Fed Up Friday: August 6 – 12

Each week there are plenty of new reasons to get fed up with our beloved central bank. Here’s what they’ve been up to in the past seven days.

Ben Bernanke: Uncertainty Could Lead to No Rate Hike until 2017

On Monday, former Fed Chair Ben Bernanke laid out his thoughts on how the rest of this year would play out for the US economy. Overall, he sees that the past two years have brought about tighter financial numbers, weaker growth, and low inflation. Bernanke seems to estimate the Fed’s false promises of a rate hike have caused investors to slow down and even reverse course in some ways.

“Fed-watchers will see less benefit in parsing statements and speeches and more from paying close attention to the incoming data,” Bernanke said in his article for Brookings. “Market participants now appear to expect few if any additional rate rises in coming quarters.”

Of course, Peter Schiff has been predicting all along that any expectation that the Fed will raise rates should be taken with a hefty grain of salt.

Marc Faber and Alan Greenspan See Eye-to-Eye: Fed at Zero Hour

It’s not every day a former Fed Chair and the publisher of “The Gloom, Boom, and Doom Report” see eye to eye, but that’s exactly what’s happening as Marc Faber’s “zero hour” Fed timeline gets closer to becoming reality. That is a difficult hour to ignore, even for Greenspan. As Bruce Pile explains:

Since 2015, we are moaning about being pegged at the zero bound of interest rates and near zero economic growth. Now we are entering the preposterous world of negative interest.”

Faber has been tracking the Fed’s decline since 2002, and his predictions landed on 2015 as the year it would all go down. Pile agrees that zero hour is indeed already upon us, just as Faber predicted.

Futures Market Predicts Fed will Coast to End of Year

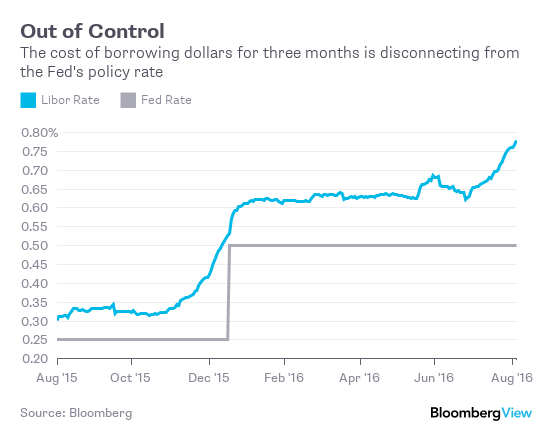

The Fed is losing control of monetary conditions, according to Bloomberg, and that is driving the futures market towards heavy doubts of a rate hike this year. In fact, predictions are well over 60% that a rate hike won’t be happening.

The reason they’re losing control all comes down to short-term interest rates. Generally speaking, the Fed uses them to alternate the economy between the slow lane and the fast lane. Cheaper borrowing equals more spending and growth. Expensive borrowing equals curbed inflation and slower growth. That is how things have always worked, at least until recently.

The chart tells a story of the bank-to-bank lending rate disconnecting from the Fed’s own policy rate. That’s the equivalent of the steering wheel falling off while you’re trying to change lanes – bad news for the Federal Reserve. This reluctance to raise rates is great for gold and silver investment, as Peter Schiff points out:

If the Fed tried to save the stock market and calls off the rates hikes and cuts rates back to zero, which I think they are going to do—now gold really takes off.”

Janet Yellen is Houdini for a New Generation, Says James Rickards

Houdini regularly escaped from straitjackets and handcuffs. Janet Yellen’s strategy for dealing with her proverbial handcuffs (i.e. weak growth and political gridlock) is crossing her fingers and hoping for the best.

James Rickards offered up one potential solution for Ms. Yellen on the Daily Reckoning. “Yellen’s only escape is to trash the dollar.” He said, “Investors who see this coming stand to make spectacular gains.” He went on to explain that a cheaper dollar is most likely a complicated route to take because it requires other nations’ currencies to work. A downward spiraling dollar means some other form of currency must rise up. Rickards believes gold is one of the potential champions of that escape strategy.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]