Alix Steel of Bloomberg spoke with Jim Rickards, author of Currency Wars, about the Federal Reserve’s conundrum over raising rates. Rickards says that despite what the Fed says now, it’s not going to raise rates in June. Meanwhile, gold has shown strength even in the face of supposed deflation. Rickards is confident that the yellow metal will climb when the Fed realizes the economy isn’t nearly as strong as its data suggests.

Jay Taylor of Taylor’s Hard Money Advisers interviewed Mises Institute President Jeff Deist about gold as safe money and the importance of unrigged markets. He warns that soon we are going to be faced with another crash as global debt levels rise. Just like Peter Schiff, Deist believes that when the rest of the world gets tired of the Fed’s money-printing, gold will re-emerge as the permanent store of value it has always been.

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was written by Dickson Buchanan, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

After Federal Reserve Chairwoman Janet Yellen’s congressional testimony, the markets are still convinced the Fed could begin to raise rates sometime this summer. This is just plain wishful thinking. The Fed can no more raise rates than it can borrow money into oblivion. The reason is simple: the Fed must maintain the pretense of being solvent to maintain its credibility as a financial institution.

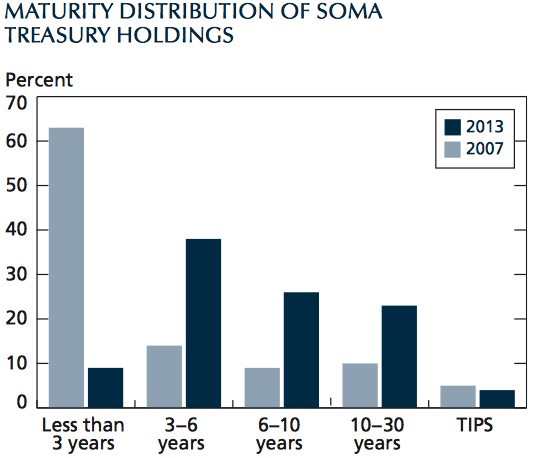

Think about the balance sheet of the Fed. Its assets are a mixture of government bonds, Treasury notes, and mortgage-backed securities. The dollars that the Fed issues to purchase those assets are its corresponding liability. Needless to say, it has purchased a lot of bonds since 2008 (QE1, QE2, QE3). So since 2008, its balance sheet has expanded on both sides.

This isn’t yet a problem, because of the duration of its assets and liabilities. Most of its assets – the bonds and mortgage debt – are long-term, with a rough average duration of over 10 years. Meanwhile, its liabilities are all short-term, current liabilities. These are deposited at the Fed by various banks, and the banks can demand them at any time.

David Morgan, a precious metals expert and creator of the Morgan Report, spoke with Greg Hunter of USAWatchdog about the value of silver as a universal currency and how people are starting to wake up to the lies of central banks. He believes that the world is now facing a dangerous “debt bomb” that central banks are avoiding by printing money. However, Morgan says the days of the financial elite are numbered, and silver is already being used again for everyday transactions.

Once again, Peter Schiff uses his latest podcast to dig into the real economic data of the United States. Here is a round up of the key figures that mainstream news ignores, while focusing almost solely on payroll numbers.

In Peter’s view, either the US economy is already in a recession, or we’re on our way there.

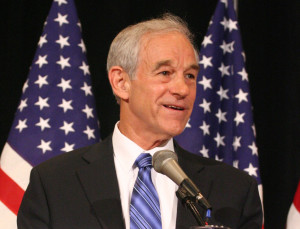

Ron Paul published a scathing article attacking the Federal Reserve’s anti-audit propaganda. Responding to vocal Fed apologists, Paul writes that the American people have a right to decide if the Fed’s monetary system is harmful and current auditing laws are not comprehensive enough.

Paul’s main arguments for a Fed audit include:

- Contrary to what Fed apologists claim, the bill does not have a provision that will allow Congress to infringe on the Fed’s independence.

- The Fed has always been under some form of political influence.

- Current auditing laws only record assets on the Fed’s balance sheet, not what was purchased and why.

- A one-time audit of the Fed’s response to the financial crisis found that it committed over $16 trillion to foreign central banks and private companies between 2007 and 2010.

- A full audit would address the Fed’s long-standing favoritism of political and financial elites.

The Commodity Futures Trading Commission (CFTC) banned four Florida companies from trading precious metals last week. The companies were alleged to have committed fraud by promising to transfer precious metals that customers never actually received. $7.8 million were scammed from unsuspecting victims. The CFTC reached settlements with each business, though the companies never admitted their guilt.

So how did these companies manage to fleece so much money from would-be gold investors? According to the Sun Sentinel, some of the companies operated through telemarketers that would call their victims and convince them to give a down payment towards a loan to buy gold and silver. The salespeople claimed the metals would either be transferred to the buyers or stored at a depository on their behalf.

This sounds like a textbook example of a leveraged gold scheme.

Renowned contrarian investor Marc Faber predicted in an interview with GoldSeek Radio that China will eventually switch to a gold-backed currency. He bases this on the widespread understanding that China has larger gold reserves than are officially reported. Faber also explained why the US dollar’s days as a global currency are numbered. This is due to the rise of the East as a dominant economic power, as well as the complete ineptitude of central bankers to deal with the systemic economic problems of Western nations. In fact, he believes the worldwide bailout is doomed to failure.

Like Peter Schiff, he believes in holding gold to protect your portfolio, but he’s even more aggressive than Peter in his allocation. Faber advocates holding 25% of your assets in precious metals.

Just last week, Alan Greenspan appeared on CNBC saying in no uncertain terms that the United States economy is “not strong.” This morning he returned to the news to explain why the US has a major productivity problem. Though Greenspan doesn’t acknowledge it directly, this is a sign of America’s waning global economic power and decay into a consumer society. It’s no wonder that Greenspan advocated gold investment last year – outside the headline jobs numbers, nearly every measure of the economy is terrible.

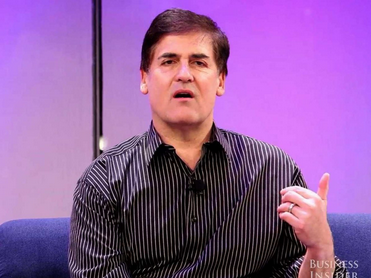

Peter Schiff isn’t the only one warning about a new tech bubble. Renowned businessman Mark Cuban just published a commentary that draws comparisons between today’s unsustainable tech explosion and the last dot-com bubble. Only this time around, Cuban warns that the carnage of the pop will be worse.

Just as back then there were always people telling you their idea for a new website or about the public website they invested in, today people always have what essentially boils down to an app that they want you to invest in. But unlike back then when the dream of riches was from a public company, now it is from a private company. And therein lies the rub.”