Nope, Everything Is Not Great: Just Look at the Data

Everything is great!

We’ve heard this mantra over and over again from government officials, TV talking heads and Federal Reserve bankers. But as we’ve been saying, all the optimism in the world can’t trump economic reality. And there are a lot of signs in the global economy indicating everything is not, in fact, great.

Dan Kurz at DK Analytics aggregates large amounts of economic data and forms it into a big picture. In his most recent post, Dan compiled a long list of economic and financial risks lurking out there in the global economy.

![]()

The following was written by Dan Kurz. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold

Growing Economic Expansion Risks

- The March 2018 household-survey count of employed Americans declined by 37,000 while the ranks of full-time American employees dropped by 311,000 (shadowstats.com).

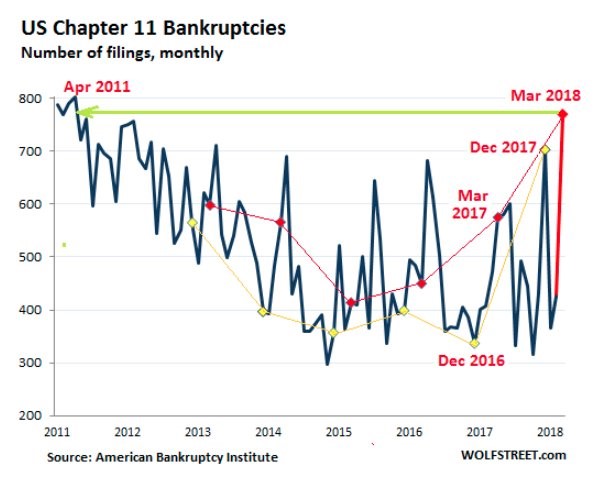

- A 63% year-over-year surge in US filings for Chapter 11 bankruptcy protection was tabulated in March.

- The worst-ever quarterly US merchandise trade deficit threatens to deflate GDP growth (shadowstats.com).

- US crude inventories are down 7% year-over-year at a 10.9% annualized rate over the last 6 months.

- German exports fell a seasonally adjusted 3.2% month-over-month in February, the biggest monthly drop since August 2015, raising question marks about the vitality of the EU’s economic dynamo amidst growing EU liquidity and solvency concerns related to the ECB’s asset purchases winding down.

- Declining global productivity: The failure of the technology is starting to be felt. Case in point: the rapid increase in DRAM prices over the last 18 months, which was due to the failure of technology laws (e.g., Moore’s Law), fed into a 10% increase in the ASP of smartphones worldwide last year, its fastest on-year growth yet (http://www.macrostrategy.co.uk).

- Domestic (US) inflationary pipeline pressures are building both in commodities (below) and in manufacturing. Needless to say, sustained dollar weakness would aggravate US inflationary pressures, potentially substantially. (And as we recently reported, dollar weakness looks good for gold.)

Growing Financial Risks

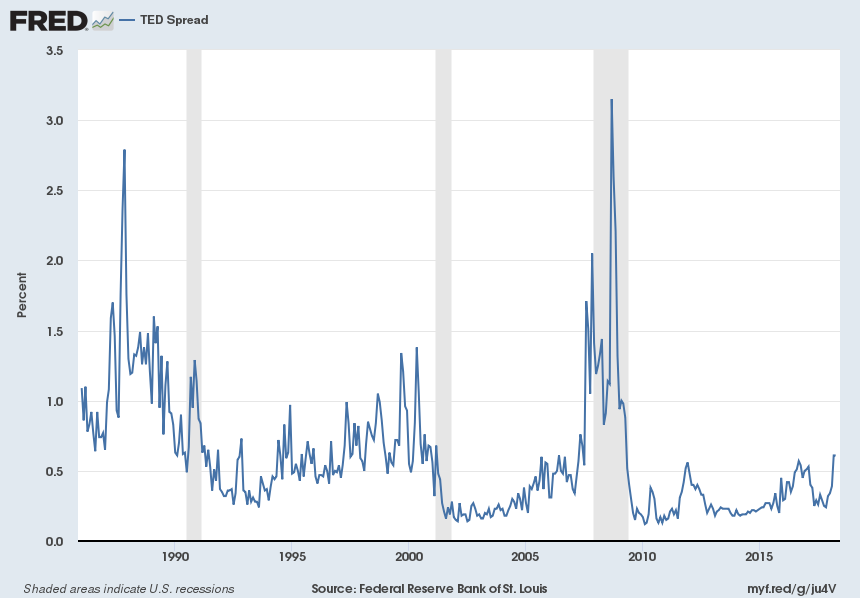

- Both the LIBOR and the TED Spread keep rising markedly, pointing to rising short-term financing costs for trillions of dollars of loans due to declining trust between banks (growing counterparty risks) and to increasing eurodollar scarcity, as regards USD-based LIBOR:

- Three-month Hong Kong borrowing costs have risen to the highest level since 12/2008, raising risks to the housing market. Diminishing liquidity may prompt banks to lift mortgage rates (http://www.macrostrategy.co.uk/)

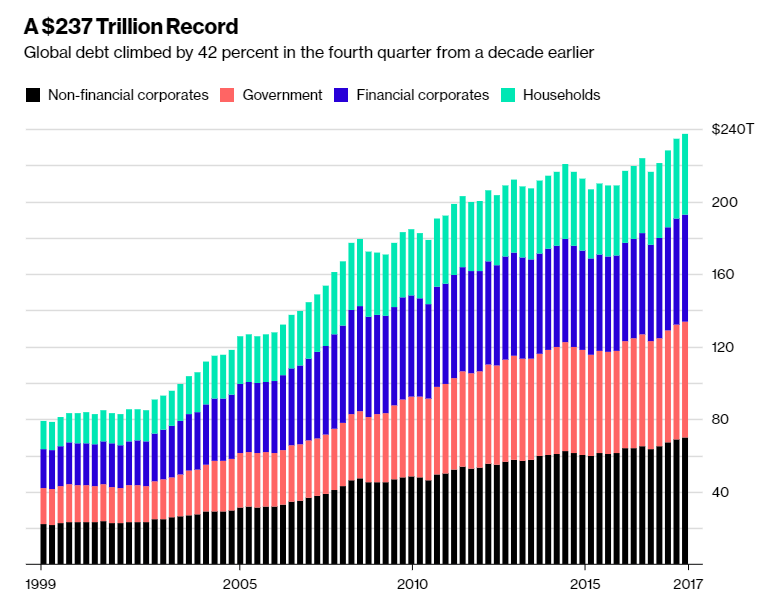

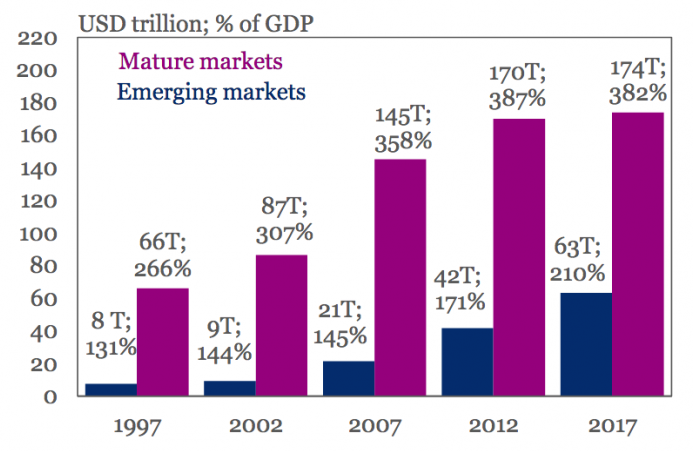

- Global debt at end of 2017: $237 trillion is 3.1x global GDP and is up $21 trillion, or 9.7%, in one year, signifying sustained misallocations, a continued decline in productivity, and increasing demographic challenges. (Just consider that a one percentage point increase in average global borrowing costs would soon translate into $2.4 trillion in higher annual interest expense, which would amount to global GDP headwind of 3%, and we’d still have historically low interest rates; normalized interest rates would translate into between 6 – 7% headwind, and interest rates which reflected our global insolvency, much less reversion beyond the mean, could not be paid, only “printed!”)

- In contrast, global nominal GDP, which stood at $75.8trn in 2016, has long been growing at a fraction of the rate at which global debt has expanded. This also attested to by a relentless rise in the global debt/GDP ratio:

- And all that “on-balance sheet” debt doesn’t address the, unfunded, non-financeable “off-balance sheet” commitments that central governments have (the US has $210 trillion, according to one source), from social security to medical care commitments for a burgeoning retirement ranks courtesy of a) inadequate contributions and b) retiring baby boomers. Nor does it address tremendously unfunded defined benefit pension plans, both public and corporate, which exceed $6 trillion in the US alone.

- (We would be remiss if we didn’t state that the $416 trillion in mostly off-balance sheet, non-exchange traded interest rate derivatives outstanding would threaten banks’ solvency should interest rates rise markedly.)

Peak EPS Risk (Last we checked, recessions haven’t been outlawed, especially not the overdue variety.)

- Flattered by repatriation gains at lower tax rates, 40% lower corporate tax rates, and a record stock buyback round likely in the making — one-time or financial engineering stuff — largely non-organic EPS gains of an expected 16% – 17% will have a short “half-life” in a weakening economy. (“Repatriation” happened in 2004, and S&P 500 EPS fell off a cliff two years later — in 2006 — and it took five years to top the 2006 S&P 500 EPS tally!)

- Share buybacks in 2018 have averaged $4.8 billion per day, double the pace from the same period last year, and could reach more than $800bn this year, which would eclipse both $530 billion in 2017 and even 2007’s all-time high of just under $700bn. Not surprisingly, a recent Bloomberg analysis found that about 60% of tax cut gains will go to shareholders, compared to 15% for employees. More financial engineering-based EPS growth, revisited.

- The $1.5 trillion GOP tax cut legislation (over 10 years) is a boon to corporations, should it remain law. It slashed the corporate tax rate to 21% from 35% and it reduced the rate on corporate income brought back to the United States from abroad to between 8% and 15.5% instead of 35%. As welcome as lower corporate tax rates are, capitalizing on them ultimately depends on achieving organic (top line) growth on the one hand and on avoiding a material increase in debt-servicing costs at both customer and corporate levels on the other hand. Given a perpetually more interest rate sensitive domestic and global economy, this isn’t an idle organic growth or financing cost concern, especially when considering the pronounced P&L operating leverage (fixed cost structure) inherent in many businesses. Stated differently,top-linee weakness typically leads to outsized profit compression.

- Poor earnings/EPS quality (also from a heightened foreign currency exposure perspective thanks to decades of “outsourcing” production)! US corporate debt is up from $3.5 trillion to over $6.1 trillion in less than a decade. And the “million dollar plus signing bonuses,” multi-million annual compensation, job-hopping, 1,000x line workers’ compensation, “slash and burn” C-Suite crowd keeps repurchasing high P/E shares with cheap debt (thank you, global financial repression) and with cash flow to underpin their multi-million dollar option gifts. Their prolific option grants a) typically vest way too early for top management to have a strategic focus and b) don’t incorporate rising book values per share thanks to retained earnings (non-distributed earnings); call it your proverbial non-aligned interests double whammy for strategic shareholders! Thus, instead of focusing on driving sustainable organic growth (we may delve into this topic in more detail in a separate post) and broad-based, lasting value creation, top management, richly compensated prior to “lifting a finger” and typically lacking strategic parallel interests with other shareholders and stakeholders, is motivated by corporate anorexia: reduce costs, R&D, and cap ex (slide 15), even if it cuts into the enterprise bone. The associated EPS myopia will, if past is prologue, be partly “addressed” by issuing stock at much lower (than buyback) prices to reduce “balance sheet leverage.” The resulting dilution and the value destruction for the benefit of the “1% today” will be paid by non-privileged shareholders “tomorrow.” How so? Via lower future earnings power (and the associated lower macroeconomic growth) and via lower future P/Es, the progeny of underinvestment, debt-based EPS levitation, and the coming beyond the mean reversion of interest rates that a decade of unparalleled global financial repression has delayed.

Conclusion: Pick Your Asset Bubble Pin – It’s Not a Question of If but When

Rising political risks (and we haven’t delved into growing geopolitical risks, neither the typically tragic and immensely expensive war or trade war varieties, both of which can be highly susceptible to “domestic disenchantment”), rising economic risks, rising financial risks, and rising peak EPS risks all suggest investors ought to “trim exposure” to overvalued stocks and bonds. Moreover, given our accumulating toxic public policy stew fallout (i.e., unsound money enabling unprecedented deficits, redistributionism, cronyism, misallocations, and declining property right protections and the ensuing unparalleled debt and failing productivity), we envision that the Keynesian power brokers in charge of global central bank monetary policy will “double-down” on what has gotten us into so much political, economic, and financial trouble. The latter is all the more true given our rapidly rising dense energy availability, affordability, and EROEI (energy return on energy invested) challenges, and thus, to a large extent, our productivity challenges.

We thus continue to think that QT (central banks selling bonds) will be brief, if it truly gets off the ground at all. However, when it becomes obvious to our central planners that “their” asset bubble progeny, upon which they have based their currency and economic malpractice “success,” are quickly deflating, they will rush to defend them. How? By expanding their balance sheets; by buying sinking bonds. While we don’t know when this will occur, we are convinced that it will. At such a juncture, it will be impossible to deny just how terribly flawed our “Frankenstein” central bank monetary policy has been, especially when dwelling on US debt of $68 trillion and global debt of $237 trillion.

So, if the bond vigilantes don’t “bolt” to front-run what will likely prove to be a very fleeting QT round by global central banks (again, if it commences at all), thereby driving up dollar-based interest rates in a world in which domestic and trade-related US financing needs could trump (no pun intended) $1.8 trillion on an annualized basis, surely rising inflation aggravated by “QE redux” will finally unnerve creditors. Why? Because they will be looking at entrenched and likely unprecedented currency debasement instead of a “financial repression worked” scenario. In such a world, even if outright defaults by various parties unable to meet obligations, from municipalities to states to massively underfunded public and private pension funds to “too big to fail enterprises,” can be addressed through the printing press, the value of the currencies in which they’ll be expressed will ultimately rival the value of a sheet of toilet paper.

Thus, an upcoming global fiat currency debasement default will finally take center stage. This will drive up rates, punish bonds, and deliver hyperinflation. Sadly, it’s the only politically feasible path. And the opportunity to sidestep this upcoming implosion in both bond and stock valuations (they are tied at the hip) is staring us right in the face. Sage investors stand to benefit handsomely from the upcoming reversion beyond the mean. And they might be well served to recall that mining-based precious metals (PM) supply is expanding the above ground gold and silver inventory at a puny $138 billion and $15 billion annual rate, respectively, based on current PM spot prices. The resulting 1% – 2% expansion in above ground PM speaks volumes about PM’s scarcity. It also suggests that any material increase in PM holdings beyond the current 1%-ish stake of investable global portfolio assets, which are currently on target to reach $278 trillion, would have to be realized via massively higher PM prices, i.e., the demand curve shifting up stoutly.

PLEASE NOTE: This commentary is not intended as investment advice or as an investment recommendation. Past performance is not a guarantee of future results. Price and yield are subject to daily change and as of the specified date. Information provided is solely the opinion of the author at the time of writing. Nothing in the commentary should be construed as a solicitation to buy or sell securities. Information provided has been prepared from sources deemed to be reliable but is not a complete summary or statement of all available data necessary for making an investment decision. Liquid securities can fall in value.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift?

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift? Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […]

Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […] Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.