Gold Bull Market Far From Over

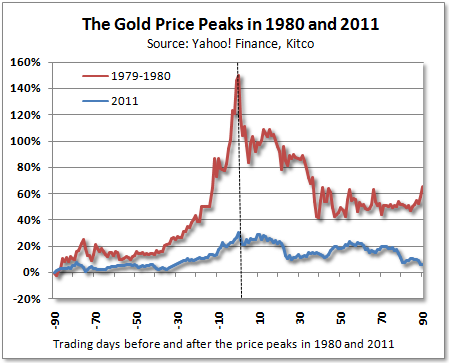

Gold’s poor performance in the past week has triggered a flood of commentaries declaring that gold peaked back in 2011 and that prices may plummet next year. Don’t be fooled – there is plenty of evidence that gold still has a bright future. Tim Iacono published an interesting article on Seeking Alpha yesterday debunking the naysayers:

“Since the gold price failed to advance after the Federal Reserve’s latest stimulus measure last week, that is, the one where the central bank raised its open-ended money printing effort to a cool $1 trillion per year, an increasing number of calls have been heard with the same refrain – the secular gold bull market is over.

Earlier in the month, it was investment bank Goldman Sachs who said that prices may rise back up above $1,800 an ounce next year but that last year’s high at just over $1,900 an ounce or a similar high next year will go down in the history books as the end of the long-running bull market.”

While in office, Trump blamed the Fed for tightening monetary policy. Now members of Trump’s team allegedly plan to give a re-elected Trump more power over the Fed, igniting panic from mainstream economists about a politicized Fed. Our guest commentator explains why the real risk, from the establishment’s perspective, is not that Trump will turn the […]

While in office, Trump blamed the Fed for tightening monetary policy. Now members of Trump’s team allegedly plan to give a re-elected Trump more power over the Fed, igniting panic from mainstream economists about a politicized Fed. Our guest commentator explains why the real risk, from the establishment’s perspective, is not that Trump will turn the […] In April, the U.S. economy added a disappointing 175,000 jobs, falling short of expectations and nudging unemployment up to 3.9% (see current trends here). This signals a slowing economy that might force the Federal Reserve to put the guard rails back on. Our guest commentator gives a deeper look at a worrisome trajectory: while part-time […]

In April, the U.S. economy added a disappointing 175,000 jobs, falling short of expectations and nudging unemployment up to 3.9% (see current trends here). This signals a slowing economy that might force the Federal Reserve to put the guard rails back on. Our guest commentator gives a deeper look at a worrisome trajectory: while part-time […] Beneath the sweet surface of our favorite treats lies a bitter reality: inflation has sent cocoa prices soaring to unprecedented heights. Once deemed the food of the gods and now a daily indulgence for millions, chocolate is facing a dramatic upheaval as wholesale cocoa prices have rocketed past $11,000 per ton. Our guest commentator explains […]

Beneath the sweet surface of our favorite treats lies a bitter reality: inflation has sent cocoa prices soaring to unprecedented heights. Once deemed the food of the gods and now a daily indulgence for millions, chocolate is facing a dramatic upheaval as wholesale cocoa prices have rocketed past $11,000 per ton. Our guest commentator explains […] As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift?

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift? Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Leave a Reply