The Federal Reserve is putting on quite the tough guy act. Everybody is convinced the central bank is going to keep up the inflation fight even if the economy gets shaky. In this episode of the Friday Gold Wrap podcast, host Mike Maharrey talks about the Fed’s hawkish messaging and wonders out loud if the central bankers are writing checks they can’t cash.

The May trade deficit came in at -$86B. This was another MoM decline but the monthly deficit is still significantly larger than it was at any point before 2022 as shown below. One of the biggest concerns is the Services Surplus contracting by 8.1%.

The silver-gold ratio hit a two-year high this week, indicating that silver is significantly undervalued compared to gold.

After the June FOMC meeting and the Fed’s 75- basis point interest rate hike, I argued that the central bank is totally winging it. Reading between the lines in the minutes from that June meeting seems to bear this out. The Fed appears to be in reaction mode. The question becomes what will it react to next? How long will the hawks keep flying as the economy tanks?

Central banks globally added another net 35 tons of gold to reserves in May, according to data compiled by the World Gold Council. This follows on the heels of a net 19.4-ton increase in gold holdings in April and an 84-ton surge in gold reserve through Q1.

China appears to be chipping away at dollar dominance.

While there is no indication that the dollar is in imminent danger of toppling from its perch as the global reserve currency, more central banks are warming up to the yuan.

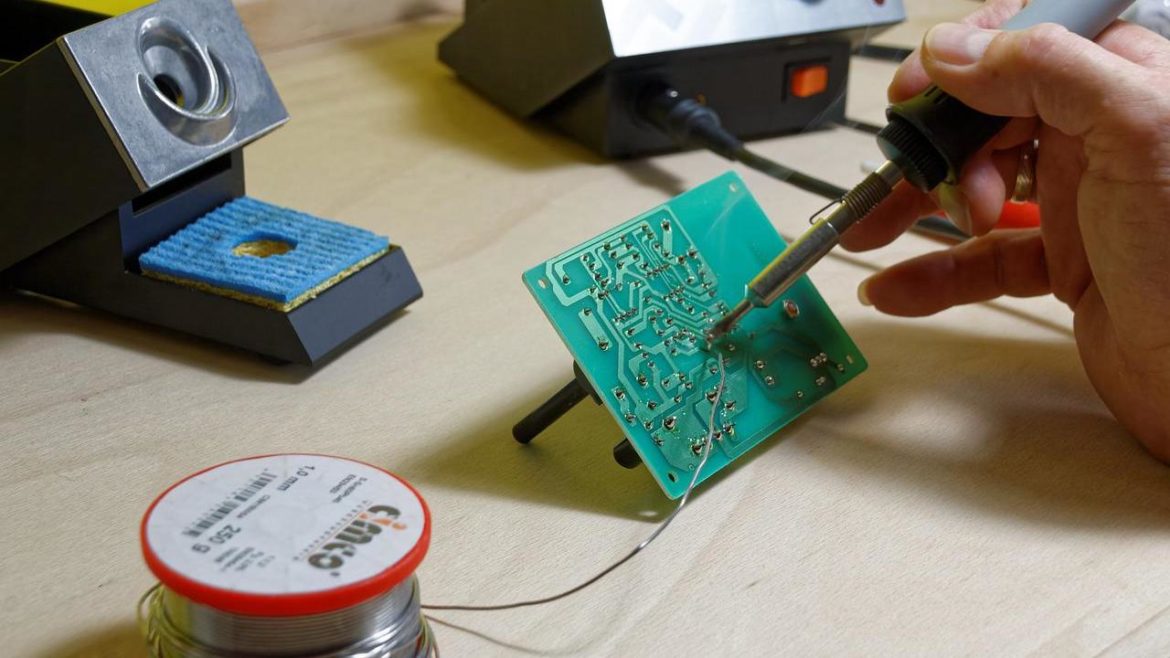

Demand for silver for brazing and soldering applications is expected to expand by 23% by 2030.

This is one of several silver-related stories in the latest edition of Silver News published by the Silver Institute.

On July 1, the Federal Reserve Bank of Atlanta lowered its Q2 GDP projection to -2.1%, officially forecasting a recession.

So, much for Jerome Powell’s “soft landing.”

The technical analysis last weekend highlighted that gold looks to be in a bottoming structure. Despite the sell-off this week, $1800 held, which could be another indication that gold is in the process of bottoming, with some final weak hands getting pushed out of the market.

Please note: the COTs report was published 7/3/2022 for the period ending 6/28/2022. “Managed Money” and “Hedge Funds” are used interchangeably.

Both silver and gold had their weakest COMEX delivery months in several years.

Gold started July delivery with 937 contracts outstanding. This is the lowest level since November of last year and the second-lowest since the start of Covid (see figure 2).