’67 Mustangs, Rolling Stone, and Diversifying Your Wealth

This article was submitted by Matt Malleo, SchiffGold Precious Metals Specialist and Managing Director. Matt was formally educated at Cornell University where he studied business. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was submitted by Matt Malleo, SchiffGold Precious Metals Specialist and Managing Director. Matt was formally educated at Cornell University where he studied business. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

The following is a fictional account of a day-in-the-life of a teenage boy named Mike Stockton living in 1967. Mike’s story is recorded as a set of entries made in his financial diary, outlining his economic activity, a summer night date, and his hopes of buying the car of his dreams.

Entry #1

July 1, 1967

Dear Financial Diary,

I am Mike Stockton a 15-year-old high school student in Wisconsin figuring out the world. I wake up on a sunny Saturday morning July 1, 1967, and go off to work. Too young to be drafted in the Vietnam War, I help support my family, pumping gas at $0.30 a gallon for my minimum wage of $1.40 an hour. I save as much as I can and I have been working for years. I’m due to get my license in one year and want to buy my dream car, a red Shelby Mustang priced at $2,461.

Today, I decide to spend $0.35 for a newly released magazine called Rolling Stone Magazine. I am a music fan and was telling all my friends about two bands that I predict will make it big, The Doors and Pink Floyd, they both released their first albums in 1967. It has been the Summer of Love, with protests around the country drawing hundreds of thousands to pressure President Lyndon B. Johnson into taking America out of the Vietnam War. It hasn’t worked though. Instead, the President gathered a group of “Wise Men” and they planned on combating the protests with optimistic reports from Vietnam.

It’s a summer Saturday night and I had a date. Took her to the movies to see The Dirty Dozen. Tickets were $1.25 each, and I bought a Shasta Cola $0.10 and a Snickers $.05 for each of us. I spent $2.80. That’s two hours work … before the tax man got a hold of me. I dream of the day when I can drive a Shelby Mustang. When that happens, we will go to the drive in so I can get more than a kiss on the cheek. During the whole movie I was thinking about my beloved Packers winning the first ever Super Bowl I this past January. What a game to watch, I was glued to the new TV set. My family got one of the first color TVs on the block. I heard the advertisers were paying $40,000 just to get a 30-second commercial during the Super Bowl!

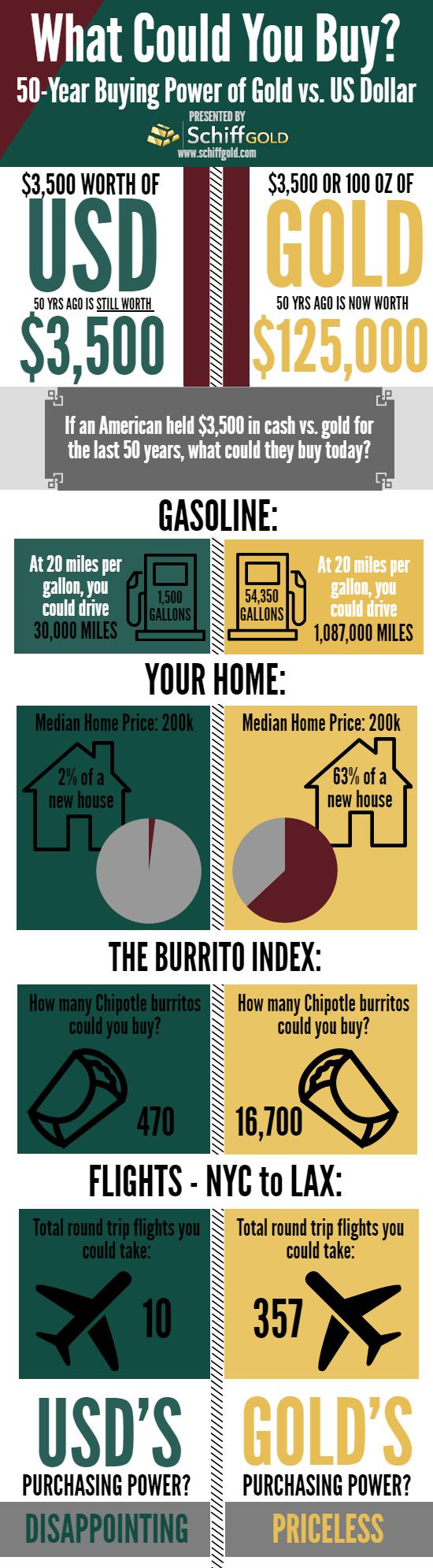

Years of work has paid off. After taxes, the Rolling Stone magazine, the movies and some food, my bank account reads $7,000 even. I ride my Schwinn Speedster ($44) to the bank and ask for $3,500 in cash, and, instead of the other $3,500, I get 100 ounces of gold at $35 per oz. I heard Irwin Schiff testimony to the Senate committee on Banking, and he was very strongly opposed to the government’s plans to remove gold backing from the dollar. I am not sure if he is right, so I am going to play it safe and hold my wealth in some dollars and some gold.

Exhausted from a long day, I put the $3,500 and the 100 oz gold coin under my pillow and go to sleep … for 50 years.

Entry #2

July 1, 2017

Dear Financial Dairy,

Bewildered, I wake up and it’s now 2017. Fifty years later! As I step out of bed I realize I am pretty sore, could be that I have been asleep for 50 years or it could be that my pillow was lumpy. Just then I remember what I was sleeping on, Eureka! $3,500 in cash and 100 oz of gold!

I spend the day figuring out what is going on with the world. Here in 2017 land, many things are different but some things are the same. My prediction about The Doors and Pink Floyd was accurate. They are still on the radio! My Packers are still good. Bart Starr retired, but we have another QB now they say is pretty good. Aaron Rodgers is his name. The Vietnam war ended but people are still bitter about it. Rolling Stone Magazine has over 1,000 issues! Prices have definitely gone up in dollar terms! A gallon of gas is now $2.40, and the movies cost $9.00! Snickers cost $1.40 and sodas are $1.19 each, My Schwinn Speedster is now $220 and that Super Bowl commercial now costs $5 Million!

The best part is that 100 ounces of gold at $35 an ounce, is now worth $125,000 ($1,250 per oz). I am glad I took Irwin Schiff’s advice and kept half my savings in gold. The dollar definitely didn’t hold its value.

Well, I better get ready for tomorrow. I am going to go to the Mustang Dealership and buy that red Shelby ’67. I’m just hoping it’s still $2,461.

Although Mike’s circumstances are imagined, the economic reality behind the fifty-year decline in the dollar’s purchasing power is very real. Mike learned an important lesson about the economic effects of fiat currencies and central banking policies.

But Mike listened to trustworthy people who advised him to diversify his wealth. It’s easy to get started protecting your personal wealth and buying gold and silver. Meet the entire SchiffGold precious metals team and learn about we help the Mike’s of the world stay ahead of corrosive inflation and central banking policies. Better yet, apply to become a Junior Broker and put your precious metals knowledge to work for you.

Get Peter Schiff’s latest gold market analysis ñ click here – for a free subscription to his exclusive weekly email updates.

Interested in learning how to buy gold and buy silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […] What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them.

What is Nvidia? If you’re a committed gamer the question may sound like nonsense. Nvidia, which was founded in 1993, is a tech company that makes GPUs and other products. It originally specialized in making products for the video game industry, that assisted in 3D rendering. If you were a committed gamer, you probably owned their products. If you weren’t, you might not have heard of them. With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […]

With the AI boom and green energy push fueling fresh copper demand, and with copper mines aging and not enough projects to match demand with supply, the forecasted copper shortage has finally arrived in earnest. Coupled with persistently high inflation in the US, EU, and elsewhere, I predict the industrial metal will surpass its 2022 top to reach a […] America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.

America’s trust in its institutions has rapidly eroded over the past 20 years. We have a lower level of trust in our judicial system and elections than most European countries. Some of this is natural, as Americans are uniquely individualistic, but much of it arises from repeated government failures.