On June 4, 2019, during an interview on Fox Business, Peter Schiff said the Federal Reserve was going to cut rates to zero and launch another massive round of quantitative easing.

March 16, 2020 — here we are.

Last week was a rollercoaster ride on Wall Street. In the midst of market madness, Peter Schiff appeared on RT Boom Bust to talk about a range of subjects from the Fed’s move to cut rates, to coronavirus, to the impact of Super Tuesday and presidential politics on the markets, to government ineptitude.

He started out the interview reiterating a point he’s made over and over again over the last few months. This market is all about the Fed and it’s always been all about the Fed.

Peter Schiff recently appeared on Fox Business Claman Countdown along with Stephen Guilfoyle and Luke Rahbari to talk about gold, bonds and coronavirus.

Stocks have sold off two straight days as investors pile into safe-havens due to coronavirus fears. Yields on both 10-year and 30-year Treasuries fell to record lows this week. Gold has also gotten a healthy boost over the last few days. The yellow metal pushed to $1,690 per ounce on Monday, but gave up some of its gains on Tuesday in the midst of profit-taking.

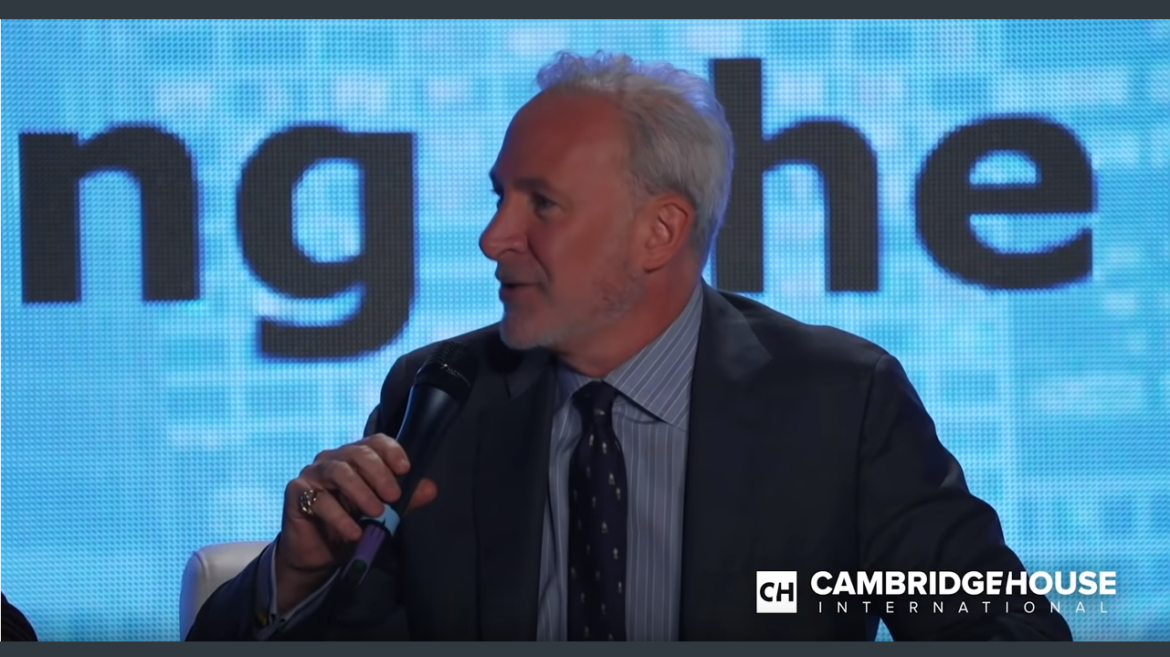

Last year at the Vancouver Resource Investment Conference, Peter Schiff bet Brent Johnson a gold coin that the Fed’s next move would be a rate cut. At this year’s conference, Peter collected his gold coin.

Brent and Peter went on to debate the future of the US dollar. Brent says the dollar will go up this year. Peter thinks it’s going down. Peter put his money where is mouth is and went double or nothing against the dollar.

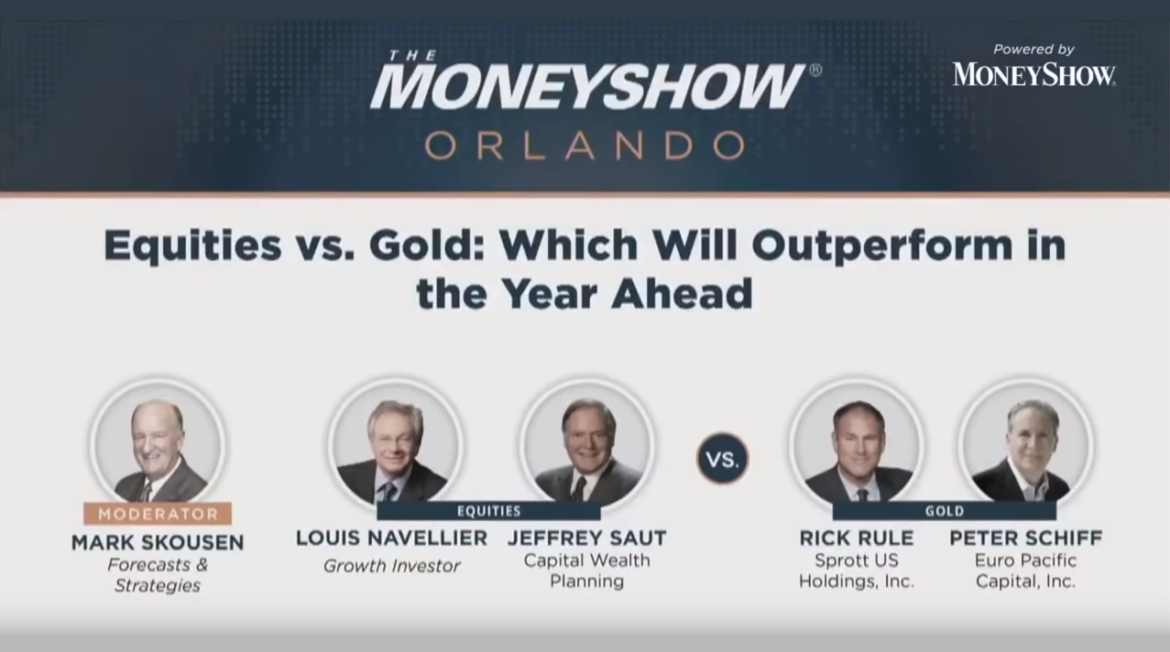

Which will outperform in 2020? Gold? Or Equities?

Peter Schiff joined a moderated debate on the subject at the Orlando Money Show. Peter teamed up with Rick Rule to argue for gold, against Louis Navellier and Jeffrey Saut, who contend the stock market is still the place to be. Mark Skousen moderated the debate.

Last week, Peter Schiff gave a speech at the Orlando Money Show and made the case that all the hype about the greatest economy in history is just that – hype. Nobody should be taking credit for the economy. We should be asking who is to blame.

During the Vancouver Resource Investment Conference, Peter Schiff joined Frank Holmes (US Global), Rick Rule (Sprott US), and Grant Williams (Vulpes Investment Management) on the “Ultimate Gold Panel. Daniela Cambone moderated the discussion.

Gold charted its best year since 2010 last year. The price increased by 18.4% in dollar terms. The yellow metal also reached record highs in every G10 currency except the dollar and the Swiss franc. Can this bull-run can continue into 2020?

Rick Rule talked with David Lin of Kitco News at the Vancouver Resource Investment Conference. Rule is the senior managing director at Sprott Inc., and he’s bullish on gold. During this discussion, Rule explains why, touching on a range of subjects including the Federal Reserve, the trade war, the US dollar, the bond market and more.

To kick off the interview, Lin points out that gold has been rather range-bound since the price spiked in the wake of tensions in the Middle East. Rule said this is a sign of a healthy gold bull market.

On Nov. 18, Peter Schiff appeared on RT Boom Bust to talk stock markets, trade war and Federal Reserve policy. He said that right now the Fed is doing a good job stimulating the bubbles, but ultimately, it’s going to end very poorly.

On the trade war front, there seems to be a lot of conflicting information and continual yo-yoing between pessimism and optimism. The Chinese seem less confident while White House economic advisor Larry Kudlow says a deal is close.

Peter said he thinks China is posturing for negotiations.

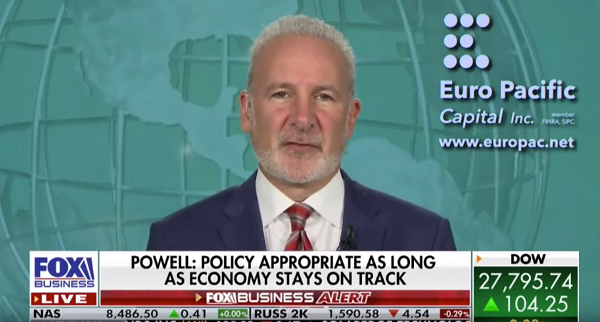

Jerome Powell lectured Congress about the national debt last week, calling it unsustainable. The Federal Reserve chairman is concerned. He admitted that with interest rates already close to zero, the central bank has very little room to cut rates in the event of an economic downturn. Peter Schiff appeared on the Claman Countdown, along with Milken Institute economist Bill Lee to talk about Powell’s comments.

Peter said that while Powell is lecturing Congress, it’s really the Fed’s fault.