Silver Demand Projected to Rise 11% in 2021

Silver got a brief boost when the Reddit Raiders turned their attention to the white metal. The online investors weren’t able to pull off a short-squeeze in the silver market, but we’ve said all along that there are fundamental reasons to be bullish on silver, the attention of Reddit Raiders notwithstanding.

New demand projections for silver in 2021 bear this out. Silver demand is expected to rise 11% this year and reach 1.025 billion ounces, according to the Silver Institute’s forecast.

If demand meets this projection, it will mark an 8-year high.

The Silver Institute forecasts both investment and industrial demand will rise in 2021.

Investment demand hit a 5-year high in 2020. The projection is that it will top that in 2021, hitting a six-year high of 257 million ounces as investors continue to add silver to their investment holdings.

The average annual silver price rose from $16.19 in 2019 to $20.52 last year, a 27% increase. With the onset of the COVID-19 pandemic, the market saw an increasing number of countries introduce looser monetary policies. This helped drive down real interest rates. Together with a rotation in favor of safe-haven assets, this encouraged investors to buy into silver and other precious metals.

Going forward, the outlook for the silver price in 2021 remains exceptionally encouraging, with the annual average price projected to rise by 46% to a seven-year high of $30. Given silver’s smaller market and the increased price volatility this can generate, we expect silver to comfortably outperform gold this year.”

Global holdings of silver in silver-backed ETFs surged last year, pushing past 1 billion ounces for the first time ever. The buying continued into 2021. Through Feb. 3, ETF holdings rose by 137.6 million ounces to a new record level of 1.18 billion ounces.

Further upside is also expected for investment in physical silver bars and coins. Demand is anticipated to rise to a six-year high of 257 million ounces.

Industrial demand is projected to post a four-year high of 510 million ounces this year. That would represent a 9% increase year-on-year. Demand from the electrical and electronics sector is poised to account for the bulk of the gains. With the growing penetration of 5G technology in consumer electronics, this sector is expected to drive notable gains for silver offtake, with a 7% increase over 2020, according to the Silver Institute.

The solar energy sector is also expected to boost demand. The global total for the sector is forecast at 105 million ounces in 2021, overcoming the losses sustained last year due to the pandemic.

Although silver loadings continue to drift lower, the sector will benefit from a growing number of countries that are installing new PV capacity.”

The Silver Institute also projects a rebound in the automotive industry and this could accelerate with the growing electrification of vehicles.

We should also see a recovery in the silver jewelry industry in 2021, according to the Silver Institute. Demand is forecast to rebound to 174 million ounces, but remain below pre-COVID levels.

To a large extent, this reflects only a modest recovery in India, where demand will be affected by high and volatile rupee silver prices. A similar outcome emerges in silverware, which is dominated by the Indian market. Even though total silverware fabrication is predicted to achieve a double-digit percentage gain this year, reaching 45 million ounces, the global total will remain considerably short of 2019 levels because of the challenges in India.”

The silver supply will likely run another surplus in 2021 as mine output recovers, but it will be the smallest surplus since the last supply deficit run in 2015.

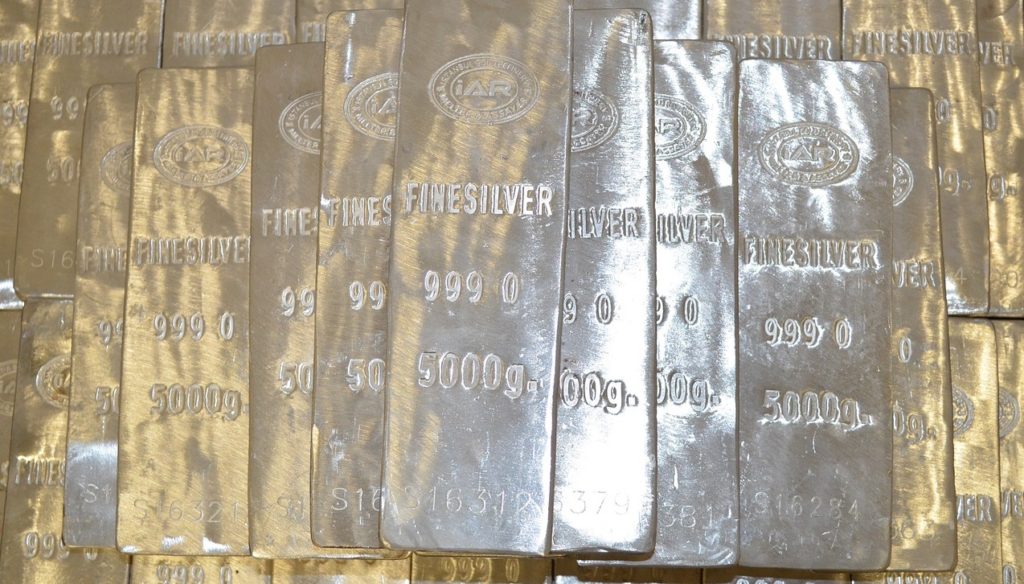

Keep in mind, silver is at its core a monetary metal. Silver has been used as money for thousands of years. As government fiat currencies devalue, silver and gold both tend to hold their value as the prices increases in dollar-terms. Currently, the Federal Reserve and other central banks are creating money like never before. The money supply increased at a record pace last year as the Federal Reserve responded to the COVID-19 pandemic. And there is no sign that the money printing will abate.

In fact, the Fed can’t exit from this extraordinary monetary policy. It has to continue monetizing the ever-increasing government debt and hold interest rates artificially low. If it were to back off quantitative easing and allow interest rates to rise, it would collapse the debt-ridden US economy. On the other hand, if it continues this reckless money creation, it will eventually crash the dollar.

Either scenario is bullish for silver.

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]