The Truth of Russian Gold Holdings

If you follow precious metals news, you might have seen a recent article reporting that Russia sold a big chunk of its gold reserves. The article has since been corrected, but it just goes to show how sloppy Western journalism can be, especially when it comes to the reality of physical gold investment.

Laurynas Vegys of Casey Research has published a new article exposing this poor reporting. He goes on to dig deeper into the extremely bullish actions of Russia, which appears to prefer gold over the US dollar.

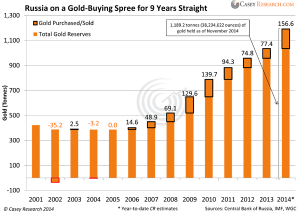

What we’re seeing here is not some haphazard pattern of purchases. Quite the contrary, this is a trend that has been in motion for quite a while, right under the noses of indebted Western governments and against the backdrop of unprecedented rounds of money printing by the world’s major central banks. This trend has taken Russia’s gold holdings from around 400 tonnes 13 years ago to what is fast approaching 1,200 tonnes at the end of 2014. Russian reserves currently represent the world’s sixth-largest hoard of the yellow metal.

“What should also jump out of the chart above is that the 150 tonnes bought year to date is above any amounts of gold acquired in previous years—significantly so.

“In the end, Russia has been well ahead of other countries in the gold-buying department for quite some time, so it’s hardly a surprise that it’s become a heavyweight gold champion among central banks worldwide this year. Gold now makes up 10.8% of Russia’s total reserves, and a whopping 18.4% of its M1 monetary supply—both unparalleled in the Western world.”

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift?

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift? Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […]

Welcome to the world of modern economics where the term “inflation” no longer signifies the increase in the quantity of money, but has evolved into a plethora of buzzwords. From “shrinkflation” to “greedflation,” these new terms and semantic shifts are by no means harmless but a manipulation of popular sentiment. Von Mises said they play […] Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

Assuming CPI measurements are not understatements, the dollar’s value has plummeted by a staggering one-fifth since 2020, yet, rather than acknowledging its role in fueling this economic turmoil, the Biden administration deflects, casting capitalism and corporate greed as the villains. The latest February CPI data show more signs of the upcoming inflation bloodbath.

Who knows what really Russia has but 1100 in current reserves, pales to India and China which seem to be in a horse race for ” Who buys the most each Year”.

Both China and India internally consume around 1100tns per year so looking still at reserves, the US is touted at 8000+tns in reserve.

Also, kill the Dollar as the Global reserve currency would put the process of PM’s at Moon Level.