Venezuela Ups Minimum Wage; Effective Rate a Whopping $13.50 Per Month

So much for that socialist paradise.

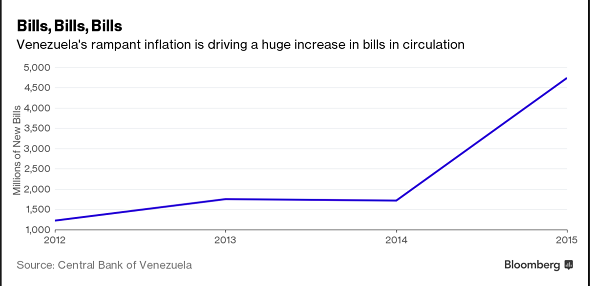

Last summer we reported that hyperinflation had devalued the Venezuelan bolivar to the point that people were using 2-bolivar notes as napkins. In order to keep up with the rate of devaluation, the Venezuelan government literally flew in 747s full of cash. Now we’ve learned that the Venezuelan government is so broke, it can’t even pay to print more money.

So, what is a benevolent socialist government to do?

Naturally, raise the minimum wage.

In fact, the Venezuelan government recently announced a 30% increase to 15,051 bolivars per month. It was the 12th minimum wage hike since President Nicolas Maduro took office.

At the official exchange rate, the new minimum wage comes to about $1,500 per month. But with the economy in shambles, and shortages of everything from food to toilet paper, the official rate is virtually meaningless. To actually buy necessary items, Venezuelans are forced into the black market, and there the value of their wage hike works out to a paltry $13.50 per month.

Download Free: SchiffGold’s Guide To Tax-Free Gold & Silver Buying

Could this be a glimpse into America’s future?

It may well be.

A Forbes article neatly sums up how Venezuela got to this point.

As to how this happened it’s a simple story. Idiot economic policy is to blame. That idiocy coming in two parts, one in theory and the second in reaction to that theoretical mistake. The oil price crash hasn’t helped, to be sure, but that’s not the cause of this disaster. The theoretical mistake is to misunderstand how prices and markets work. To think that prices are just near random numbers applied to things which can be changed at will…Arbitrarily trying to change prices might change the legal price but it does not change the market clearing one. Thus any move away from that market price produces shortages or gluts. Make the price of toilet paper less than the market clearing price and there’s nothing to wipe with. Make the price of labor higher than that market clearing one and some people can’t get a job. There simply are no exceptions to this. Price fixing causes shortages or gluts.”

We recently reported on how fixing the price of labor via the minimum wage in Puerto Rico was a major factor in that country’s financial crisis.

It’s easy to sit back, shake our heads and pity the Venezuelans and their socialist dreams. But in reality, the US government and central bankers believe in, and are implementing, essentially the same policies that drove the South American country into its current crisis. They love to print money, manipulate interest rates (prices), and mandate minimum wages.

The US may not be traveling down the road quite as fast as Venezuela, but the scenery looks awfully familiar.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

With the eventual introduction of central bank digital currency (CBDCs) now seemingly inevitable, there are a lot of directions central banks could take with their digital currency projects that would have dramatic implications for the price of gold.

With the eventual introduction of central bank digital currency (CBDCs) now seemingly inevitable, there are a lot of directions central banks could take with their digital currency projects that would have dramatic implications for the price of gold. Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

Leave a Reply