The New Normal Boom: US Secular Stagnation (Video)

Nobel-winning economist Robert Shiller told CNBC that he sees another big bubble forming throughout the United States. He calls this boom the “New Normal Boom” and warns that deep down, investors believe the US economy isn’t truly recovering.

Highlights from Shiller’s interview:

“We’re not so good at even recoveries these days. There are places in the United States that are really in bubble territory. For example, San Francisco. It is hot, hot, hot. They’re going way over the asking price; every house sells quickly. It looks like a boom. But you know, San Francisco is a city which has a history of booms. There seem to be certain boomy places. California is booming. Why is that? You have to go there and live. They have a sort of high-strung mentality. It’s sort of a sense of their own importance. I shouldn’t say this. I’m not a Californian. London has the same problem, by the way…

“When [does the economy start doing well and the markets start doing badly]? I wish I knew that… There is a secular stagnation story, which is a powerful theme right now. I consider that a thought virus. In the sense that it’s become implanted in people’s minds and it’s become a source of worry. I think a lot of people feel that down deep [they] know we’re not getting out of this. We had a sort of recovery in the US, but I don’t know whether we’re sinking back into a ‘new normal.’

“In my new book, I like to name booms. I don’t think we’re very good. We have an official body that names hurricanes… I call this the ‘new normal boom.’ It’s a funny boom in asset prices, because it’s driven not by the usual exuberance. It’s driven by an anxiety.”

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Last week, Peter debated Steve Hanke, professor of economics at Johns Hopkins University, on inflation, the debt crisis, and the future of the dollar. David Lin hosted the debate on The David Lin Report and provided moderation for the event. While Peter and Hanke have their disagreements, both ultimately agree that the United States is in rough fiscal and monetary shape, and terrible monetary […]

Last week, Peter debated Steve Hanke, professor of economics at Johns Hopkins University, on inflation, the debt crisis, and the future of the dollar. David Lin hosted the debate on The David Lin Report and provided moderation for the event. While Peter and Hanke have their disagreements, both ultimately agree that the United States is in rough fiscal and monetary shape, and terrible monetary […] Paul Buitink, host of the Reinvent Money show, recently interviewed Peter on debt in Europe, possible futures for various currencies, and government monitoring of crypto and gold.

Paul Buitink, host of the Reinvent Money show, recently interviewed Peter on debt in Europe, possible futures for various currencies, and government monitoring of crypto and gold. Peter recently appeared on the Bald Guy Money show for a conversation on gold’s role in American and global politics, the influence of the BRICS coalition on metals markets, and, as always these days, the disastrous monetary policy coming out of the Fed.

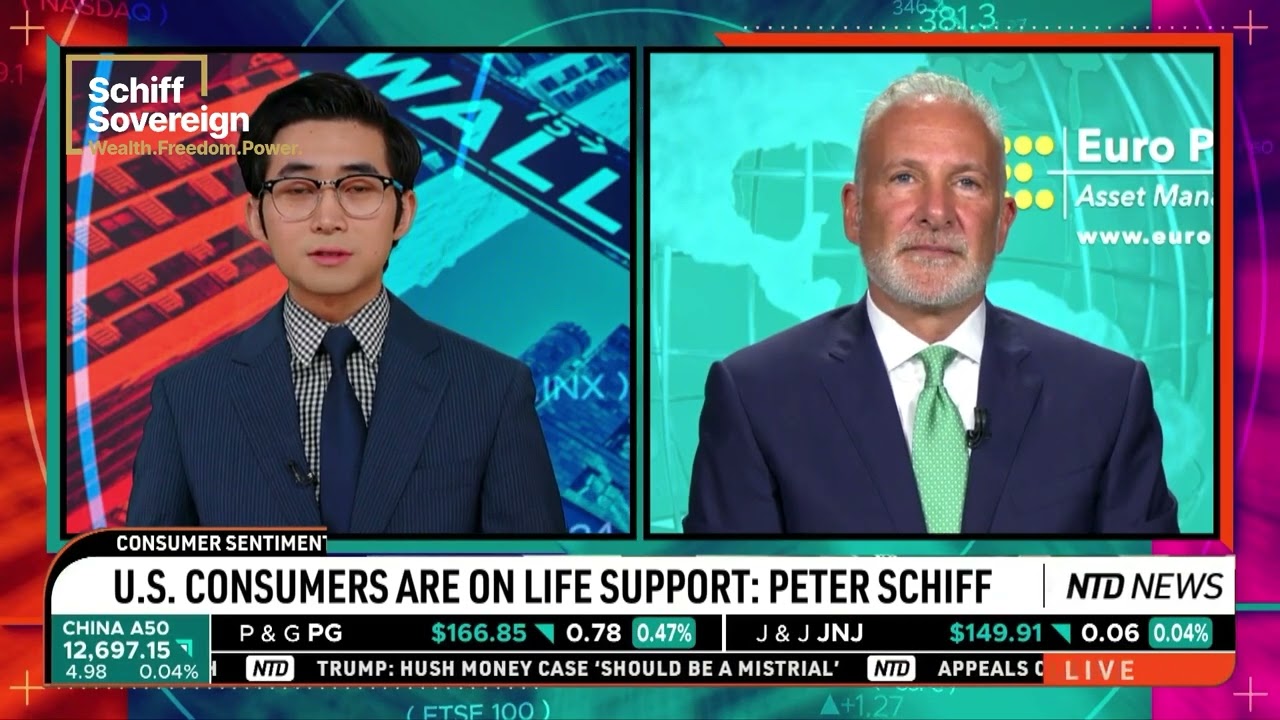

Peter recently appeared on the Bald Guy Money show for a conversation on gold’s role in American and global politics, the influence of the BRICS coalition on metals markets, and, as always these days, the disastrous monetary policy coming out of the Fed.  On Friday, Don Ma interviewed Peter on NTD’s Business Matters. Their conversation focuses on declining consumer sentiment. With GDP and unemployment figures also signaling a recession, a worsening consumer outlook bodes poorly for the economy.

On Friday, Don Ma interviewed Peter on NTD’s Business Matters. Their conversation focuses on declining consumer sentiment. With GDP and unemployment figures also signaling a recession, a worsening consumer outlook bodes poorly for the economy. While in office, Trump blamed the Fed for tightening monetary policy. Now members of Trump’s team allegedly plan to give a re-elected Trump more power over the Fed, igniting panic from mainstream economists about a politicized Fed. Our guest commentator explains why the real risk, from the establishment’s perspective, is not that Trump will turn the […]

While in office, Trump blamed the Fed for tightening monetary policy. Now members of Trump’s team allegedly plan to give a re-elected Trump more power over the Fed, igniting panic from mainstream economists about a politicized Fed. Our guest commentator explains why the real risk, from the establishment’s perspective, is not that Trump will turn the […]

Leave a Reply