Buy Gold the Ultimate Monetary Insurance Policy

Learning how to buy gold and other precious metals can feel like a journey for some. How much of one’s savings should be in gold and silver? What types of gold to purchase (coins, bullion, bars, other)? These and other questions relating to the purchase of physical precious metals are all important.

But why even bother with physical gold when so many other investment opportunities exist? Because gold is the ultimate monetary insurance policy. No other asset offers the same level of security, privacy, and liquidity. The value of gold is determined by the free market and does not depend on governments, banks, or stock markets.

Countries around the world face unprecedented levels of sovereign debt, and this balance will come due. However, governments like the United States are obsessed with just one solution to their debt problems: currency debasement, also known as inflation. The US is on autopilot towards the permanent destruction of the dollar with its inflationary monetary policies. Buying gold is one of the best and easiest ways to protect yourself from that destruction and grow your wealth at the same time. Click here to learn the ABC’s of buying gold.

Buying Gold Coins is Perfect for New Investors

Click Here to Place an Order

Unlike other precious metal dealers, SchiffGold works with our customers on a one on one basis to make sure you’re getting the service you deserve.

SchiffGold also offers some of the lowest pricing in the entire industry!

If you’re ready to buy or simply have questions you can reach out to us via:

LIVE CHAT: Click here or look for this icon![]()

EMAIL: info@schiffgold.com

PHONE: 1-888-465-3160

Buy Gold Maple Leafs

The Canadian Gold Maple Leaf is produced by the Canadian National Mint. Its beautiful design and its .9999 fine gold purity has made it among the most popular gold 1 oz. coins in the world.

Buy Gold American Eagles

Produced by the US National Mint, the American Gold Eagle, with its iconic design, is considered by many to be the most prominent and popular of all 1-ounce, gold, nationally-minted coins.

Buy Gold Fractional Coins

Gold American Eagle and Canadian Maple Leaf coins are also produced in sizes less than one full ounce. Many people buy gold fractionals since their value is significantly less than the 1 ounce coin, and could be useful in barter transactions.

Buy Gold Bars – The Most Affordable Gold Option

Click Here to Place an Order

Unlike other precious metal dealers, SchiffGold works with our customers on a one on one basis to make sure you’re getting the service you deserve.

SchiffGold also offers some of the lowest pricing in the entire industry!

If you’re ready to buy or simply have questions you can reach out to us via:

LIVE CHAT: Click here or look for this icon![]()

![]()

![]()

![]()

EMAIL: info@schiffgold.com

PHONE: 1-888-465-3160

Buy Gold Valcambi Combibars

The .9999 fine gold 50-gram (1.6075 oz.) bars are about the size of a credit card, and can be easily broken into 1-gram bars without any loss of material.

Buy Gold 1-Oz Bars

Our 1-ounce Gold Bar is 99.99% pure and is widely accepted in global markets.

Buying Gold

1. Is gold a good investment for me?

2. What kind of gold should I purchase?

1. Is gold a good investment for me?

So if you’re socking away funds for retirement, why save in dollars? The US dollar is consistently losing purchasing power. Plus, in today’s banking environment it can actually cost money to keep your savings in a bank account. Gold is one of the best ways to ensure the 100 dollars you have today will hold its purchasing power decades into the future.

SchiffGold and Peter Schiff generally recommend keeping 10-15% of your savings portfolio in gold and silver. You don’t have to be extravagantly wealthy to buy gold – anyone who has started a nest egg can allocate a portion of it towards the yellow metal.

For more information about why people invest in gold:

Read SchiffGold’s Investment Philosophy

Download SchiffGold’s Free White Paper: Why Buy Gold Now?

2. What kind of gold should I purchase?

There are thousands of gold products on the market, but the list of well-known bullion products from reputable mints and refineries is short. Generally, you want to buy gold coins or bars from one of the major national mints or larger private refineries. You will notice these are the only products we feature on the SchiffGold website. (Read more about our product policies here.)

Gold Bars

Gold Coins

There are also several large private refineries in the United States that make top-notch, world-renowned products, such as the American Gold Buffalo coin.

Gold Canadian Maple Leaf Coins

For more information on which products are right for you:

- Our free special report, Classic Gold Scams, is a must-read for first-time gold buyers. It warns you which products to avoid when buying precious metals:

Free Download: Classic Gold Scams And How To Avoid Getting Ripped Off

- SchiffGold’s Guide to Tax-Free Gold & Silver Buying will help you plan and understand the tax and reporting requirements for both buying and selling gold:

Download Free: SchiffGold’s Guide To Tax-Free Gold & Silver Buying

Click Here to Place an Order

Unlike other precious metal dealers, SchiffGold works with our customers on a one on one basis to make sure you’re getting the service you deserve.

SchiffGold also offers some of the lowest pricing in the entire industry!

If you’re ready to buy or simply have questions you can reach out to us via:

LIVE CHAT: Click here or look for this icon![]()

![]()

![]()

![]()

EMAIL: info@schiffgold.com

PHONE: 1-888-465-3160

SchiffGold Product Policies

Type of Product

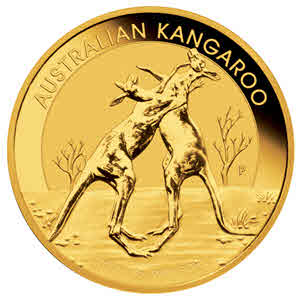

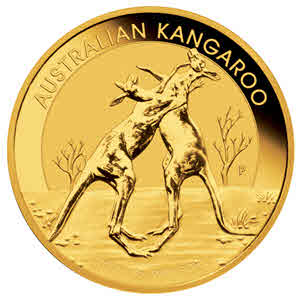

We recommend that serious investors buy gold and silver in only the form of bullion coins and bars. Within that category, buyers are wise to stick with industry standard, nationally-minted coins: American Eagles and Buffalos, Canadian Maple Leafs, Australian Kangaroos, and South African Krugerrands.

Many of our competitors push exotic or commemorative coins, which are sold to unsuspecting investors for 25-30% commissions over the price of the metal they contain. In general, these products are terrible investments and should not be considered if you are looking to protect your savings from inflation.

In gold, we recommend buying these types of products: 1-ounce and fractional gold coins, 1-ounce bars, 10-ounce bars, and 1-kilo bars.

In silver, we recommend buying these types of products: 1-ounce coins, 1-ounce and fractional rounds, 10-ounce bars, and 100-ounce bars. We also recommend junk silver – US quarters, dimes, and half dollars that were minted prior to 1964 and are 90% silver by weight.

While we do not recommend or sell rare or collectible coins, we have access to any and all gold and silver products that might interest you. If you are looking for products not listed on our website, we can usually offer them at prices far below what our competitors would charge. Call us for more information: (888) 465-3160.

Pricing

Our prices are among the lowest in the business. Owing to the size of our business, we are able to purchase at the steepest discounts and pass the savings along to our customers. We will work hard to earn your business.

In addition to excellent pricing, we provide diligent and attentive customer service. Our clients enjoy exclusive access to Peter Schiff’s insights and recommendations. We custom-build an experience that is suited to your needs. This is what sets us apart from the competition.

We do business the old-fashioned way: providing individual service with a real person. We do not offer online purchases. Many online companies rely on deceptive pricing, hidden costs, or worse. Our prices are transparent and total. Call us at (888) 465-3160 to learn more about how we can help you to buy gold.

Honesty and fair dealing are the hallmarks of SchiffGold and Peter Schiff. We look forward to earning your business.

Why We Don't Sell Numismatic Coins

We have nothing against collecting numismatic coins for aesthetic or hobby reasons. However, if you want to buy gold, we argue that for two critical reasons numismatic coins are generally poor investments.

First is the mark-ups or commissions. It is not uncommon to see mark-ups of 20% to 35% on numismatic coins. That means that the price of gold has to appreciate by 35% before you break even on a sale.

Would you buy a stock if your broker charged you a commission of 35%? We have our roots in the securities industry, where commissions are far lower, which is part of why we do not sell numismatic coins.

In addition, selling little-known, unusual, or exotic coins may be difficult, or you may have to sell below the market value of the metal. Unless the dealer has an immediate need for the coin you purchased, he may be reluctant to repurchase it from you. In contrast, bullion coins are a fungible commodity for which there is always a ready, liquid, and transparent global market.

Reliability & Integrity

The precious metals field is completely unregulated. Dealers of dubious reputation are not uncommon, as are investing schemes that sound good but are often rigged to bilk unsuspecting buyers.

In times of economic uncertainty, shady operators take advantage of the urgent and emotional demand for precious metals by jumping into the marketplace. In such an environment it is incumbent on consumers to buy gold only from trustworthy companies.

Peter Schiff is Chairman and Principal Owner of SchiffGold. Over the years, Peter has developed a sterling reputation as a no-nonsense straight shooter who zealously guards his public image.

Time and again, Peter has shown his in[yasr_overall_rating]tegrity by telling the truth, often at the expense of popularity and potential business. His specific goal with SchiffGold is to bring honesty, integrity, and fair pricing to the business.

Liquidity

Liquidity is an important factor when you buy gold and silver. There will come a time when you want to sell your metals. Since we only work with recognizable, highly liquid bullion products, you can sleep easy knowing the metals you purchased can be easily sold.

Liquidity presupposes a fast and efficient market, which may not exist for so many of the numismatic and exotic coins that are offered by our competitors. Often, the only buyer for your collectible coins may be the dealer from whom you bought them. This is not an ideal situation.

SchiffGold stands ready to help you buy gold or sell your precious metals. We stand behind everything we sell and are happy to buy back any gold or silver product you’ve purchased – whether you bought it from us or not.