States are Moving to Abolish Federal Fiat Currency

Dan Kurz is a CFA with over two decades experience working in Zurich, Switzerland as a thematic strategist for Credit Suisse CIO Office. Dan’s site, DK Analytics, offers deep and broad analysis at the macro and micro level.

Dan Kurz is a CFA with over two decades experience working in Zurich, Switzerland as a thematic strategist for Credit Suisse CIO Office. Dan’s site, DK Analytics, offers deep and broad analysis at the macro and micro level.

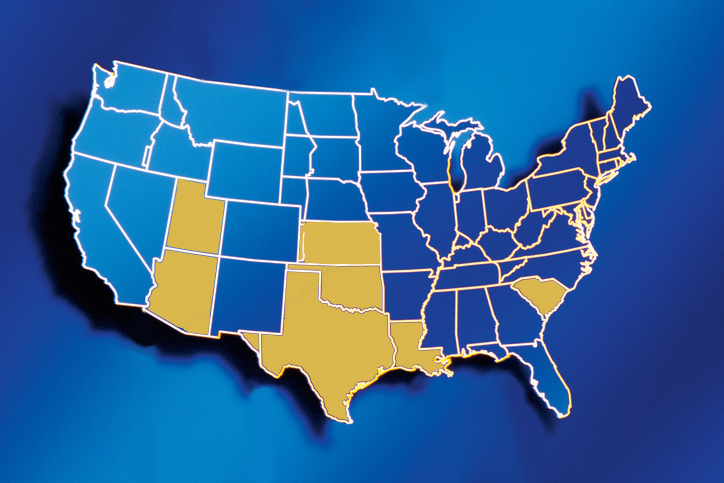

Spearheaded by legislative efforts in Utah, Texas, and Oklahoma, a substantial number of states have undertaken efforts to reinstitute gold and silver as money (according to the hyperlink-based sources, 24 have made efforts). Numerous states are increasingly concerned about the nation’s Fed-based fiat monetary system, which debases the dollar, enables protracted, yawning deficit spending and trade deficits, and runs up huge, unpayable debts. With Utah, Texas, and Oklahoma blazing a trail back to constitutional money, states such as Louisiana, Arizona, South Carolina, and Kansas have been inspired to once again make gold and silver legal tender with which to conduct commerce in their jurisdictions.

They are trying to bring back what the Constitution dictates for states in terms of permissible tender (money): “No State shall … make any Thing but gold and silver Coin a Tender in Payment of Debts;” (Article 1, Section 10 of the Constitution).

When the Constitution was signed in September 1789, today’s Washington, DC was a mosquito-infested swamp. Once it became the young federalist republic’s new capital in July 1790, it was a backwater lacking meaningful revenues short of tariff income (there was no federal income tax until 1913). Federalism was written in CAPITAL LETTERS. At that time, leading citizens of the several states ran for office to represent their states in Washington, DC as a “do good sacrifice” for both their states and their young country. They typically didn’t stand for re-election or seek multiple terms. Action, commerce, good income generation, wealth, and their families were waiting for them when they returned home to their respective states, … which could only conduct commerce with gold and silver coins. Call it a de facto national precious metals monetary standard.

They say that history repeats. This is for good reason. Much of Asia still considers gold and silver to be money. China invented paper money before the first millennium came to a close. The Chinese, and other old cultures, including the Indians (whose women, to this day, wear their wealth, gold, on their foreheads, necks, and arms as jewelry) and the Turks, have lots of historical experience as regards paper money becoming worthless. Gold and silver have continued to move from West to East as Asians and Asian nations shield themselves from unprecedented, global fiat currency debasement.

So, let’s see: we’ve got Asians with the collective wisdom of thousands of years of monetary history; we’ve got our brilliant Framers, who were steeped in historical knowledge as regards both Age of Enlightenment principles (very much including inalienable rights) as well as how to keep both debt and inflation at bay, which they codified in our peerless Constitution; and we’ve got states (including a handful of original states from whence the Framers came), which gave reluctant birth to the federal government and sought to “ring fence” its powers, looking to return to constitutional money.

These factions, constituents, and principles represent possibly unrivaled aggregated knowledge as regards what constitutes the ultimate form of money (purchasing power preservation and inflation and deflation protection), physical gold and silver.

Which ties into a recent post of ours with the title “Fruitful disruption or more cronyism, debt, and inflation? And valuations?” Or, what happens when we move from real money and the rule of law to fiat money and fiat government. As regards our take on precious metals in today’s world, we state this in our concluding remarks:

“… We would be remiss if we didn’t also call out portfolio reallocation into vital, scarce real assets (which can’t be printed into existence), especially dense energy and ag assets, and into real money, physical gold, and silver, or precious metals (PM). PM have been artificially suppressed by central banks and their member banks (Wall Street, London, Frankfurt) for a decade, if not longer, and in sync with unprecedented and sustained global financial repression. As such, and on the heels of the upcoming great “asset valuations reset,” PM liberated from paper manipulations may prove to be “cash on steroids,” bestowing substantially increased purchasing power on correctly positioned investors. History clearly suggests that fiat currency regimes, and the assets tied to them, are quite short-lived — their longevity is less than three decades, on average. We are nearly 46 years into a global fiat currency system anchored by a debasing dollar that officially buys only 17% as much as it did in 1971 (it’s actually a lot less, but …).”

Read the rest of Fruitful disruption or more cronyism, debt, and inflation? And valuations?

Get Peter Schiff’s latest gold market analysis ñ click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.