Tom Woods and Mark Thornton, Senior Fellow at the Mises Institute, discuss the Federal Reserve’s long history of being completely wrong about the state of the United States economy. He shared some choice quotes from Fed officials in which they claimed the economy was in great shape just before the 2008 crash. Instead of working to improve its forecasts, the Fed strives to have as many economists agree with its position as possible, giving it an air of authority. As Thornton put it:

The reality is that this whole thing is a con game where they’re taking advantage of us, and they’re doing so with fancy words and misleading languages. So you have to understand that that’s what the Fed is about. They’re operating an economy, a monetary system, and a banking system where money is just pieces of paper… They’re always trying to build confidence, and they use the language of the Federal Reserve to try to mislead people about what’s really going on.”

Jim Grant told Fox Business that the Federal Reserve has kept itself in emergency mode for too long, with interest rates near zero for almost 7 years. In fact, remaining in emergency mode has only made the next emergency more likely. Grant fears that central banks (the Fed in particular) have become far too powerful in their ability to bail out irresponsible bankers by destroying the wealth of savers.

The Fed, the government… are instituting a de facto nationalization of essential banking activities… It can’t be that the single purpose of banking is to prevent banks from going bankrupt. Yet this has become in effect the policy of our minders at the Federal Reserve. They are becoming quite all-powerful…”

Jim Rickards spoke to ABC News Australia about the long-term costs of devaluing currency. Sustained economic growth cannot come from devaluation when the entire world is cheapening currencies at once. Instead, people just lose their purchasing power and global inflation is the long-term result. Like Peter Schiff, he warned that the Federal Reserve won’t be raising rates any time soon and that the world faces a fiscal crisis bigger than the crash in 2008.

John Tamny, Political Economy Editor at Forbes, spoke to the Austrian Economics Research Conference about the roots of the Great Depression, the financial crisis, and the Great Recession. He explained how most modern economists ignore important economic fundamentals, or simply misunderstand them. For example, contrary to popular belief, governments cannot stimulate demand by simply spending more. He also focused on the beauty of recessions, which allow an economy to cleanse itself of bad business practices. Like Peter Schiff, Tamny argues that the US needs to experience a painful, but necessary recession sooner than later to truly heal its economy.

Alasdair Macleod, head of research for GoldMoney, explained to USAWatchdog that America is losing influence in international banking. China is steadily gaining more support for a new bank that would finance major infrastructure projects in developing countries.

The Asia Infrastructure Investment Bank (AIIB) represents enormous investment potential by creating an Asian market enveloping more than half the world’s population. China already has support for the AIIB from countries throughout Asia, the Middle East, and the eurozone. However, it is doubtful that China will ever invite the United States to be a member. In fact, it would probably prefer the US dollar to play no part in the what would be the largest market the world has ever seen.

The US is being left in the dust in other ways as well. While China continues to buy up gold, Macleod warned that almost all Western traders fail to understand the value of the commodity. To compete with the growing economic powerhouses in Asia, the US should adopt a similar strategy of gold accumulation and simultaneously stop flooding the world with dollars that will have to return home one day.

In his latest podcast, Peter Schiff reviews the latest economic data that indicates how poorly the economy is doing. Financial forecasts continue to be completely off-base, and many important data points have seen downward revisions. Meanwhile, the cost of basic necessities has gone up thanks to inflation. Peter expects the employment data is the outlier and will eventually catch up to the rest of these indicators.

In a stunningly despotic move, France has launched severe new restrictions on cash transactions. After September 2015, French residents cannot make cash payments of more than 1,000 euros, down from the current limit of 3,000. Foreign visitors’ cash payments will be capped at 10,000 euros rather than 15,000. Not only that, but any bank withdrawal of more than 10,000 euros per month will be reported to French authorities for good measure.

The claim is that these restrictions will help to fight terrorism. French Minister of Finance Michael Sapin pointed out that the terrorists who killed 17 people at Charlie Hebdo and a Parisian food store partially used cash to finance their attack.

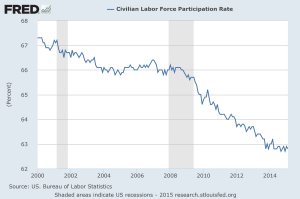

Peter Schiff isn’t the only one warning that the economic data of the United States is much worse than the media portrays. Michael Snyder has shared 10 charts pulled straights from the Federal Reserve’s own records that show how things have gotten worse since last crisis, not better. Some of these are points Peter has raised time and again, such as the low labor force participation rate. You can see it has been ticking steadily lower since the turn of the millennium.

However, Snyder goes on at length about a number of other important data points. Whether he is looking at the ballooning national debt or the velocity of money, he draws attention to the most important key fact:

Fox Business’ Kennedy spoke with Peter Schiff about President Obama’s praise for a mandatory voting system. Peter argued that mandatory voting doesn’t automatically lead to better government, because people won’t necessarily be making informed decisions. What’s worse, mandatory voting could only be enforced with monetary penalties, which would just become another tax burden. Kennedy and Peter also discussed why the United States needs to experience a recession for the economy to truly grow out of the problems created by the Federal Reserve’s monetary policy.

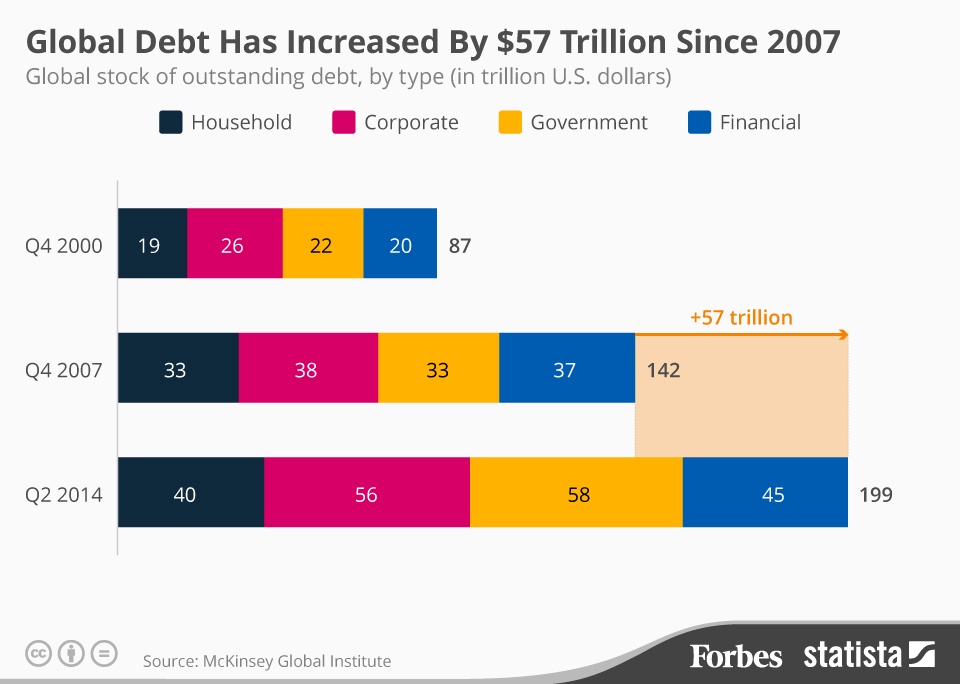

An article from the New York Post pointed out that many analysts are joining Peter Schiff in saying that the global debt explosion is unsustainable. In fact, it’s pushing countries around the world towards yet another precipice of financial collapse. The Post cites some grim statistics of American and global debt:

- Global debt has expanded $57 trillion since 2007, reaching a total of $199 trillion last year.

- Total US debt was $40 trillion last year, or 233% of US gross domestic product.

- Even the Atlanta Fed has cut its estimate for first-quarter GDP growth to 0.3%.

- Central banks in the eurozone adopted a $60 billion per month QE program, pushing bonds to an all-time low.