The World Gold Council released their latest Gold Demand Trends for the 3rd quarter of 2013. The report goes into detail about world gold demand in the investment, consumer, central bank, and technology sectors. Gold Demand Trends is available as a free download, and Marcus Grubb, the World Gold Council’s managing director for investment, gives a video presentation summarizing the report’s key findings.

82% of consumers in India and China believe that over the next five years, the price of gold will increase or be stable… Bar and coin demand grew 6% globally, compared to the same period in 2012. Year-to-date, demand for bars and coins has grown by a remarkable 36%. Turning to central banks, gold demand remained steady at 93 [metric] tons, with this period being the 11th consecutive quarter in which they have been net purchasers of gold… The figures for Q3 reinforce gold’s continued strength, diversity, and enduring appeal. They suggest that in what has been a challenging year, the market is returning to balance.”

Watch the Video & Download Gold Demand Trends Here

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Max Keiser spoke with Peter Schiff yesterday about what sort of monetary and fiscal policies the US must embrace in order to really grow the economy. Peter and Max agree that QE isn’t going to stop until a genuine currency crisis erupts and the price of gold goes through the roof.

We need monetary reform… Meaning money has to be real, it has to be legitimate, and savings have to come into existence based on under consumption… Anything would be an improvement to the pure fiat system we have now. So if we can’t go back to a pure, 19th Century style gold standard, just going back to something that imposes monetary discipline [would help], so you just can’t create money out of thin air…”

[youtube http://www.youtube.com/watch?v=MNXmL771mBA?rel=0&w=640&h=360]

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Peter Schiff appeared on CNBC Europe to talk about the European Central Bank’s decision to cut interest rates to a record low today. Peter argued that Europe should avoid going down the road of money printing and currency debasement that the United States has embraced, addressing particularly the wrong-headed idea that inflation is a legitimate way of growing an economy. The ECB’s actions are just the latest events in an ongoing international currency war – how are you protecting your wealth from becoming another casualty?

You don’t feel pressure when the things that you need to buy become less expensive. That’s relief. Falling prices are a relief to consumers. What pressures consumers is when costs go up, when you have a rise in cost of living. So the ECB is going to complicate the problem for the European economy by making things more expensive. You don’t grow your economy by destroying the value of your money.”

[youtube http://www.youtube.com/watch?v=-QVpI9O3j80?rel=0&w=640&h=360]

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In this clip from yesterday’s Kudlow Report on CNBC, Peter Schiff shares his interpretation of the Federal Reserve’s latest statement, arguing that the next move the Fed will make is to increase its quantitative easing. Larry Kudlow agrees with Peter that the Fed has no real exit strategy and implies that higher inflation targets are not going to help the economy. When the financial media starts to agree with Peter, you know it’s time to buy physical gold and silver!

You go back to the Fed statement – the Fed doesn’t mention taper. It says ‘adjust monetary policy.’ Adjustment doesn’t imply a direction. I think what the Fed is getting ready to do is increase the amount of QE, not diminish it.”

[youtube http://www.youtube.com/watch?v=wqNPISp7Tzc&w=460&h=259]

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In a new video blog post, Peter Schiff expands at length upon Janet Yellen’s lousy record as an economist. While the media claims that Yellen warned of the housing bubble as early as 2005, Peter reveals that this is a complete whitewash of the truth. Looking directly at Yellen’s own words, he demonstrates that Obama’s nominee for Fed Chairman is likely to bring only more stimulus and inflation while doing nothing to prepare for the real crash.

Janet Yellen is just as clueless as everybody else. In fact, she admitted as much herself. In 2010, when she was testifying before the financial crisis enquiry commission… [Quoting Yellen] ‘I did not see and did not appreciate what the risks were with securitization, the credit ratings agencies, the shadow banking system, the SIV’s – I didn’t see any of that coming until it happened.'”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

On CNBC Asia last Friday, Peter Schiff explained why he has no doubt that the government will raise the debt ceiling. Of course, this only means more pain in the long-term and eventually a dollar collapse and sovereign debt crisis. If you want to protect yourself from this looming economic crisis, Peter recommends avoiding US markets that depend on consumer spending. Instead, diversify into hard assets like physical gold and precious metals.

I think [our creditors are] going to flee the dollar, flee the Treasury market. We’re telling the world that default is inevitable. We said if we don’t raise the debt ceiling, then we have to default. That means we can only pay our bills so long as we can borrow the money to do it. But you don’t pay your bills by going deeper into debt… When our creditors realize that…they’re never actually going to get paid back, then they’re not going to keep on lending. Then all we’ve got is the Fed and a printing press.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In his latest video blog, Peter Schiff explains why Goldman Sachs is completely wrong with its prediction that gold will plummet if the debt ceiling is raised. Peter also reminds us that he’s always predicted that Obama would make the worst possible choice for replacing Bernanke as Fed Chairman: Janet Yellen.

Not raising the debt ceiling – that is not why somebody’s going to buy gold. Not raising the debt ceiling would be bearish for gold. Why? Because if the debt ceiling is not raised, that means the government can’t go deeper into debt. That means government spending has to be slashed. That would also bring the US into a badly needed and way overdue recession… What’s bullish for gold is raising the debt ceiling.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

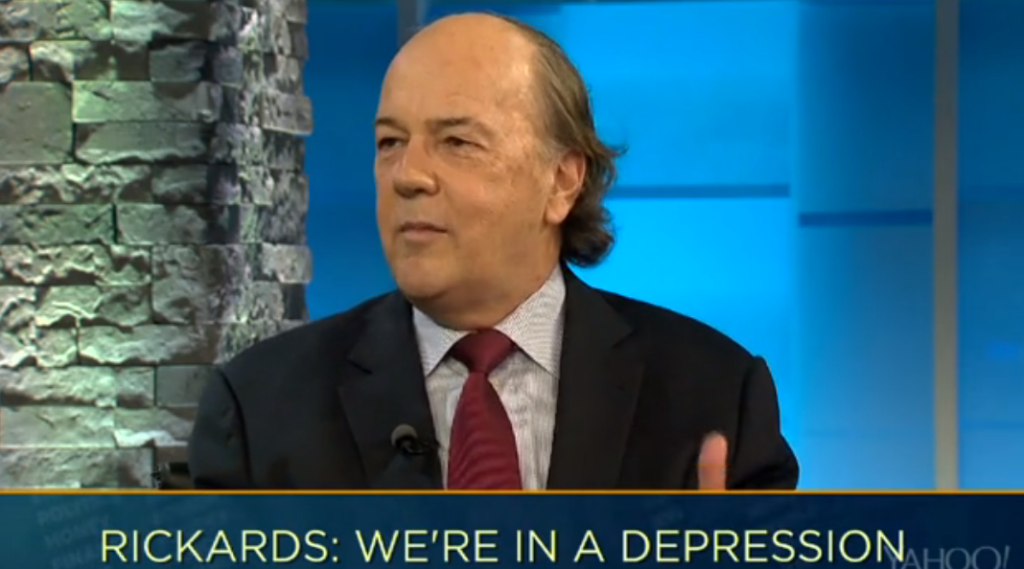

Yesterday, on Yahoo! Finance, Jim Rickards spoke with Lauren Lyster about how Janet Yellen will perform as Chairman of the Federal Reserve. Rickards agrees with Peter Schiff, reasoning that Yellen is going to keep the stimulus flowing. He also explained why he thinks the US is actually in a depression and will be experiencing a recession within that depression next year!

You can have a recession within a depression, in fact I expect a recession next year… This recovery is four years old. The average recovery is fifty months or so… Besides that, with the sequester, the government shutdown… Fewer and fewer people are working, so I don’t see where the drivers of growth are coming from.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

In an interview on The Street, Peter Schiff explained the relationship between physical gold and the debt limit of the United States. Peter argued that the Fed is lying about inflation because it doesn’t want to admit that there is no real economic recovery.

What’s good for gold is when they raise the debt ceiling, because it confirms that we’re going to have a lot more debt and a lot more money printing… If you’ve looked at how far gold prices have increased over the last decade or so, a lot of that is a function of the debt and the inflation that has accompanied all that debt… [The Fed is] probably going to increase the amount of QE… Inflation is a problem and it’s going to get worse. So they’ve got it all wrong, and so they’re mis-pricing gold.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Ned Goodman, a Canadian billionaire businessman, addressed Cambridge House’s Toronto Resource Investment Conference a few weeks ago. While Goodman’s delivery is subdued, his message could not be more important. Goodman believes the US is already in a recession and reviews the reasons why the international community is beginning to turn its back on the US dollar.

The Chinese have 3 1/2 trillion US dollars and they’re spending these dollars as quickly as they can. And it will not be long before the rest of us in the world and the US will be thinking likewise… In the ’30s everyone wanted US dollars. Today, everyone wants to get rid of them. Buying hard assets is what you’ll hear from many people…”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!