By Jeff Clark from Casey Research

After a 12-year run, it looks like gold’s wave has truly crested, and many bears are arguing that it’s all downhill from here. A quick glance at a long-term gold price chart certainly seems to confirm this impression:

Earlier this month, Paul Craig Roberts was interviewed by Greg Hunter of USAWatchdog about the perils faced by the US dollar as the world’s reserve currency. Roberts is a former Assistant Treasury Secretary and believes it is likely that there will be a major dollar crisis sooner than later. Roberts talks about the strong global demand for physical gold that continues even while international demand for US dollars shrinks. Like Peter Schiff, Roberts believes that the Fed has no safe way to end its monetary stimulus without triggering a major crisis and explains his position in depth in this extended interview.

In the last few months, both China and Japan have sold off some Treasuries, some $40 billion between them. This is not a huge sum, but it does show that they’re ceasing to accumulate them. And there’s also been reports that China is accumulating very large quantities of gold. So this does show that the dollar may have a limited life as the supreme currency.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The Silver Institute released their monthly Silver News this week, and it is full of interesting updates on silver investment and advances in silver technologies. This edition includes articles on silver’s use in bio-batteries made with sewage, the 12th China International Silver Conference, and the US Mint’s staggering amount of silver coin sales this year.

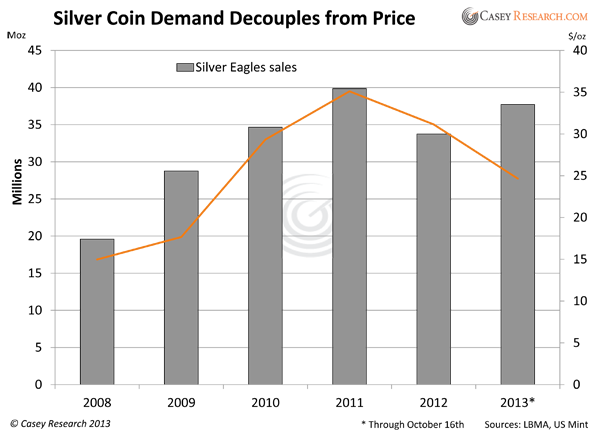

“With two months to go in 2013, the U.S. Mint already has surpassed last year’s sales of American Eagle Silver Bullion Coins and is on track to beat 2011’s record.

Sales through mid-October totaled 36,954,500 compared to 33,742,500 for all of 2012. With sales averaging over 3.5 million coins per month this year, besting 2011’s record-setting sales of 39,868,500 appears to be in reach.

In an interview with Silver News earlier this year, Richard A. Peterson, Deputy Director of the United States Mint, outlined several reasons for the coin’s popularity.”

Download the Latest Silver News Here

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

By Jeff Clark from Casey Research

Some readers may want to toss a rotten tomato at the second part of that headline given stubbornly weak metals prices, but let’s see if the data we’ve uncovered below will lower that cocked arm.

As of last Friday, silver is down 32% on the year, and down a whopping 55% since its $48.70 high on April 28, 2011. The bear market cycle is now two-and-a-half years old, and no one can say with absolute certainty that the bottom is in.

Sounds like an investment to avoid.

Bloomberg published a feature article this week about Peter Schiff, attempting to paint him as an irrational gold bug and discredit his predictions of the looming economic crisis. The folks at The Daily Bell have published a rebuttal to Bloomberg’s hit piece, explaining some of the finer points of free market economics and why Peter is right about gold’s future.

Every week or month, Bloomberg editors attack gold and this article, striking out at chief gold bug Peter Schiff, is more of the same.

The bias is subtle but apparent. The article manages to point out that Schiff’s father is in jail for tax evasion and that Peter Schiff has made a personal fortune even while his precious metals recommendations have soured, from a mainstream media perspective.

As editors and writers of an alternative ‘Net publication, we have to admire the way Schiff confronts naysayers and fear mongers when it comes to the economy. As he responded once when we were speaking about free-market economics, ‘What other kind is there?'”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Jeff Clark, Senior Precious Metals Analyst for Casey Research, published an excellent article about the undiminished investment demand for silver this year. Gold has taken a beating from unjustly bearish investors, but the appetite for silver around the world does not seem to be fading at all. In a recent interview, Peter Schiff noted that silver is one of his most important safe haven investments thanks to its amazing upside potential.

“As of last Friday, silver is down 26.6% on the year, and down a whopping 55% since its $48.70 high on April 28, 2011. The bear market cycle is now two and a half years old—and no one can say with absolute certainty that the bottom is in.

Sounds like an investment to avoid.

For now, let’s ignore the fundamental argument for silver—an alternative currency that, like gold, will sooner or later respond to the historic levels of currency dilution throughout much of the developed world—and consider the behavior of investors. In response to the price drubbing, have they abandoned the silver market? If that were so, it might be a warning sign that we’ve overstayed our welcome.”

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Enjoy this enlightening interview with Doug Casey on This Week in Money, hosted by Jim Goddard. Casey expounds upon the failing US dollar, the importance of precious metals investing, Asian gold demand, Janet Yellen, and the broader future of the United States.

“Confidence [in the US dollar] is going to be lost more and more quickly. Non-Americans who don’t have to hold dollars…are going to be looking towards the exits… I’m very partial to the precious metals… [Gold is] at a very very reasonably priced acquisition at $1300 an ounce. I suggest that people take those dollars out from under their mattresses and trade them for gold coins.”

Listen to the Full Interview Here

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Forbes published an eye-opening op/ed by Keith Weiner of the Gold Standard Institute today. Weiner first looks at the government’s historical data on the costs of consumer goods and employee salaries. He then looks at the same data in terms of gold ounces, revealing that American workers are laboring longer for dramatically less pay than their parents. Not only that, but their purchasing power has also plummeted since the 1960s, before Nixon completely severed the US dollar from the gold standard.

“By switching to gold, we can measure both wages and prices on an absolute scale—in ounces—and we can make precise comparisons. To convert the price of anything to gold, just divide the price by the current gold price. For example, in 2011 if a big-screen TV was $785, then divide that by the gold price of that year; the television set cost half an ounce of gold.

The bottom line is that, in terms of gold, wages have fallen by about 87 percent. To get a stronger sense of what that means, consider that back in 1965, the minimum wage was 71 ounces of gold per year. In 2011, the senior engineer earned the equivalent of 63 ounces in gold. So, measured in gold, we see that senior engineers now earn less than what unskilled laborers earned back in 1965.”

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffBlog

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Brett Arends published an excellent article on MarketWatch today, revealing that US Treasury officials have no intention of selling gold reserves. As one Treasury spokeswoman told him: “Selling gold would undercut confidence in the US both here and abroad, and would be destabilizing to the world financial system.”

“Grab any Wall Street trader in a bar, or any portfolio manager in his office, and he’s likely to tell you gold is finished.

It’s silly, nothing more than a shiny metal, a substance with little use and little real value, a ‘barbarous relic,’ and the stuff of nothing more than superstition. Only a fool would own any gold in his portfolio. Right?

After all, its value has plunged by $500 an ounce in the past year, and $100 just in the past month. Gold hasn’t even rallied during the budget crisis: So much for its ‘Safe Haven’ status.

There is just one nagging problem with this story line. One group of people disagrees. And I am not talking about wacko gold bugs in Arizona (‘the ex-husband state’) with tinfoil on their heads.

I am talking about the people running the United States Treasury. They remain firm believers in gold. Big-time.”

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

By Jeff Clark from Casey Research

Goldman Sachs is once again predicting that gold will fall, setting a new near-term target of $1,050.

Never mind the schizophrenic gene that would be required to follow the constantly fluctuating predictions of all these big banks; it’s amazing to me that anyone continues to listen to them after their abysmal record and long-standing anti-gold stance.

Sure, the too-big-to-fails can move markets – but they say things that are good for them, not us. For example, while Goldman Sachs was telling clients and the public to sell gold in the second quarter of 2013, they bought 3.7 million shares of GLD and became the ETF’s 7th largest holder.