Peter Schiff’s Gold Commentary

By Peter Schiff

Earlier this week the Federal Reserve ignited a firestorm in the global markets by admitting that the U.S. economy is facing significant downside risks. Although it continues to sugar coat the unpleasant reality, never has such a stunningly obvious statement resulted is so much turmoil.

Once again we are seeing the knee-jerk market reaction to seek refuge in the perceived safety of the U.S. dollar and U.S. Treasuries. However I expect investors will soon discover that such assets are firmly in the eye of the storm. As the tempest moves on, those enjoying the dollar’s current stability may soon find themselves battered by a category five monster.

On Tuesday, September 13, Peter Schiff, the CEO of Euro Pacific Capital, www.europac.net testified before the House of Representatives Subcommittee on Regulatory Affairs, Stimulus Oversight and Government Spending. The hearing entitled, “Take Two: The President’s Proposal to Stimulate the Economy and Create Jobs” examined federal job creation efforts. Mr. Schiff, author of many best-selling books including “How an Economy Grows and Why it Crashes” is well known for his views on how federal regulatory activism and irresponsible monetary and fiscal policy is actively destroying jobs in America. The following statement from Mr. Schiff will be read into the Congressional Record this morning. Within a few days, video of the hearings will be available on the Committee’s website.

How the Government Can Create Jobs

Testimony by Peter D. Schiff

Offered to the House Sub-Committee on Government Reform and Stimulus Oversight

September 13, 2011

Mr. Chairman, Mr. Ranking member, and all distinguished members of this panel. Thank you for inviting me here today to offer my opinions as to how the government can help the American economy recover from the worst crisis in living memory.

By Peter Schiff

Although it was labeled and hyped as a “jobs plan,” the new $447 billion initiative announced last night by President Obama is merely another government stimulus program in disguise. But semantics are of supreme importance in American politics…some could argue that word choice is the only thing that matters. As a result, despite the fact that this plan bears no substantive difference from previous stimulus bills, the President never once mentioned the word “stimulus” in his hour-long speech. But a rotten banana by any other name still stinks.

By Peter Schiff

This morning many on Wall Street were stunned by the big fat zero put up by the August jobs report, the worst showing in 11 months. The data convinced many previously optimistic economists that the United States will slip back into recession. I believe that we have been in one giant recession all along that was only temporarily interrupted by trillions of useless and destructive deficit and stimulus spending. Unfortunately, the August numbers will increase the talk of government efforts to stimulate the economy.

But while President Obama prepares to unveil a new plan for the Federal Government to create jobs, evidence is rapidly piling up on how his Administration is actively destroying jobs with stunning efficiency. Recent examples of this trend are enough to make anyone with even a casual respect for America’s former economic prowess hang their head in disgust.

The assault on private sector employment began in April when the democrat controlled National Labor Relations Board (NLRB) issued a complaint seeking to force Boeing aircraft to move Boeing’s newly opened non-union production facilities in South Carolina back to its union controlled plants in Washington State. Although Boeing simply says that it is looking to open a cost effective domestic manufacturing facility (an endangered species) to employ American workers, the NLRB alleges that the company was punishing union workers in Washington for past strikes. Despite a lack of any direct evidence that Boeing was being punitive, and the fact that the company was not laying off any union workers, the NLRB has not backed down. Against little public support and nearly universal revulsion among business leaders, the NLRB is continuing its campaign to keep Boeing from exercising its freedoms and to employ people in a manner that makes sense for its business.

The Boeing move served notice that the Obama’s loyalties were firmly tied to the Union interests that were so critical to his election in 2008. This week, the anti-business tendencies of the administration came into even sharper focus.

In the telecommunications industry, service provider AT&T made the seemingly essential move in its attempt to acquire wireless specialist T-Mobile. But the Justice Department sued to block the $39 billion deal on antitrust grounds, saying that the merger between the second and fourth largest cell phone providers would unfairly restrict competition and raise prices.

In so doing, the DOJ seems to be operating under the assumption, without any direct evidence, that at least four companies are needed to provide healthy choice in the marketplace, and that three providers simply won’t cut it. More broadly, competition may increasingly come from outside the telecommunications sector (in particular from cable and satellite industries). Plus, with the speed of technological change, who knows what types of competitors will arise in the years to come. The situation reminds me of the broken merger in 2004 and 2005 between Blockbuster Video and Hollywood Video. Based on antitrust concerns emanating from the Justice Department, Blockbuster backed off from the deal. Of course, just a few years later the whole sector was made obsolete by Netflix, and any advantage Blockbuster would have gained would have only been temporary.

In light of the current and future competition that is sure to change the way consumers talk with one another over great distances, AT&T and T-Mobile are much better positioned to survive as a combined entity. In any event if AT&T can’t buy T-Mobile, someone else will. The company’s parent, Deutsche Telecom, has stated its intention to divest itself of its American subsidiary.

So why not help American business survive in an increasingly competitive market? Most likely antitrust lawyers at the DOJ have been otherwise bored with the lack of merger deals to scrutinize (another downside to a weak economy), and this transaction just happened to be in the wrong place at the wrong time. But the legal activism will certainly cost jobs. Even the unions recognize this and have supported the merger.

But the absurdity of the current environment reached a peak when the DOJ, and agents from, get this, the U.S. Fish and Wild Life Service, raided the Nashville factory of the legendary Gibson Guitar company. The raid resulted in agents carting off more than a half million dollars of supplies and essentially shutting the company down. The take down of one of America’s commercial icons apparently resulted from Gibson’s purchase of partially finished ebony and rosewood guitar fingerboards (these endangered trees are carefully managed) from an Indian supplier.

Now here’s the interesting part. The Indian government had issued no complaint about the transactions and there was no evidence that the company had violated U.S. law. The DOJ acted simply on suspicion that Gibson had violated Indian law. Since when do U.S. companies have to make sure that they comply with laws of every country in the world before they produce a product?

I had the good fortune on interviewing Henry Juszkiewicz, the CEO of Gibson on my radio show this Thursday.

After speaking to him, I didn’t know whether to laugh or cry at the stunning economic incompetence of our government officials, who in the cause of arbitrary regulatory nitpicking, seem willing to sacrifice the reputation and prospects of one of the few remaining American manufacturers. God help us all.

On the other side of the coin, the government’s own efforts to create jobs in the private sector have met with little success. It was announced yesterday that Solyndra LLC of Fremont California, a manufacturer of solar panel has filed for bankruptcy protection and has laid off its remaining 1,100 workers. The development is notable because the company was a veritable poster child of the Obama Administration. The president himself visited their facilities in May of 2010 and touted the company as the template for America’s “green technology” future. As a result of its politically advantageous profile the company was able to secure $535 million in loans guaranteed by the government.

But apparently government blessing does not guarantee market success. Unfortunately, Solyndra could not sell its products profitably despite the government support and cheerleading. Instead $535 million in investment capital was diverted from potentially money making enterprises to a money losing enterprise. This is what happens when government calls the shots.

When it comes to the financial sector, the government can’t seem to decide whether it wants to preserve jobs or destroy them. After bailing out the banks three years ago (and making some of them too big to fail), it was reported today that the government is preparing to launch a multi-billion dollar lawsuit to recoup losses that Fannie Mae and Freddie Mac suffered on mortgage backed bonds (loans that the government itself encouraged the banks to make). If the government were to prevail, job losses would surely emerge in the sector, and the government may need to bail out the banks once again!

So as we wait with eager anticipation as to what the President may reveal in his jobs speech next week, you can be sure that it’s not going to help America regain its competitive edge. The sooner we regard the government as a job killer rather than a job creator, the sooner we can all get back to work.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

By Peter Schiff

The markets are going through another sell-off phase, yet the traditional notions of a ‘safe haven’ are changing. No longer is the US dollar the default shelter; instead, gold, the Swiss franc, and the Japanese yen are the preferred assets.

All three of these havens – gold, francs, and yen – have been surging upward this month. Two of them, however, are being actively devalued by central banks desperately (and foolishly) trying to curtail appreciation. The Swiss and Japanese are enlisting both policy measures and all the banker-speak they can muster to stem the tide of investment flows into their currencies.

The game is Last Haven Standing, and Spielberg has already acquired the movie rights.

Switzerland: From Neutrality to Intervention

Looking to Europe, the Financial Times now has the awkward task of reporting that mighty European Union’s currency is coming apart at the seams, while neighboring Switzerland has barely enough hotels to house the world’s waterlogged financial refugees. The franc is up 5.41% against the euro this year and almost 14% against the dollar. One wonders if the only way to prevent a collapse of the these major debtor currencies is to back them with Swiss-made wristwatches. At least then they’d have a partial gold standard and there’d be no excuse to be late for an austerity protest!

Unfortunately, the Swiss National Bank is so afraid of the franc’s rise that it has flooded the market with liquidity and cut interest rates to zero. The SNB even recently threatened to peg the franc to the euro. It’s as if survivors on one of the Titanic’s lifeboats were so confused and bewildered that they began tying their boat to the sinking behemoth out of a desire for a ‘stable relationship.’

Note to Japan: It’s Not the Speculators

Japan, ironically, has been blessed that while its debt problems are severe, they’ve been severe for so long that markets are willing to take that as a sign of stability. And, aside from the public debt problem, Japan does have fairly impressive fundamentals. They are still a productive economy with high personal savings and exposure to booming China. So, it’s no wonder the Yen has risen 6.63% against the dollar so far this year.

Former Finance Minister, and now Prime Minister, Yoshihiko Noda stated recently that he would “take bold actions if necessary and won’t rule out any possible options” to restrain the yen’s appreciation. Yet, while Noda has said the ministry will study whether “speculation” is behind the yen’s rise, he doesn’t seem to understand that this is a permanent move away from dollars and euros and into anything which might be a better alternative. This is not driven by Wall Street gamblers, but rather by everyday investors seeking shelter.

Clearly Shifting Sentiments

My readers know that I see these past years in the US markets as one ongoing crisis. We’re not “facing a double-dip recession” as the media suggests; instead, we’re really in the midst of a prolonged economic depression. The periodic market panics since 2007, both in the US and Europe, all stem from the same disease and, as such, ought to be properly understood as related symptoms, not as separate events.

And as one long, ugly narrative, these subsequent panics resemble a series of steps; sharp drops leading down either to a dismal “new normal” or – more likely – a collapse in both the fiat dollar and euro currencies and a widespread return to gold as money.

My brother, Andrew Schiff, wrote an article for my brokerage firm this month reviewing the market turmoil and how it compares to previous crises since ’07. He found a steady shift in what investors perceive as a safe haven.

During the depths of the credit crunch, from October 2008 to March 2009, the S&P lost over a quarter of its value, as investors flocked to the US dollar, driving it up 8%. Foreign stock markets sold off and most foreign currencies fell substantially. The Swiss franc fell over 3%. Gold rose some 6.5% and the yen rose 5.75%, but neither kept pace with the US dollar, which rose 13.5%.

Then, during the dip between April 23, 2010 and July 2, 2010, the S&P dropped again by almost 15%. The dollar rallied barely more than 3%. The Swiss franc gained slightly instead of falling. And this time, both the yen and gold beat the dollar, gaining 4% and 5.5% respectively.

Now here we are in August, and what’s happening?

In extreme volatility, the S&P fell over 13% before rebounding to its starting place. The dollar has remained essentially flat even with intensified fears in the euro zone. The yen is also flat, despite heavy intervention to push it down. The Swiss franc rose 8% before Switzerland’s central bank threatened to peg the currency to the euro, and gold has surged almost 12%!

See the pattern? On each step of this multi-year downward spiral, global investors are slowly but coherently altering their preferred safe haven. Alternatives are being desperately sought, though actions first by the Japanese central bank and more recently by the Swiss have prevented their currencies from fully realizing potential gains as dollar-alternatives.

Fortunately, gold doesn’t have a central bank, so it can rise as fast as the dollar falls.

The Fiat Downgrade

Whether it is in their interests or not – and I argue it is not – central bankers look set on continued competitive devaluation of their currencies so that their economies don’t have to do the hard work of retooling for the new reality.

That is why gold is doing so phenomenally well, and why it should continue to do so. New gold comes into the market at a rate of about 2% per year. This number has been fairly steady over time, and reflects the ability of mining companies to locate, finance, purchase, and develop new gold mines. I invest in these companies, and trust me, it’s not an easy job.

Contrast this with a paper currency – more dollars can be created by Bernanke simply printing extra zeros on his banknotes. See that $10 bill? Shazam, it’s a $100!

The reason currencies like the yen and Swiss franc are considered safe is simply a longstanding habit of their central banks not to print too much. But a habit is much less reliable than a physical constraint.

Think of a dog that has been trained not to eat steak. If you put it in a room with a juicy ribeye, would you be more confident the steak would be there when you came back if the dog was in a kennel or just sitting there? Just like a dog always craves steak, and will grab a bite when no one’s looking, central bankers always crave the printing press.

That’s why we need to hold an asset for which scarcity is dictated by nature itself – gold.

As this realization becomes more commonplace, and as this depression accelerates, I expect gold to be the Last Haven Standing. This will not be a “new normal,” but rather a return to thousands of years of economic tradition.

A Note About the Fundamentals

Those who do not really understand the fundamentals, such as commodity trader Dennis Gartman, continue to look at gold’s rise as a bubble. In fact, Gartman just called the top in gold, again, claiming that one of the “great bubbles of our time” had finally popped.

He cites as evidence the quick 200-point rise to over $1900/oz, which Gartman sees as a speculative blow-off top. He also cites the meaningless fact that one Gold ETF, GLD, has a larger market cap than one S&P 500 ETF. He absurdly compares this situation to the Japanese Emperor’s palace eclipsing the value of the entire state of California at the top of Japan’s real estate bubble. Those ETFs simply represent one way of owning assets, and do not, as Gartman contends, indicate that investors value gold higher than the entire US stock market. In fact, a true comparison of the two asset classes reveals gold’s value is historically low relative to the value of US stocks.

Rather than the bursting of a bubble, the recent technical action in gold is more indicative of a break-out. In fact, the positive divergence of gold stock from bullion in this recent correction is evidence that a more powerful leg in this bull market is about to begin. Up until now, the market for gold stocks has been characterized by fear. However, it now appears to me that gold stocks will make a new high before the metal itself. If the stocks finally begin to lead the metal, it means traders are finally starting to believe in this rally. Rather than evidencing the end of the trend, such a shift in sentiment likely indicates an acceleration in that trend. Maybe when the last skeptic finally throws in the towel, we may finally get the blow-off top Gartman thinks already occurred – but that day is likely many years into the future.

In fact, all the talk about a gold bubble seems to be based on the fact that so many investors are now talking about gold. However, the problem with this argument is that despite all the talking, very few investors are actually buying. Bubbles are not formed by talk, but by action. Before we get a gold bubble, all those investors talking about gold actually have to buy an ounce. In fact, before a bubble pops, its not just investors, but the average man in the street who will have to be buying. Thus far, he has not even joined the conversation.

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Casey Research’s Gold Commentary

By Jeff Clark

With gold a stone’s throw away from $2,000 and already up 27% on the year, the objective investor might begin wondering how much higher both it and silver can climb. After all, gold is nearing its inflation-adjusted 1980 high – and that peak was a spike that lasted only one day.

So, how much upside is realistically left in each metal? And is one a better buy than the other? There are dozens of ways to calculate price projections, but I’m going to use data based strictly on past price behavior from the 1970s bull market.

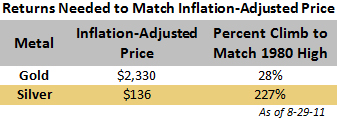

First, let’s measure what today’s inflation-adjusted price would be if each metal matched its respective 1980 high, along with the return needed to reach those levels:

Based on the CPI-U (the government’s broadest measure of inflation), gold is a couple jumps away from matching its 1980 high of $850. Silver, meanwhile, has much further to climb and would return over three times our money if it reached its former peak.

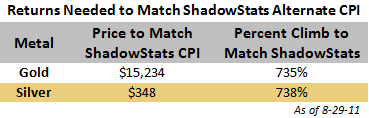

But the CPI is a poor measure of real inflation. Let’s use John Williams’ Shadow Government Statistics. His data is much closer to the real world and is calculated the way it was during the Carter administration, stripped of later manipulations.

Check out how high gold and silver would soar if they adjust to this level of inflation:

Clearly, both metals would hand us an extraordinary return from current prices. Those are some admittedly high numbers, but remember, that’s what the CPI figures above would register if government officials had never changed how it’s calculated. What’s interesting about these prices is that we’re not even halfway to reaching them.

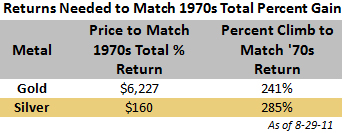

Let’s look at one more measure. I think another valid gauge would be to apply the same percentage gain that occurred in the 1970s to today’s market. From their 1971 lows to January 1980 highs, gold rose 2,333%, while silver advanced an incredible 3,646%. The following table applies those gains to our 2001 lows and shows the prospective returns from current prices:

Gold would fetch us over three times our money, while silver would return us almost four times.

Regardless of which measure is used, it’s clear that if gold and silver come anywhere close to mimicking the performance of the last great bull market, tremendous upside remains.

You may be skeptical because these projections are based on past performance, and nothing says they must hit these levels. That’s a valid point. But I would argue that we’re in unchartered territory with our debt load and money creation – and neither shows any sign of ending. We had a lot of problems in the 1970s, but our fiscal and monetary abuse now dwarfs what was going on then. The need to protect your assets gets more pressing each day, not less so. That, to me, is the key signaling this bull market is far from over.

You may also be skeptical because the media continue to claim gold is in a bubble. To date, their proclamations have been nothing but a great fake-out, every time. Want to know when we’ll really be a bubble? When they stop saying it’s one and actually start buying and recommending gold. When they begin running 15-minute updates on the latest gold stock. When you are sought out relentlessly by your friends and relatives because they know you know something about all this “gold and silver stuff.”

All told, I think the baked-in-the-cake inflation – rooted in insane debt levels and deficit spending – will be one of the primary drivers for rising precious metals this decade. This means the masses will look for a store of value against a plunging loss of purchasing power. Enter gold and silver.

The current correction may not be over, and you can count on further pullbacks along the way. But the data here suggests the upside in gold and silver is much bigger than any short-term gyration or any worry that may accompany it.

By Peter Schiff

Picking up where they left off in 2008, the media is in the midst of a campaign to ignore and undermine the presidential candidacy of Ron Paul (they gave me even rougher treatment during my 2010 Senate run). Political pundits just do not know what to do with a candidate who fails to fit into the blue and red boxes that form the simple narrative of American politics. They are perturbed by the grass roots nature of the campaign, by the strange honesty and earnestness of the candidate and his supporters, and the odd mixture of conservative values and liberty-minded policies. And like most adolescents, they reject what they don’t understand.

By Peter Schiff

This week’s wild actions on Wall Street should serve as a stark reminder that few investors have any clue as to what is really going on beneath the surface of America’s troubled economy. But this week did bring startling clarity on at least one front. In its August policy statement the Federal Reserve took the highly unusual step of putting a specific time frame for the continuation of its near zero interest rate policy.

Gold Mining Commanding a Premium

Financial Post – Gold, like oil, is getting harder and harder to find. That is the conclusion of a recent report by Clarus Securities. Employing data from the Society of Economic Geologists, analyst Laurie Curtis finds that deposits yielding high quantities of gold per ton of ore extracted peaked in the 1980s. The cost of discovery, in particular, has nearly quintupled to $47 an ounce in 2009, up from $10 an ounce during the 1980s. Higher capital expenditure and a steadily increasing gold price will be the only way for supply to keep up with today’s surging demand. Read Full Article>>

Gold Standard Emerging as World Order Unravels

The Telegraph – Ambrose Evans-Pritchard, international business editor of The Daily Telegraph, writes that with Japan and the West likely at debt saturation, gold is making a comeback to its historical role as an anchor of stability in a sea of liquidity. Squabbling politicians in Washington and Brussels make for good theater, but generate little confidence in the eyes of investors as regards the medium- to long-term resilience of the purchasing power of their respective fiat currencies. No alternative asset class exists that is capable of absorbing the impending wave of wealth on the lookout for safekeeping. With the post-Bretton Woods global monetary order growing increasingly threadbare by the day, a new gold standard is just over the horizon, forecasts Mr. Evans-Pritchard.

Read Full Article>>

Swiss Mull Re-Linking Franc to Gold

MarketWatch (WSJ) – The Swissie has performed admirably over the course of past three years as the flight to quality has taken center stage. But for the right-wing Swiss People’s Party (SVP), a strong, resilient Franc is not enough, and certainly does not equate with a bulletproof Franc backed by solid gold. Later this year, the Swiss Parliament, which decoupled the Franc from gold as recently as the year 2000, is expected to debate the introduction of a parallel Gold Franc. The little Alpine nation still holds almost as much bullion as gargantuan China. Per capita, it is #1, with $6K in gold per person – six times the amount per person held by the US.

Read Full Article>>

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!