Marc Faber, publisher of the Gloom, Boom & Doom Report, had some simple advice for a post-Brexit world – own some gold.

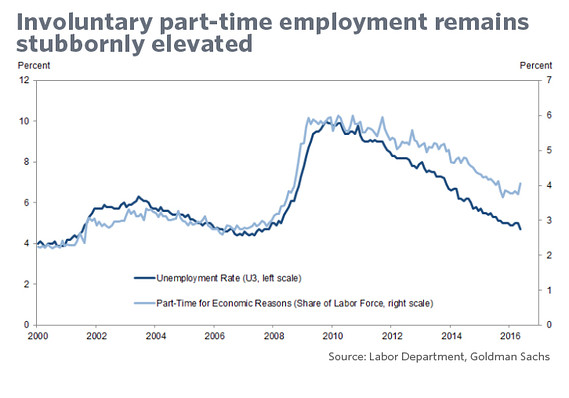

So, what caused UK voters to abandon the EU in the first place? There are many theories as to what drove the leave vote, but Faber said it really comes down to one thing – frustration with the current system.

If you go to England, London is doing very well. The financial sector in London is doing well. The asset economy is doing well. But ordinary people aren’t doing well…There is dissatisfaction with the system, and this is what the vote is about. And I believe it would be better if the arrogant bureaucracy in Brussels would be contained and reduced in size.”

Faber said economic growth around the world is slowing, and he offered the same reason Peter Schiff did on his recent Fox Business appearance – central bank intervention. In a segment quoted by Bloomberg but not included in the video clip, Faber said we can expect more of the same from central banks in the wake of Brexit. Like Peter, he thinks the Fed will use the post-Brexit turmoil to engage in even more monetary intervention:

If Brexit is used as an excuse, the central banks will print more money, QE4 in the US is on the way and the depreciation in the purchasing power of currencies will continue. In that situation, you want to own some gold.”

Mainstream media pundits and government officials continue to talk about a growing US economy, but signs in America’s heartland point in the opposite direction.

Peter Schiff has made the case that the stagnating economy is driving this strange election cycle, and helps explain the rise to prominence of Donald Trump and Bernie Sanders.

But the election isn’t the only sign everyday Americans sense problems in the economy. Their behavior also reveals concern.

According to a MSN Money report, Americans have drastically reduced eating out. Growth in the fast food sector has come to a screeching halt:

Visits to fast-food restaurants had been growing at a quarterly clip of 2% since September 2015, but haven’t grown at all in March, April or May, according to as-yet-unpublished data from market research firm NPD Group Inc. When fast-food growth comes to a halt, ‘that’s a red flag because it’s been an area of growth and it’s 80% of the industry,’ NPD restaurant analyst Bonnie Riggs said.”

All of the talk over the last few days has focused on Brexit. But Peter Schiff says people are ignoring some bigger issues. On Monday, he appeared on Fox News Business and continued pounding this theme, calling Brexit a “day of reckoning,” and reiterating a point he made on CNBC’s Trading Nation – that the Fed now has an excuse to cut rates and launch more quantitative easing:

First of all, this is not about Brexit. Brexit is all the media. Brexit is the catalyst. It is like the match that lights the tinderbox. The markets are artificially propped up by central banks, by cheap money, by QE, and it’s all hype and hope. The markets never should have been where they were. And what Brexit is doing is challenging the belief that the markets have the confidence in central bankers to keep all these bubbles in the air…There’re a lot of dominoes that are going to come down. Yes, the Fed is going to use this maybe as an excuse to cut rates and do QE 4. It was looking for an excuse for a long time. But we have some real serious problems that go beyond what is happening in Britain.”

My how things change.

This time last month, it was a foregone conclusion that the Federal Reserve was going to raise rates in June. Then the government released a shockingly bad jobs report and suddenly that rate hike was taken off the table. Even so, many pundits believed July would finally bring the much anticipated boost in the interest rate. But in the wake of the UK’s decision to leave the EU – that one is pretty much off the table as well.

In fact, many analysts now believe Janet Yellen won’t boost rates at all in 2016.

Peter Schiff recently appeared on CNBC’s Trading Nation and said the Brexit vote was “just what the doctor ordered as far as getting her out of jail free,” because now Yellen has the perfect excuse not to raise rates.

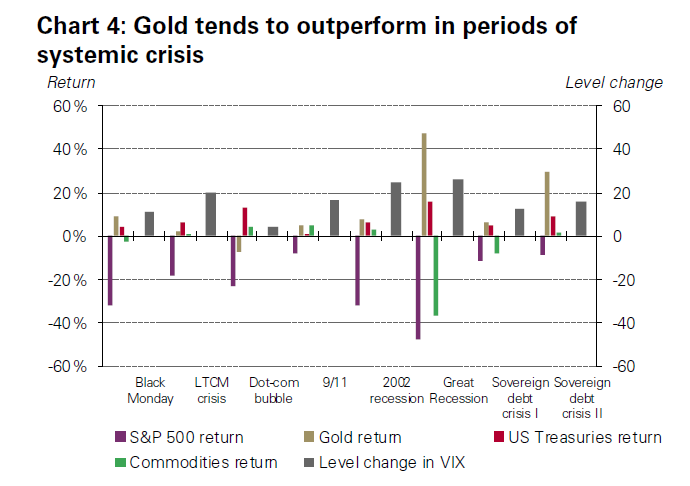

In a report released in the wake of the Brexit vote, the World Gold Council predicted “strong and sustained inflows into the gold market.”

In the immediate aftermath of the referendum, gold surged, reaching as high as $1,358.54 per ounce before falling back later in the day Friday. It was the highest level for gold since 2014. As World Gold Council analysts put it, gold did exactly what it was supposed to do:

Gold is fulfilling its classic role as a safe haven asset and performing exactly as the many investors that bought it in the run up to the referendum will have hoped. We expect to see strong and sustained inflows into the gold market driven by the intense market uncertainty that now faces the global markets.”

In fact, the sale of physical gold in the UK was brisk in the weeks leading up to the vote. The World Gold Council said it expects that trend to continue and even accelerate:

Purchases of gold coins by small retail investors, which were already up sharply in the months running up to the vote, should accelerate further.”

The mainstream media and global markets have responded to the Brexit vote as if it is the end of the world.

Well, is it? Or is it an opportunity?

Peter Schiff appeared on CNBC’s Trading Nation Monday and said the Brexit hysteria in the markets and the mainstream media is unwarranted, and it actually presents opportunities on several different levels – some good and some not so good.

Brexit has certainly been good for gold. Download SchiffGold’s Free White Paper: Why Buy Gold Now?

On a positive note, Peter thinks the vote gives the UK the perfect opportunity to untangle itself from the web of big government, if it applies the Brexit principle more generally:

The price of gold soared in the wake of the Brexit vote, going as high as $1,350 on Friday before settling back slightly. As of the Monday morning after the vote, the yellow metal was up more than 5% from its close Thursday before returns started coming in.

The spike in gold after the shock of Brexit isn’t surprising, but many analysts say the bull run will likely continue.

The UK’s decision to exit the EU caught the mainstream off guard. Most analysts had predicted the stay vote would carry the day. Unsurprisingly, startled stock markets sold off and gold rallied when it became clear the pundits were wrong. Of course, historically investors turn to safe-haven assets like gold and silver in times of turmoil, so a spike in the price of gold is exactly what you would expect. Naeem Aslam, chief market analyst at Think Forex in London, called gold the “real winner” in the Brexit vote.

But there are indications that a lot more factors than just short-term, knee-jerk, safe-haven buying are pushing the price of gold up. That means this may be more than a reactionary spike in the market. A recent MarketWatch article made the case for $1,500 or even $1,900 gold in the next year or so:

The decision, known as Brexit, has vast implications for global financial markets, economies and currencies as well as for monetary policies among the world’s major central banks. That means gold could soon have many more reasons to rally.”

According to Peter Schiff, the Brexit vote is just what the doctor ordered for Janet Yellen.

Stocks plunged and gold surged in the wake of Brexit. As of Monday morning, gold was up more than 5%. Most analysts think gold went up because of the UK’s decision to leave the European Uniion, but Peter said even before the vote that he thought it didn’t really matter. In fact, he called the Brexit vote a “non-event” as far as its long-term impact on the gold market.

In his latest podcast, Peter reiterated the point. Yes, gold is going up, but he said it was going up regardless of the outcome of the referendum:

You know, a lot of people think the reason gold is up is because Brexit. I mean, that was a catalyst for the rally today, but it was going up anyway…I think even if they had voted to remain, I believe gold would have gone up. I don’t think it mattered. But this is an easy excuse for people who don’t understand why the gold is going up; they can just chalk it up to the uncertainty and not look at all the things we’re actually certain of in the US economy, and with the Fed and the dollar that are the real driving force behind gold.”

Peter went on to look at some recent economic news lost in all of the Brexit talk, and said the outcome of the vote was great news for Janet Yellen:

It appears some of the Obamacare chickens are starting to come home to roost.

Opponents of the massive intervention in the health care and insurance markets warned that it would increase prices and negatively impact employment. Supporters of the government health care program poo-pooed those predictions. But as some of the real-world implications of Obamacare become more apparent, it appears those predicting those unintended consequences were right.

We’ve heard countless stories about soaring insurance premiums across the country over the last several months. According to a recent Chicago Tribune report, rising insurance costs will continue into the future:

The British vote to leave the EU Thursday sent shockwaves through the financial markets and pushed gold to a 2-year high.

In the historic Brexit referendum, the British voted to leave the European Union by a 51.9 to 48.1 margin. Unofficially, 17,410,742 Brits cast exit votes, with 16,141,241 casting ballots to remain in the EU.

Nigel Farge headed up the UK Independence Party. He called the vote a victory for the little guy:

The dawn is breaking on an independent UK. If the predictions are right this will be a victory for the real people, for the ordinary people, and for the decent people.”

As it became clear the UK exit from the EU would prevail, gold surged. The price of the yellow metal climbed 4.7% to $1,316.05 an ounce by 11 a.m. in London. When markets opened in the US, gold rose as much as 8.2%, hitting $1,358.2 an ounce before paring gains and settling around $1,325 per ounce. Dominic Schnider, head of commodities and Asia-Pacific foreign exchange of the wealth-management unit at UBS Group AG said this is exactly what one would expect: