Peter recently appeared on Market Overtime with Oliver Renick for an interview. In their wide-ranging discussion, Peter speaks on monetary policy, the reliability of inflation data, and reasons to avoid Bitcoin.

Peter recently appeared on Fox Business to discuss Bitcoin’s recent performance. In this segment, he takes on Natalie Brunell, host of the podcast Coin Stories, in a friendly debate on the merits of crypto and precious metals.

On Thursday, Peter appeared on OAN’s Real America with Dan Ball to discuss the U.S. Strategic Petroleum Reserve, the costs of home ownership, and the debt crisis. Peter argues the Biden administration won’t be able to refill the reserve, given oil’s 22% price increase this year. With the CRB exploding, Jerome Powell’s claim that inflation is coming down seems unlikely to be true.

Last week, Peter was interviewed on Speak Up with Anthony Scaramucci. In their conversation, they covered a wide range of important topics, including inflation, the fate of the dollar, and the trade-offs between gold and cryptocurrency.

This weekend, Todd Sachs interviewed Peter on the state of the economy. They discuss the parallels between now and the 2007-2008 housing crisis, the role of economic sentiment in voters’ opinions, and why foreign central banks are losing faith in the dollar.

Peter recently appeared on OAN’s Real America with Dan Ball to discuss the minimum wage, government spending, and inflation. He first points out the blatant corruption of the California state government, which recently passed a $20 minimum wage for all fast-food restaurants except those that bake their own bread. The state’s governor, Gavin Newsom, has received several large campaign donations from the owner of many Panera Bread franchises in California, causing Newsom’s critics to question the motives of such an exception. Peter also points out that, under Newsom’s logic, such an exemption will actually hurt Panera’s employees. If minimum wages are so helpful to workers, why exempt Panera at all?

In a recent interview, Peter Schiff was featured on Real America with Dan Ball.

Peter Schiff recently appeared on the Commodity Culture podcast to talk about gold. He said that while gold has done relatively well this year despite significant headwinds, we haven’t seen anything yet. Once the markets realize inflation is here to stay, gold will be off to the races.

Peter Schiff recently appeared on Real America with Dan Ball to talk about the state of the US economy. He described it as a disaster and said Bidenomics consists of putting lipstick on a pig.

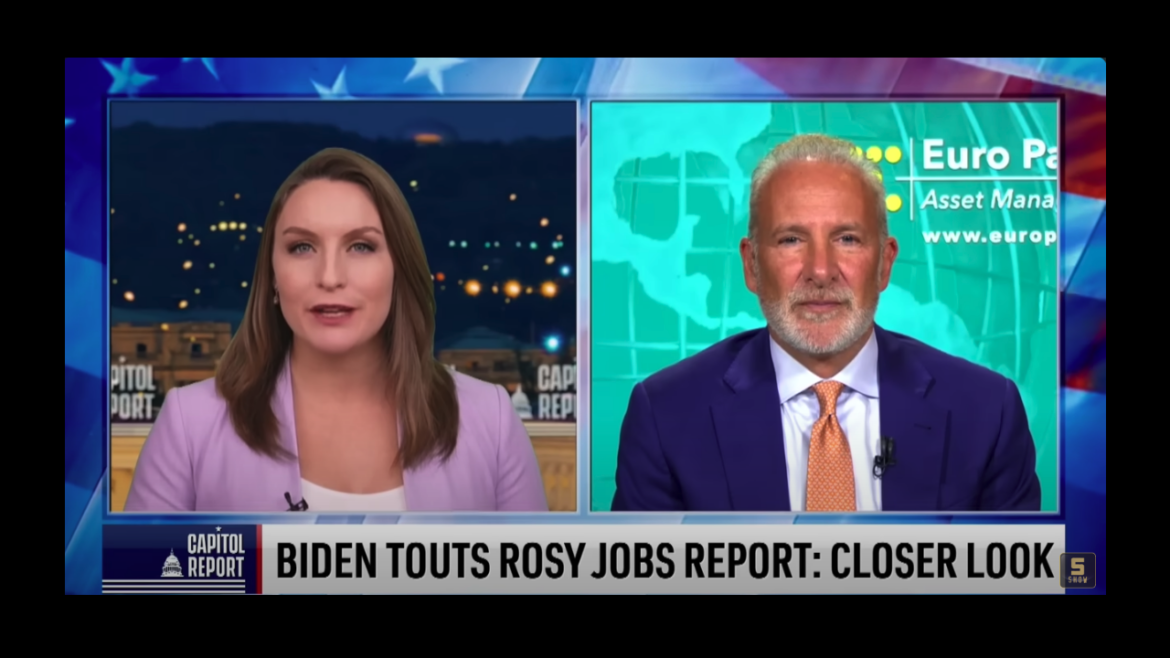

Most mainstream pundits characterized the November jobs report as a “Goldilocks” report. Job growth was strong enough to support the “soft landing” narrative but not so strong it might scare the Fed into raising interest rates again.

President Joe Biden used the report to boast about his economic achievements. But according to Peter Schiff, Biden doesn’t have anything to boast about. He talked about it during a recent interview on the Capitol Report on NTD News.