Stefan Molyneux interviewed Peter Schiff on Freedomain Radio. In this hour-long conversation, Stefan and Peter cover the gamut of essential economic issues: the gold market, hidden inflation, the so-called US economic “recovery,” and the ultimate death of the US dollar. This is a great video to catch up on nearly every hot-button issue in the media, from China’s economy to Donald Trump’s campaign to Puerto Rico’s default to American’s misunderstanding of high minimum wage.

South Koreans have embarked on a gold buying spree.

Residents of the Asian country are on pace to purchase a record amount of gold in 2015. By year’s end, total sales will likely top 1 trillion won ($860 million) based on first-half sales through Korea Gold Exchange 3M Co Ltd, the country’s largest gold merchant.

In his 100th podcast, Peter Schiff looks at the latest lousy data from the labor market. Last quarter’s wage growth is the worst since the government started recording it in 1982. He also discusses the disparity between the paper and physical gold markets, and the reactions his brokerage and metals clients have had to the growing bubble of the US dollar.

You have more paper gold trading relative to the actual physical supply than ever before… But in the real, physical [gold] world, the actual buyers – it’s skyrocketing. The mints are running out of supply. Orders are getting backed up… Nobody is calling to sell. Everybody who’s calling is calling to buy more… On the other side of the coin, people who have brokerage accounts and asset management accounts, most of the calls I’m getting now are from clients who are wanting to sell…

“My Canadian clients who hold the same stocks as my US clients, their statements are going up. Because their statements are in Canadian dollars… But people should react the same way, because this is a bubble in the dollar. This is a bubble in confidence in the US recovery that doesn’t exist. Confidence that the Fed has finished QE, when they’ve only just paused. Confidence that they’re about to embark on a rate tightening cycle, when I don’t think we’re anywhere near that…”

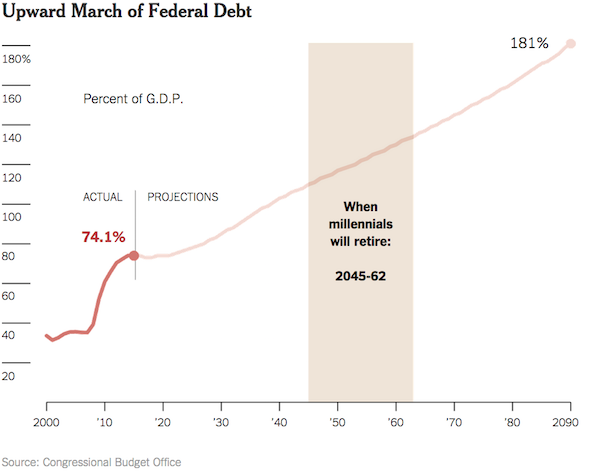

The New York Times ran a surprising op-ed on Sunday highlighting some structural problems in the US economy.

The issues raised in the column titled “We’re Making Life Too Hard for Millennials” by Wall Street executive and NYT contributing opinion writer Steven Rattner won’t surprise our regular readers. In fact, you will find the analysis rather familiar. But the fact that it appeared on the pages of the New York Times comes as quite a shock. Apparently, the mainstream is becoming aware of what we’ve been saying for years.

Rattner contends we should worry about future prospects for the millennial generation.

Peter Schiff appeared on MSNBC last week to talk about why gold is an essential asset for protecting your wealth from inflation and a failing US dollar. The conversation became a bit combative when Peter was asked to defend his claim that government inflation measures are inaccurate. Unsurprisingly, the MSNBC anchor took it for granted that government statistics are implicitly trustworthy.

Coin Sales Soar, Driven by Greek Crisis and Low Prices

Reuters – The sale of gold and silver coins soared in July, with the Greek financial crisis and low prices pushing demand. With more than a week left until the end of the month, sales of US Mint American Eagle gold coins had already vaulted above 110,000 ounces, the highest monthly total since April 2013. July sales eclipsed the total of 76,000 ounces sold in June, and 21,500 ounces sold in May. On July 7, the US Mint temporarily sold out of its 2015 American Eagle silver bullion coins due to a “significant” increase in demand. Sales did not resume until July 27.

Read Full Articles Here, Here, and Here >>

China Discloses Gold Holdings

The Wall Street Journal – China released an update on its gold reserves for the first time in six years. At the end of June, China’s gold holdings totaled 53.32 million troy ounces, up 57% from the end of April 2009 when the People’s Bank of China last reported reserves. China’s official holdings are now the fifth largest in the world, behind the US, Germany, Italy, and France. China’s holdings now eclipse those of Russia and Switzerland. Despite the increase, China’s holdings were less than many analysts anticipated.

Read Full Article >>

You go to the bank, deposit your paycheck and walk away thinking your money will remain safe and secure, ready for you to withdraw whenever the need arises.

But as Greeks have discovered, that’s not necessarily the case. In the event of a crisis, you may not be able to access your money.

According to a Guardian article, some officials in the Greek government were prepared to take a page out of the Cypriot playbook and confiscate funds from banks.

This article is written by Peter Schiff and originally published by Euro Pacific Capital. Find it here.

While the world can count dozens of important currencies, when it comes to top line financial and investment discussions, the currency marketplace really comes down to a one-on-one cage match between the two top contenders: the US dollar and the euro.

In recent years the contest has become a blowout, with the dollar pummeling the euro into apparent submission. Based on the turmoil created by the European debt crisis and the continuing problems in Greece and other overly indebted southern tier European economies, many investors may have come to assume that euro boosters will be forced to ultimately throw in the towel and call off the entire experiment, thereby leaving the dollar completely unchallenged as the champion currency, now and for the foreseeable future. This is a stunning turnaround for a currency that was seen just a few years ago as a credible threat to supplant the dollar as the world’s reserve.

The Chinese yuan continues to gain stature in the world financial system.

Earlier this week, the London Metal Exchange announced it will begin accepting yuan as collateral for banks and brokers trading on its platform.

The LME is the largest metal trading venue in the world. It facilitated some $15 trillion in metal trades last year. The yuan joins the United States dollar, the euro, the British pound and the Japanese yen as allowable collateral.

The Wall Street Journal called the LME move “another milestone for China’s currency.”

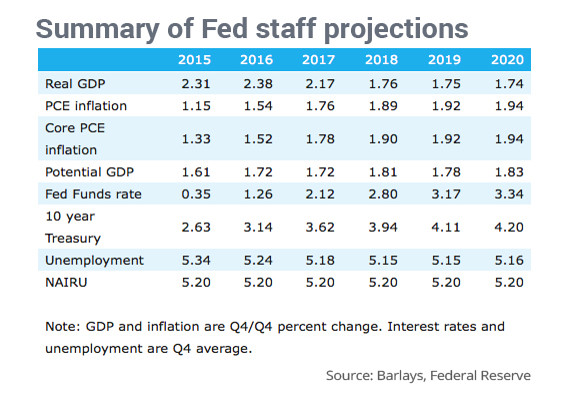

On Friday, the Federal Reserve accidentally published the economic forecasts of its staffers, which normally remain private. The numbers reveal that the Fed is painting a much rosier picture of the United States economy than they publicly admit. Peter Schiff dug into these numbers during his podcast published on Saturday. Use the chart below to follow along with Peter’s analysis. Peter also discusses the gold market, which he believes is setting itself up for a massive short squeeze.