The Fed Is All Hat and No Cattle

In response to the coronavirus economic lockdown, the Fed pulled out all the stops, launching what amounts to QE infinity. And there is no end in sight. During a recent 60 Minutes interview, Federal Reserve Chairman Jerome Powell said there is “no limit” to what the Fed can do.

This is the same “cure” the Fed gave us in the aftermath of the 2008 financial crisis. Most of the mainstream swears it worked. But did it really?

We have been arguing that it didn’t In fact, we believe the Fed’s solution is actually the root of the problem.

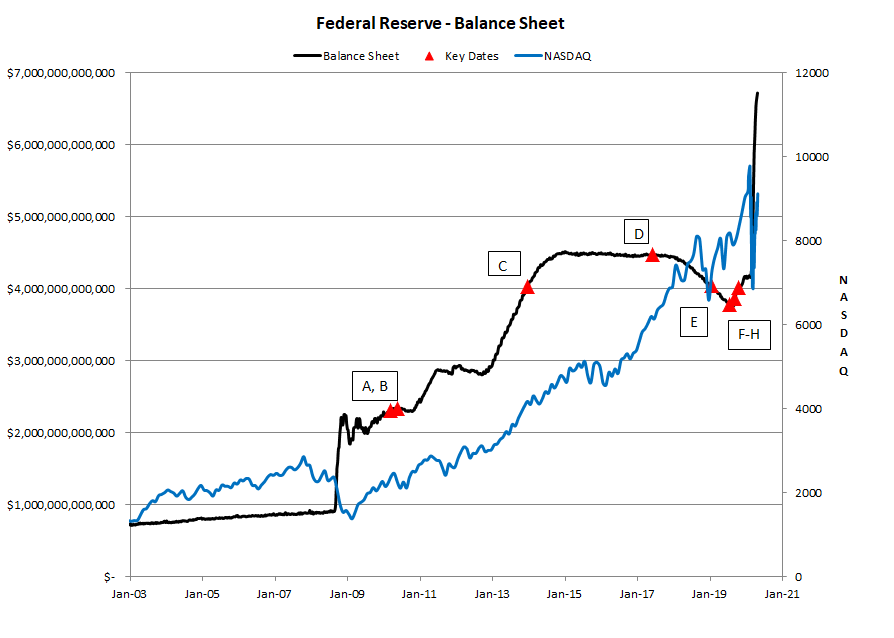

In a recent post at The92ers.com. Peter Schmidt takes a look back at the “cure” for the 2008 financial crisis and shows it wasn’t as successful as advertised. The Fed managed to increase its balance sheet, but the promised reduction in the balance sheet never materialized. When the Fed tried to normalize rates and shrink the balance sheet, the stock market tanked and the central bank went right back to its easy-money policies.

And it isn’t going to work this time around either.

![]()

The following was written by Peter Schmidt. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

The phrase “all hat and no cattle” perfectly describes the Fed of the post-2008 crisis era.

For those who don’t know, the phrase describes someone who looks the part of a cowboy and talks like a cowboy, but, when push comes to shove, is incapable of performing any of the difficult tasks traditionally performed by a cowboy.

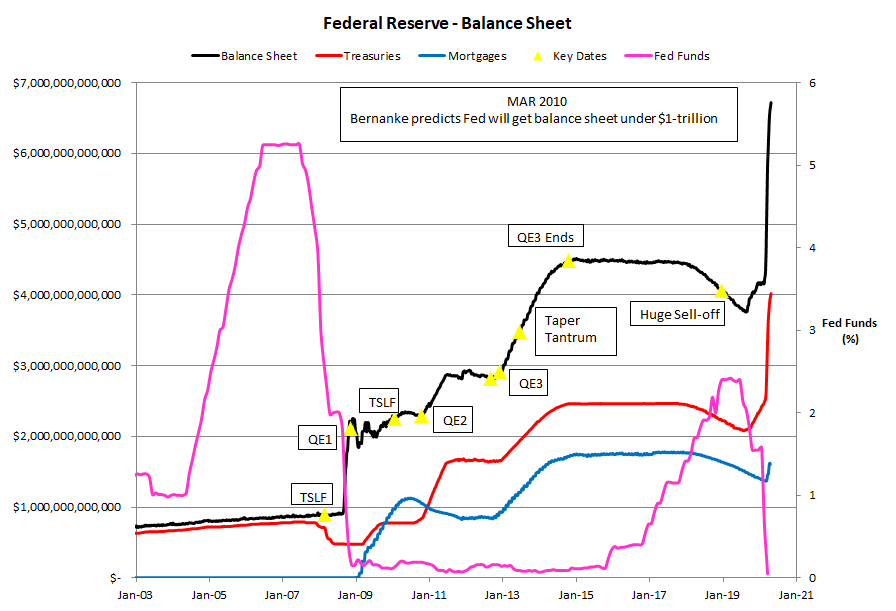

In the aftermath of the financial crisis peak, universally reckoned to be the collapse of Lehman Brothers in September 2008, the Fed implemented an unprecedented campaign of quantitative easing, (QE). Though the product of MIT PhD economists, QE was quite simple. It required the Fed to greatly expand its balance sheet. The Fed did this by creating money – trillions of dollars worth – out of thin air. The Fed then used the money it created to purchase all sorts of distressed assets from banks, primarily mortgage securities, and Treasury debt. The mortgage securities and Treasury debt it purchased became assets to the Fed, while the money the Fed created became a liability to the Fed and a reserve in the banking system.

The theory was that with all these reserves in the banking system, credit would be readily available for businesses. With all this credit available, businesses would borrow and the economy would recover. As the economy recovered, the Fed would then sell all the assets it had acquired through QE. As these assets were sold back, they would come off the Fed’s balance sheet and the Fed’s balance sheet would return to pre-crisis levels.

What could be simpler?

Before getting into the ‘all hat and no cattle’ aspects of the Fed, it is worth noting that the entire QE program was deeply flawed and incapable of working as the Fed believed it would.

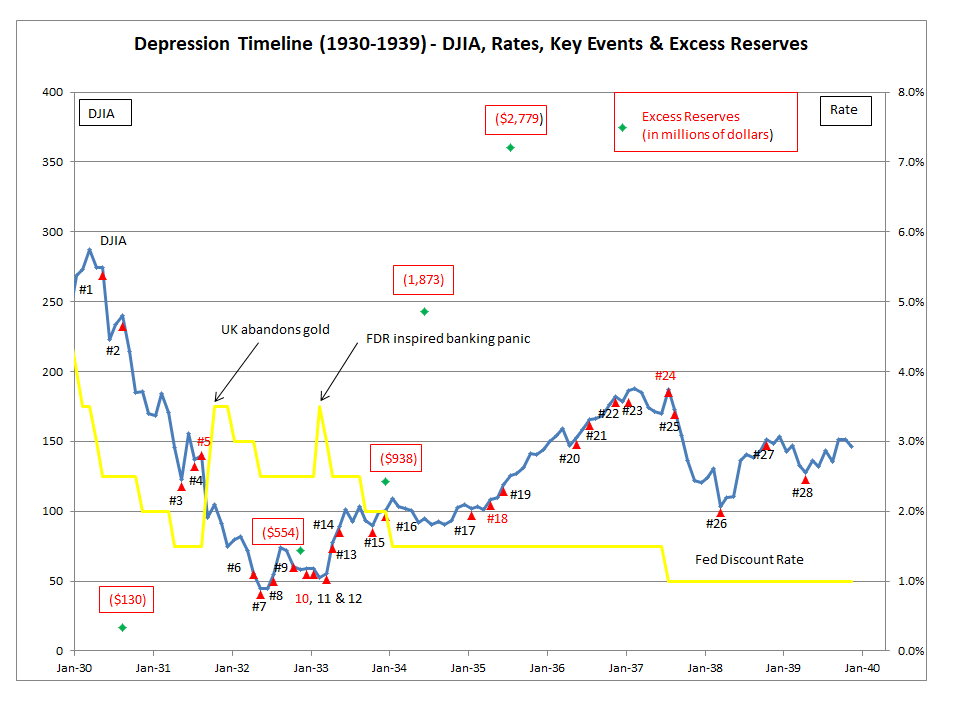

Ben Bernanke – largely by his own reckoning – is considered an expert on the Great Depression. Bernanke’s implementation of QE proves he knows almost nothing of value about it. Ben Bernanke concludes that the Great Depression was caused by a collapse in the money supply. In reality, the collapse in money supply during the Great Depression was an effect, and a cause of nothing. The money supply collapsed not because the banking system didn’t have reserves to lend; the money supply collapsed because no one was willing to borrow money. See the chart below and excess reserves soaring during the Depression-era. By the mid-1930s, excess reserves in the banking system exceeded total reserves in the pre-1929 banking system.

Given his conclusion that an effect of the Depression – the collapsing money supply – was actually a cause, it shouldn’t be surprising that QE didn’t go as Bernanke planned. After a brief review of how the Fed blew up its balance sheet – the “all hat” part of QE, the “no cattle” part of QE will be demonstrated by both statements from Fed officials as well as three interest rate decisions. In these statements, Fed officials promise to reduce the balance sheet to pre-crisis levels and dismiss any concerns related to reducing its balance sheet.

However, all these statements are ultimately proven to be so much hot air in the wake of the huge December 2018 sell-off in stocks.

The Fed Can Blow Up Its Balance Sheet (All Hat)

KEY Dates

- 11 MAR 2008: Term Securities Lending Facility (TSLF) – Fed trades Treasuries for debt

- 24 NOV 2008: QE 1 Begins – Fed purchases hundreds of billions of mortgage securities

- 01 FEB 2010: TSLF Ends – with large scale asset purchases underway, TSLF is redundant

- 01 NOV 2010: QE2 Begins – Fed to purchase at least $600-billion of Treasury securities

- 13 SEP 2012: QE3 Begins – Fed to purchase $40-billion in bonds per month, no end date

- 12 DEC 2012: QE3 Expands – Fed expands monthly purchases to $85-billion per month

- 29 JUN 2013: Taper Tantrum – Treasury rates soar as Fed hints at tapering asset purchases

- 29 OCT 2014: QE3 Ends

- 01 JAN 2019: Nasdaq Bottoms

The Fed can’t reduce its balance sheet (No Cattle)

Key Dates

- (A) 25 MAR 2010: Ben Bernanke promises to get the balance sheet under $1-trillion. (1)(B) June 2010: James Bullard of the St. Louis Fed describes the Fed’s QE programs as “temporary in nature” and “always meant to be temporary in nature.” (See #2, p. 156)

- (C) 01 JUN 2014: St. Louis Fed states, “The FOMC has stipulated that the expansion of the Fed balance sheet is temporary (emphasis in the original) and that holdings will return to normal as the recovery progresses.” (3)

- (D) 14 JUN 2017: Janet Yellen cavalierly dismisses any concerns with the Fed reducing its balance sheet and compares the process to “watching paint dry.” (4)

- (E) 30 JAN 2019: Powell states, “The case for raising rates has weakened somewhat.” The stock market collapse from December 2018 has caused the Fed to blink. (5)

- (F) 01 AUG 2019: Fed cuts rates, 0.25%

- (G) 19 SEP 2019: Fed cuts rates, 0.25%

- (H) 31 OCT 2019: Fed cuts rates, 0.25%

Conclusion

It is widely held throughout the financial media that QE ‘worked’ and the Fed should be praised for its heroic action. It is further argued that somehow the government made money by its massive bailout programs. What ridiculous arguments! How can anyone argue QE worked with the Fed’s balance sheet swollen to obscene levels?

A necessary prerequisite for any argument that QE was a ‘success’ would require the Fed to return its balance sheet to something approaching pre-crisis levels. Because that never happened, there is no basis for judging QE a success. All that can be said of QE at this point is that it was a massive bailout for the banks and institutions (Fannie and Freddie) that brought the country to its knees. Hardly a cause for celebration.

Of course, the coronavirus now gives the Fed a perfect excuse for further expand its balance sheet. However, as shown here, the Federal Reserve’s failure to make any serious inroads at reducing its post-crisis balance sheet has nothing to do with the coronavirus. Long before the virus became an issue, the Fed had started to increase its balance sheet and cut rates. By 31 October 2019, the Fed’s balance sheet was back above $4-trillion. Given what happened after 2008, it is a foregone conclusion that the Fed will be full of all sorts of brave talk about how they are going to unwind the enormous balance sheet expansion prompted by the coronavirus.

My advice – don’t believe a word of it.

Peter Schmidt served six years in the Air Force and has spent the rest of his professional life in the petrochemical, oil refining and power generation industries. Peter has BS and MS degrees in mechanical engineering from Lehigh University and is a licensed professional engineer in California and Louisiana. Peter is finishing up his book, “Elites in Name Only – the Financial Crisis,” a comprehensive look at the people behind the 2008 financial crisis. He also runs the website the92ers.com, which provides an overview of the 50 people most responsible for causing the 2008 crash.

Photo by Garry Knight

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift?

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift? Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […]

Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […] Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.