President Trump managed to put together a new NAFTA deal with Canada just before the deadline. In his latest podcast, Peter Schiff called the “NAFTA rebrand” a marketing fraud.

When Donald Trump was a candidate, he said NAFTA was the worst trade agreement ever negotiated by anybody. Even as he was taking credit for the new deal he just negotiated, Trump reiterated how bad the original deal was. Now he is saying the new NAFTA is the greatest deal ever negotiated.

So, we went from the worst deal in the history of deals to the best deal in the history of deals. The problem is — it’s basically the same deal. I mean, the only thing that’s really changed is the name. And we went from a good name to a lousy name.”

Interest rates are climbing quickly.

The yield on the 10-year US Treasury hit the highest level since 2011 in the midst of a massive bond sell-off Wednesday. The selloff spread across the globe on Thursday morning. ZeroHedge called the spike in yields a “monster move.”

Sept. 30 marked the end of the federal government’s 2018 budget year. According to data released by the US Treasury Department, the federal debt grew by nearly $1.3 trillion in fiscal 2018 – $1,271,158,167,126.72 to be exact. It was the sixth-largest fiscal-year debt increase in the history of the United States.

So much for that Republican Party fiscal responsibility.

The total federal debt currently stands at $21.5 trillion.

After hitting their highest level in 15 months in August, analysts expect Indian gold imports to continue climbing in the fourth quarter.

The flow of gold into India hit a 15-month high when it more than doubled to 100 tons in August. Demand started climbing in July when imports jumped for the first time in seven months.

You can add Poland to the list of countries buying gold.

The Polish central bank added about seven tons of gold to its reserves in July and another two tons in August, according to International Monetary fund data. It was the largest gold purchase by Poland since 1998.

We’ve been saying gold and silver are on sale. Well, it appears investors are taking advantage of the bargain.

The sale of American Gold Eagle coins surged in September, according to the latest data from the US Mint. Investors snapped up 60,500 ounces of Gold Eagle bullion coins in various denominations. That compares with just 35,500 ounces in August — a 41% increase.

As we head into the month of October, it’s interesting to note that two of the worst stock market crashes in history during this month. Of course, we had the 1929 Wall Street crash that kicked off the Great Depression, and there was also the Black Monday stock market crash in 1987.

As Peter Schiff noted in his latest podcast, given that stock market valuations are higher today then they were at those prior peaks, you would think there would be more concern about the possibility of another October surprise. But there seems to be very little worry out there. Nevertheless, Peter raised an interesting question, could the twin deficits in trade and the federal budget portend another October crash?

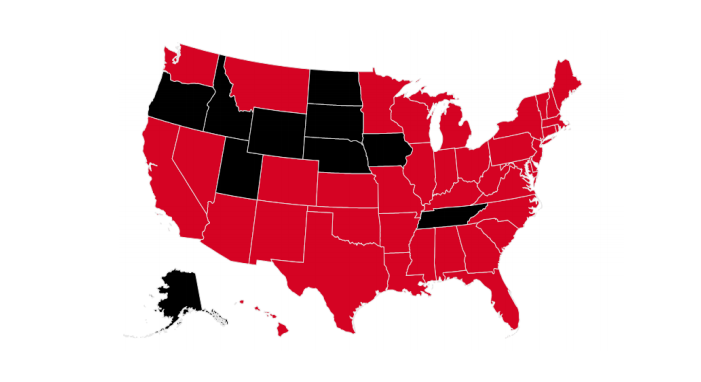

The federal government isn’t alone drowning in debt. Most US states don’t have enough money to pay their bills either.

That was the conclusion of the Truth in Accounting annual State of the States 2018 report. According to the report, American states have racked up $1.5 trillion dollars in unfunded state debt. Much of the red ink is related to pension plans and retiree benefits

As expected, the Federal Reserve nudged interest rates up another 25 basis points Wednesday. The federal funds rate now stands at 2.25%.

The Fed offered up a rosy outlook for the US economy, projecting growth will continue for the next three years. The central bank also dropped the phrase, “the stance of monetary policy remains accommodative” from its statement. As an analyst told Reuters, “It does seem to potentially indicate they believe monetary policy is becoming less accommodative and getting more toward that neutral rate.”

The Indonesian stock market has plunged nearly 7% this year. The country’s currency, the rupiah, has fallen 9%, and is at its weakest level since the 1998 Asian financial crisis. Bond yield have soared. To weather the storm, Indonesians are buying gold.