Jessica Fung, Commodities Analyst for BMO Nesbitt Burns, explained her firm’s belief that gold has always been and will always be a safe-haven investment. Fung sticks to the mainstream perspective that the Federal Reserve is still planning to raise interest rates in 2015, though she does admit that BMO now predicts the Fed is going to push back that rate hike. It’s interesting to watch a major financial firm dance around the increasingly confused market sentiment and convoluted messages from the Fed.

Investors should take note that major financial players are starting to publicly admit that gold is an essential investment regardless of the supposed strength of the US economy or dollar – exactly what Peter Schiff has been saying for years.

Explore the latest exciting developments in the silver industry with the February edition of Silver News. Its front-page story covers how silver nanowires are being explored as an alternative to widely-used indium tin-oxide. Once testing is complete, silver could become even more essential to the manufacturing of touch-screens, plasma televisions, and other common electronics.

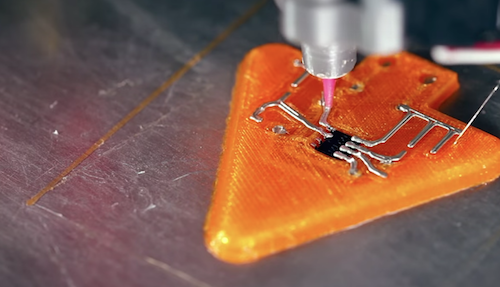

Perhaps even more exciting is the new commercial release of a 3D printer that can simultaneously print conductive silver inks inside plastic designs. Everyday consumers can now print customized electronic devices. This advancing technology could add significant demand to the electronic silver market beyond large manufacturers. You can watch a video about this new printer from Voxel8 below.

Chinese Gold Demand Outpaces World Production

Forbes – More than 315 metric tons of gold were withdrawn from the Shanghai Gold Exchange from the beginning of January to mid-February. During the same period, only 300 tons were newly-mined around the globe. The gold demand came in preparation for the Chinese New Year, the country’s biggest holiday. China is already the world’s second largest gold consumer, but its bullion demand will likely surge with changing demographics. In the next 5 years, China’s middle class is expected to grow 66% to 500 million.

Read Full Article>>

Peter Schiff appeared on RT last night to discuss Janet Yellen’s testimony, the Federal Reserve’s schedule for raising interest rates, the direction of the US economy, and stock buy backs that indicate a bubble in the stock market.

After her testimony to Congress this week, the mainstream media reported that Janet Yellen has put the Federal Reserve on the path to raising interest rates. However, Peter Schiff digs into Yellen’s official testimony from this week, showing beyond a shadow of a doubt that the Fed hasn’t even begun to think about a rate hike. It’s all right there in Yellen’s official prepared remarks. Peter also addresses the ridiculous popular notion that inflation is necessary for economic growth.

James Grant, Founder of Grant’s Interest Rate Observer, spoke with Kitco about his disappointment in the current price of gold. He places most of the blame on central banking, and the market’s inability to understand the long-term consequences of monetary manipulation. However, Grant believes it won’t be long before the world wakes up to the realities of this manipulation and returns to gold as a safe-haven investment.

The gold price, is to me, the reciprocal of the world’s faith in the words, deeds of these central bankers… The lower the confidence [in central banking], the higher the gold price.

“I, for one, can’t imagine why anyone would have confidence in the doctrines of central banking, predicated as they are on the manipulation of prices. Interest rates are prices. Central banks are in the business now, more than ever, of manipulating interest rates. They are inflating asset markets. It seems to me that the world will eventually see that these policies are non-starters.”

The US Justice Department has begun to investigate whether 10 of the world’s largest banks have manipulated gold and silver prices. The Justice Department is just the latest in a series of financial regulators to investigate possibilities of precious metals manipulation, including the UK Financial Conduct Authority, Germany’s BaFin, and Switzerland’s competition commission WEKO. On top of that, there are a number of pending civil lawsuits in New York against some of these same banks for gold price rigging.

What should physical gold and silver investors take away from this news?

The Dow and S&P 500 once again closed at record highs last Friday, and investors continue to be bullish on the American economy. Nobel Prize-winning economist Robert Shiller sees things differently and has been warning of market bubbles.

A bubble is a social epidemic of enthusiasm and excitement spread by word of mouth, attracting more and more investors into a market.”

In the new edition of his book Irrational Exuberance, Shiller argues that many traditional investment assets are now driven by investor psychology rather than fundamental realties. From housing to stocks to bonds, Shiller sees the American economy entering a new era in which traditional investment approaches need to be reconsidered.

374 metric tons of gold were withdrawn from the Shanghai Gold Exchange (SGE) in the first 6 weeks of 2015. During the same period, about 300 tons of gold were newly mined in the entire world. Using these figures, China is currently consuming more gold than the world is producing.

The surge in Chinese gold consumption comes from preparations for the Chinese New Year celebrations, which began last week. Gold is one of the most traditional gifts to give during this holiday, but it’s not the only product the Chinese buy. They spend astounding amounts of money during this celebration: $100 billion in 2014, which was twice what Americans spent during the Thanksgiving and Black Friday holiday weekend.

ADS Securities Chief Market Strategist Nour Eldeen Al-Hammoury explained to Bloomberg why he’s betting on the United States sliding back into recession in 2015. Just like Peter Schiff, he finds the GDP, factory orders, trade deficit, and other economic data points to be much more indicative of the true health of the economy than the bogus jobs numbers.

Since the end of QE, until today, most of the numbers – more than 70% of the numbers – came in far away from the expectations. If you go back to the history, every single QE, when the QE stops, the economy slides back into a recession…”