and inflation. He first points out the blatant corruption of the California state government, which recently passed a $20 minimum wage for all fast-food restaurants except those that bake their own bread. The state’s governor, Gavin Newsom, has received several large campaign donations from the owner of many Panera Bread franchises in California, causing Newsom’s critics to question the motives of such an exception. Peter also points out that, under Newsom’s logic, such an exemption will actually hurt Panera’s employees. If minimum wages are so helpful to workers, why exempt Panera at all?