Gold Is the Best Standard of Value

This article was written by Joel Bauman, SchiffGold Senior Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was written by Joel Bauman, SchiffGold Senior Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

The current debt-based fiat monetary system creates an illusion of wealth expansion.

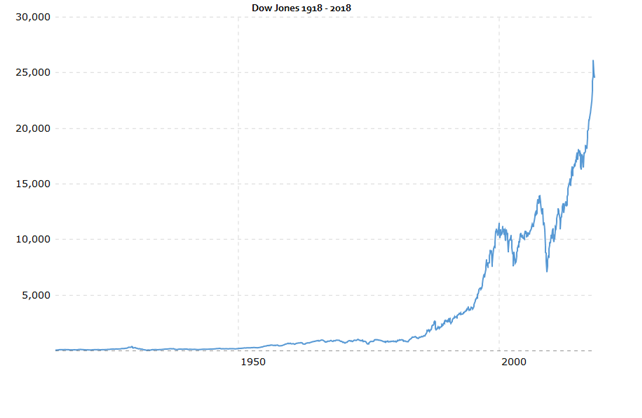

For example look at this 100-year price chart of the Dow Jones Industrial Average.

The Dow Jones chart looks a lot like a Bitcoin graph with its exponential growth. No wonder so many financial advisors say the best thing investors can do is simply buy and hold.

But one has to wonder, is this chart impressive simply because US equities really have been doing so well? Or is it because the denominator, the dollar, fails to measure wealth over time? Or both?

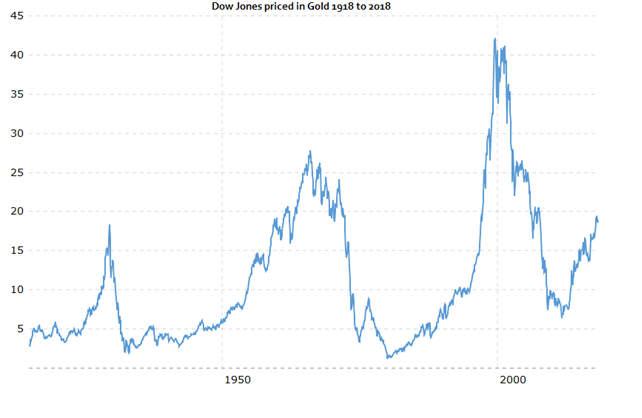

Let’s look at the same time period using gold as the measure of value instead of using dollars.

Looking at this chart, the classic ‘buy and hold’ advice doesn’t seem so great. You can see distinguishable highs and lows on this graph.

Any potential stock buyer looking to time their purchase may have benefited from the Dow/gold chart. For example, in 2011 it was easy to see stocks were at their relative lows in terms of gold. However, the original Dow chart priced in dollars shows the index near all-time highs.

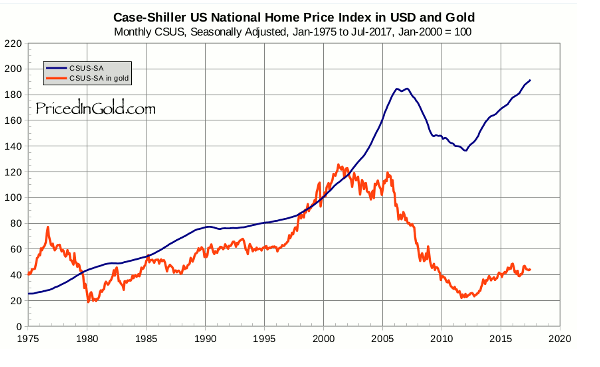

You can see a similar trend in the US real estate market.

It’s interesting to note how the US real estate market was in a dollar bubble during the early 2000s until about 2006 when prices softened. In gold terms, there wasn’t really a bubble, the market was relatively flat during the early 2000s with a sharp decline beginning in 2005-06.

All of this demonstrates an important truth: Investors should care about maximizing their wealth and it’s difficult to measure wealth with a poor fiat standard like the dollar.

Wise words from the book of Proverbs notes the importance of an honest standard.

A false balance is an abomination to the Lord: but a just weight is his delight.” Proverbs 11:1

Even though gold isn’t generally recognized as money in the modern economy, this doesn’t mean individuals can’t have a personal gold standard. Before making any serious financial purchases or sales, I recommend checking an asset’s gold price history. This can be done through websites such as pricedingold.com. There are also a number of charting tools that allow users to create historical price graphs denominated in gold.

With gold, the real value of assets may be seen and investments can be measured by their true productivity and not their illusionary growth in fiat dollars. This truth cannot be understated.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.