Newly Released White Paper: The Student Loan Bubble

This article accompanies SchiffGold’s newly released white paper, The Student Loan Bubble: Gambling with America’s Future. To learn more about the shocking student debt bubble, click here for a free download.

“You need a college degree to succeed in America.” This idea has become so commonplace that the right to higher education is now a core issue in most political platforms. What if a young person cannot afford a college degree? The “obvious” answer from politicians on both sides of the aisle is that the government should subsidize them. Very few are brave enough to ask the far more important question: “At what cost?”

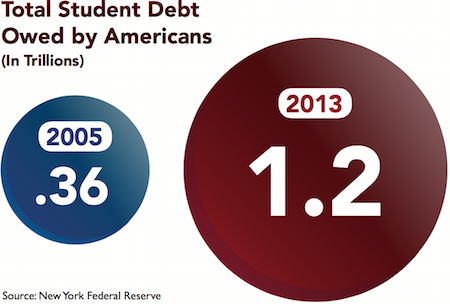

The answer is simple: as of today, the cost is $1.2 trillion. That is the current level of student loan debt in the United States, which represents the second largest category of consumer debt after home mortgages. It has grown by leaps and bounds since the financial crisis of 2008 and now surpasses even car loans and credit card debt.

The American Dream used to be simple: the ability to shape one’s own destiny and wealth without interference from the king, the government, or other powerful interests – the right to “life, liberty, and property.” Over generations, this dream has been coopted by politicians and bankers to gather votes and riches. In the 20th century, the idea of owning a home became an integral part of the Dream, which led to the disastrous idea that even unqualified borrowers deserve the opportunity to buy a house. We are all familiar with the fallout – the subprime mortgage crisis and ultimately the Great Recession.

Today, ten years later, politicians are now claiming that a college education is part of the American Dream and also a right of all Americans – regardless of their credit rating and SAT scores. Spurred on by even lower interest rates and the implicit promise that John Q. Taxpayer will once again come to the rescue should anyone happen to default, we now have a growing student loan bubble on our hands.

Since 2003, student loan debt has more than quadrupled – rising from $250 billion to well over $1 trillion. It has increased over $500 billion (a 75% increase) since the beginning of President Obama’s first term, when it sat at $660 billion. Furthermore, at the end of 2008, the default rate was 7.9%, but now stands at 11.3% – a huge increase that is most assuredly an underestimation.

Perhaps the most alarming element of this trend is that there is no collateral required for a student loan. Banks can foreclose and repossess the house when a borrower defaults on a home loan. However, what can a bank repossess in the case of a student loan? A diploma? Knowledge? The bottom line is that each dollar of a defaulted student loan will pack much more of an economic punch.

And don’t assume for a minute that the students themselves will escape unscathed. Student debt cannot be expunged through bankruptcy. The federal government can garnish up to 15% of gross income for 25 years from defaulters.

Some might say, “What’s the big deal? America has already been dealing with massive amounts of debt. Is this really going to make that much of a difference?” The big deal is that the student loan bubble adds significantly to the nation’s large debt burden, which at 102% of GDP is clearly unsustainable and doomed to inevitably lead to an economic collapse.

What’s more, the current figure of $1.2 trillion is just today’s student debt load. This is expected to nearly triple in the next ten years.

Every investor needs to understand how the student debt bubble will impact the US markets. In a newly released white paper, SchiffGold explains how best to prepare for a financial collapse that will dwarf the 2008 financial crisis. Download this exclusive SchiffGold White Paper for free today: The Student Loan Bubble: Gambling with America’s Future.

Addison Quale is a Precious Metals Specialist with SchiffGold. He studied economics at Harvard University and earned a Master of Divinity at Gordon-Conwell Theological Seminary. Addison brings a well-rounded perspective to precious metals investing, with work experience at an investment consulting firm in Boston.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […]

Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […] California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […]

California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […] The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […]

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […] Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The big deal is that the federal government profits massively off student loan interest. If students default, the govt. will have a budget shortfall because they’ve already spent the money before it’s been collected. Interest rates for the most reliable borrowers (grad students) are way too damn high!