A Brief History of Platinum

Platinum has caught the eye of customers lately given how relatively inexpensive it has been trading compared to other precious metals.

Even though throughout history platinum has been cheaper per ounce than gold, platinum experienced a major spike in price from roughly 2000-2008. Since then, platinum has remained less expensive than gold, and this has caused some people to consider it a better potential speculative play versus simply buying gold.

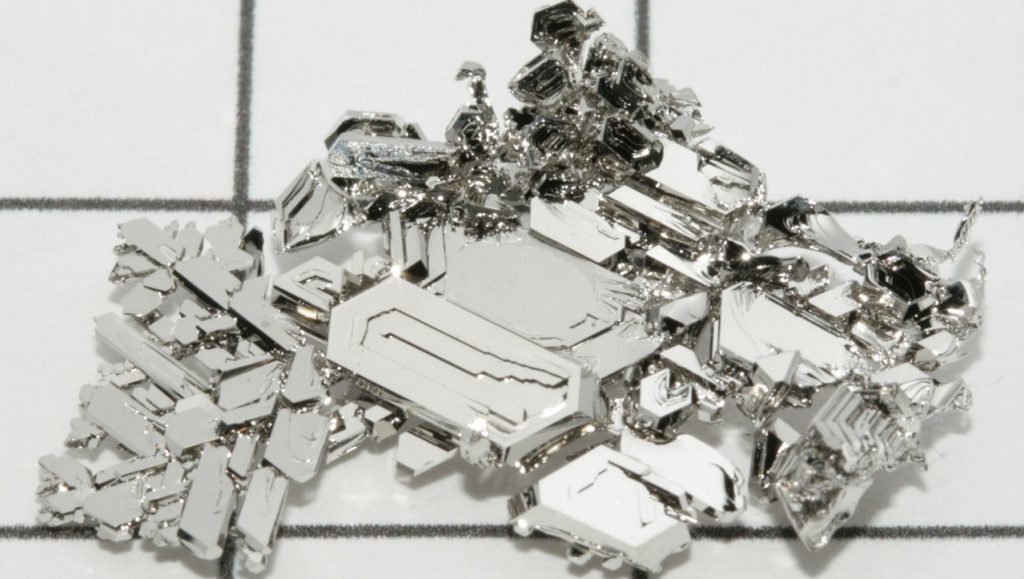

Platinum is one of the rarest metals in the world. Only 0.005 ppm (parts per million) can be found on the Earth. That compares to gold at 0.004 ppm and silver at 0.075 ppm. Platinum actually exists in higher quantities on the moon and meteorites, however, this is currently a moot point. Until we are far in the future and have means for economical space mining, I don’t think this will play a factor in its price valuation.

While we know a lot about gold and silver, given they have been around for thousands of years, platinum is more of the “new kid on the block.” The metal is primarily known for its use in catalytic converters. Given that it’s not as well know, I thought it would be interesting to look into platinum’s brief history and how it has historically been used.

Some historians speculate that in the ancient world, platinum was thought to be a natural mix of gold and silver. One of the earliest sightings of platinum was in Egypt on the Casket of Thebes mixed with gold and silver. Platinum was also used by some indigenous tribes in South America to make nose rings and other ceremonial jewelry.

When Spanish conquistadors began exploring the New World in the 1600s, they discovered platinum while mining for gold. However, they considered it an annoyance and disposed of it. They dubbed platinum “platina” which means “little silver.” This later evolved into the word, platinum.

Platinum was officially “discovered” by Spanish mariner Antonio de Ulloa in 1736 in Colombia and he wrote the first scientific description of the metal. This led to platinum being studied by scientists who were intrigued by its resistance to corrosion and their inability to melt it. It wasn’t until later, when techniques to reach higher temperatures were invented, that platinum’s melting point was discovered.

Platinum was originally thought to be an unpredictable metal, until what scientists thought were inconsistencies were discovered to actually be different Platinum Group Metals, now known as PGM. At this point in history, platinum was mainly used for decoration and laboratory instruments.

In the late 1800s, we began to see platinum used in jewelry. The famous Cartier and his sons were able to master the metal and bend it to their skill. This created a high demand among royals around the world for platinum and increased the Cartier brand’s renown.

Until the early 1800s, platinum was only found in Colombia; however, in 1819, platinum was discovered in the Ural Mountains in Russia. This helped make the metal more accessible. Platinum was then discovered in Canada in 1888. That country became the world’s largest supplier of the metal after World War I continuing until the mid-1900s. Around that time, platinum was starting to be used as a catalyst, and an increasing demand was placed on the metal. Then in 1924, platinum was discovered in South Africa, which became, and continues to be, the world’s largest supplier. Around 75% of the world’s platinum is mined in South Africa.

Since the early 1900s, scientists have continued to discover different uses for platinum, including catalytic converters in vehicle engines, dental work, computers, pacemakers, and chemotherapy.

Platinum was first used as currency in Russia when coins were minted in the late 1820s. Since then famous mints around the world have issued platinum currency. Both the Royal Canadian Mint and the Australian Perth Mint first minted platinum coins in 1988. They were followed by the United States mint in 1997, the Austrian Mint in 2016 and the Royal Mint in 2018.

Here at SchiffGold, we sell platinum coins and bars along with our gold and silver products. Note we don’t have an official company outlook on the metal given it doesn’t have a historical monetary precedent. The platinum coins minted have been more for marketability rather than practical monetary use. We feel gold and silver are the primary precious metals for hedging against the USD and that platinum is more of a speculative metal that plays on its industrial uses.

With that said, many have done well in the past strategically buying and selling platinum at the highs/lows. I’m curious to see how platinum performs in this next decade.

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […] The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.