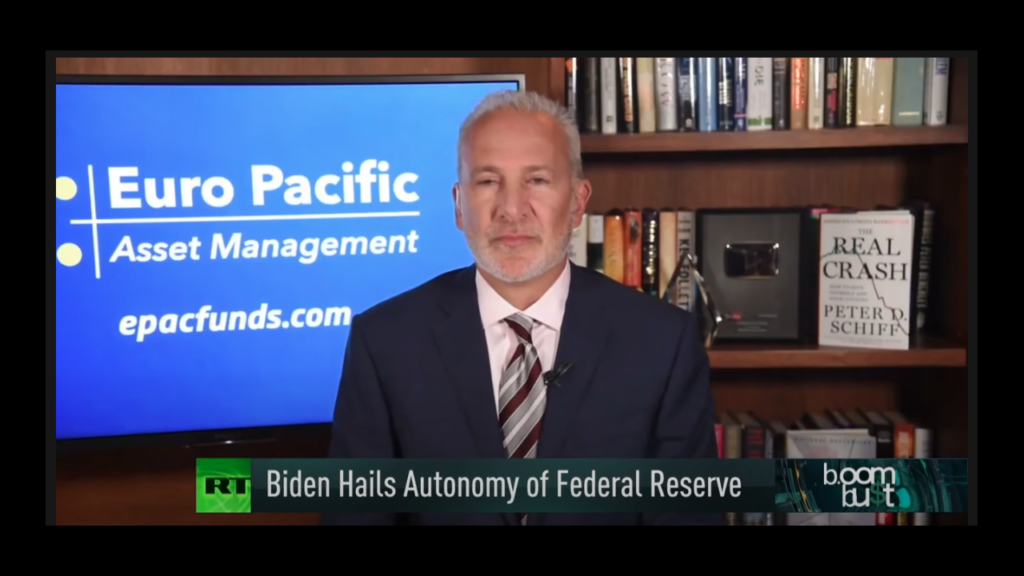

Peter Schiff vs. A Marxist Professor: Is Socialism the Problem or the Solution?

Peter Schiff debated Marxist professor Richard Wolff on RT Boom Bust. Wolff just can’t grasp that socialism isn’t the solution to America’s problems. Socialism is America’s problem.

Wolff does a fair job of diagnosing the economic problems. He said the current bout of inflation is proof that the US economic system “really isn’t working very well.” He also acknowledged that inflation has been coming down the pike for a long time thanks to the amount of money printed relative to the number of goods and services available. He correctly notes that raising interest rates to fight inflation would put the US government and American consumers in a tight spot due to the enormous levels of debt.

Peter said he agreed with the professor saying he doesn’t think “this current socialist economic system” works.

Central government planning, manipulation of interest rates, the constant creation of inflation — inflation is not new. That’s how the government has been bailing out the markets from the crises it created with its subsidies and artificially low interest rates. So, now the inflation is moving from financial assets into real goods in a way that government statistics can no longer hide because the actual rate that prices are rising is probably twice what the government admits.”

Peter emphasized that this is not a transitory situation.

This is the tip of an inflationary iceberg.”

And what should be done about it?

Abandon the system we have now and go back to free-market capitalism – laissez faire, sound money. That is the only path back to prosperity.”

Wolff claimed the system isn’t socialist at all. He pointed to the reappointment of Jerome Powell as Fed chair, calling Powell “an enthusiastic supporter of the capitalist system.” He also claimed, “there is absolutely nothing in Mr. Biden’s portfolio that has anything to do with socialism.” He called Peter’s call for a return to free markets as “going backward.”

Peter came back firing.

If Biden were a capitalist, he would be advocating for less government, not more. He would want to cut government spending, not dramatically increase it.”

Peter also said Powell is not part of capitalism. He’s the antithesis.

This is central government planning. This is price-fixing of interest rates. The Federal Reserve has nothing to do with capitalism. Under a capitalist system, the market would set interest rates, not the Federal Reserve. And under capitalism, we would have sound money, not the fiat money that’s manufactured by the Federal Reserve. So, your problems are not with capitalism. They’re with these socialist institutions that are creatures of government.”

Wolff responded by claiming America used to have a “private capitalist system,” but it created so many problems it couldn’t solve that it had to create the institutions Peter now wants to get rid of. He went on to characterize China as a great socialist success story.

Peter pointed out the obvious: communism failed in China.

That’s why they abandoned it. Yes, it’s a communist party, but there’s actually more free-market capitalism happening in China than there is in the United States. That is the problem. It is when they went away from communism and embraced private property and profit, and unleashed entrepreneurship — it’s private capitalism that is thriving in China, despite the communist government.”

Peter said what we need is more capitalism in America.

The problem is we’re moving more in the direction of the policies that the Chinese abandoned.”

Get Peter Schiff’s most important gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Peter recently appeared on Market Overtime with Oliver Renick for an interview. In their wide-ranging discussion, Peter speaks on monetary policy, the reliability of inflation data, and reasons to avoid Bitcoin.

Peter recently appeared on Market Overtime with Oliver Renick for an interview. In their wide-ranging discussion, Peter speaks on monetary policy, the reliability of inflation data, and reasons to avoid Bitcoin. Peter recently appeared on Fox Business to discuss Bitcoin’s recent performance. In this segment, he takes on Natalie Brunell, host of the podcast Coin Stories, in a friendly debate on the merits of crypto and precious metals.

Peter recently appeared on Fox Business to discuss Bitcoin’s recent performance. In this segment, he takes on Natalie Brunell, host of the podcast Coin Stories, in a friendly debate on the merits of crypto and precious metals. On Thursday, Peter appeared on OAN’s Real America with Dan Ball to discuss the U.S. Strategic Petroleum Reserve, the costs of home ownership, and the debt crisis. Peter argues the Biden administration won’t be able to refill the reserve, given oil’s 22% price increase this year. With the CRB exploding, Jerome Powell’s claim that inflation is coming […]

On Thursday, Peter appeared on OAN’s Real America with Dan Ball to discuss the U.S. Strategic Petroleum Reserve, the costs of home ownership, and the debt crisis. Peter argues the Biden administration won’t be able to refill the reserve, given oil’s 22% price increase this year. With the CRB exploding, Jerome Powell’s claim that inflation is coming […] Last week, Peter was interviewed on Speak Up with Anthony Scaramucci. In their conversation, they covered a wide range of important topics, including inflation, the fate of the dollar, and the trade-offs between gold and cryptocurrency.

Last week, Peter was interviewed on Speak Up with Anthony Scaramucci. In their conversation, they covered a wide range of important topics, including inflation, the fate of the dollar, and the trade-offs between gold and cryptocurrency.  This weekend, Todd Sachs interviewed Peter on the state of the economy. They discuss the parallels between now and the 2007-2008 housing crisis, the role of economic sentiment in voters’ opinions, and why foreign central banks are losing faith in the dollar.

This weekend, Todd Sachs interviewed Peter on the state of the economy. They discuss the parallels between now and the 2007-2008 housing crisis, the role of economic sentiment in voters’ opinions, and why foreign central banks are losing faith in the dollar.