The Myth of the Non-Essential Business

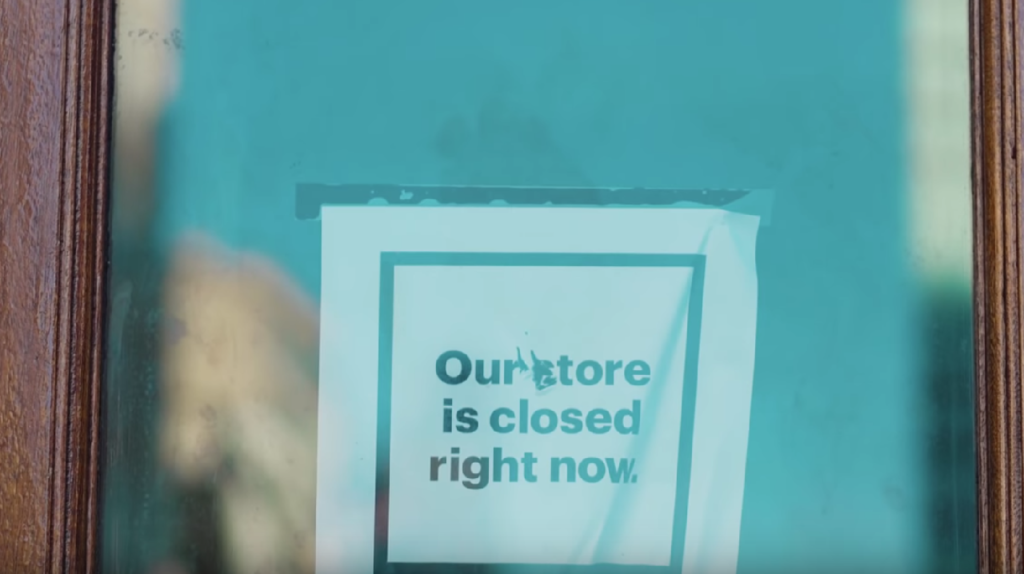

As the coronavirus-induced economic lockdowns have tightened across the US, we’ve seen the emergence of a government-inspired fantasy – the myth of the nonessential business.

Government officials across the country have forced the closure of these so-called non-essential businesses while allowing “essential” enterprises to soldier on. Politicians and bureaucrats have developed arbitrary criteria to determine which businesses are and are not essential.

I say arbitrary because there is really no objective way to make such a determination.

In the first place, every business is essential to the owners and employees who depend on it for their livelihood. Try telling the owner of a “non-essential” craft shop that her business is non-essential when her mortgage comes due.

As I wrote last week, the economy is life-sustaining.

Looking at the macroeconomic picture, determining what is or isn’t economically “essential” presents us with the fundamental problem of central planning: nobody possesses the knowledge necessary to grasp all of the ramifications of shutting down one business in favor of another.

The economy is an intricately intertwined system. It is diversified across time and distance. One part depends on another in a symbiotic relationship. Production and distribution form a long chain of interconnected links.

No link in a chain is “non-essential.”

When you yank one link out, however insignificant it might seem, you destroy the entire chain.

That’s exactly what these government officials are doing with their arbitrary closure of “non-essential” businesses. They are destroying the economic chain. They may take solace in the fantasy that they are only shutting down that which is non-essential, but they fail to recognize their own ignorance.

Leonard Read traces the production of a simple pencil in his classic essay, “I, Pencil.” The story reveals the complexity of the economy and the power of the market by chronicling the production of a simple pencil. From the lumberjack who cuts down the tree that supplies the wood, to the trucker who drives it to the sawmill, to the oil rig worker who pumps the oil that fuels the truck, to the hundreds, if not thousands, of other people who directly or indirectly contribute to the production to the little pencil, each has a role to play and none is “non-essential.” Disrupting one of the hundreds of processes will reverberate through the system and could result in the pencil not being produced.

It’s hubris to think some group of people can micromanage an economy and determine what is or is not essential.

Of course, politicians excel at hubris.

We can debate the necessity of social distancing and economic shutdowns. Perhaps they are necessary in light of the pandemic. But we should also consider the price. Because the cost of shutting down businesses is high, both to the owner and employees who depend on them for sustenance and the broader economy that depends on them as key links in a long chain. And this is true whether governor so-and-so thinks they are “essential” or not.

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […] The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.