Slower US Mint Sales Are Keeping Coin Premiums Low

Even as central banks buy more gold than ever, coin premiums have been driven lower throughout the retail precious metals market. One of the big factors: is disappointing sales from the US Mint.

In addition to keeping sales profitable, the markup on physical gold and silver coins helps cover costs like administration, storage, and transportation. The US Mint is a bureau of the US Department of the Treasury, and in addition to handling gold movements to central banks and fulfilling other duties, it’s a major producer and seller of physical bullion. Its customers are a handful of authorized gold and silver dealers, who then sell the products to retail investors.

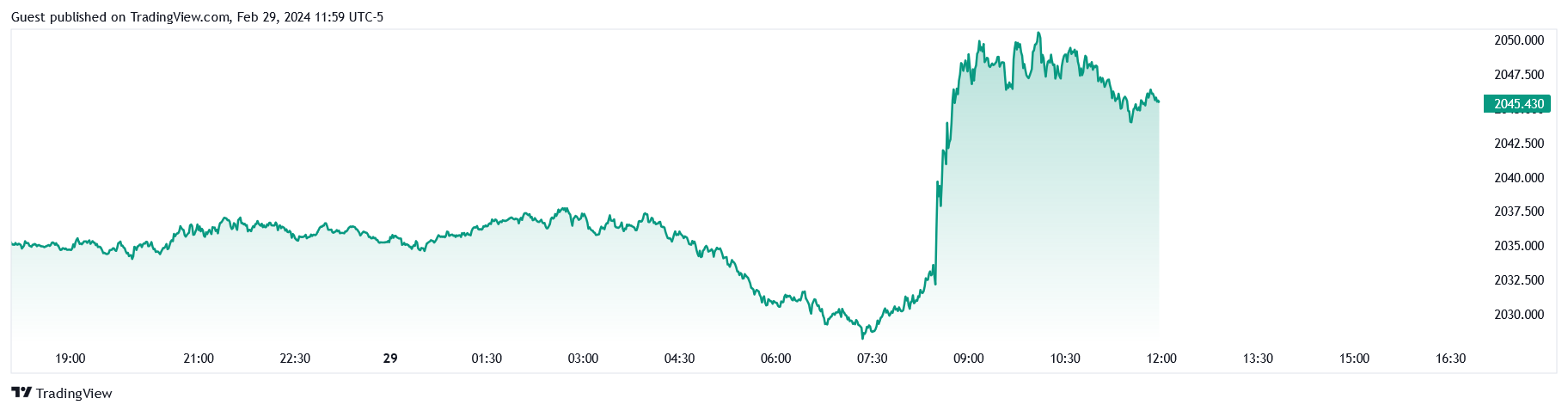

The US Mint’s market share is significant enough that when sales there are low (or high) enough, it affects the mark-up rates across the wider bullion market. That’s what we’re seeing now, even as gold shows healthy price action and looks poised to go even higher in the face of global war and weak fiat currencies:

Gold vs USD, 5-Day Chart

Overall in the 2023 fiscal year, revenue at the US Mint dropped almost 13% despite sales volume increasing 24.5% compared to 2022. The sales increase was driven by the popularity of American Silver Eagles, which wasn’t enough to offset the sharp decline in sales for other bullion products. As CoinNews’s Mike Unser reports:

“Demand for U.S. Mint gold bullion coins saw a significant decline compared to the prior year, with sales of American Gold Eagles dropping by 20.7% to 988,000 ounces and sales of American Gold Buffalos decreasing by 19.2% to 375,000 ounces.”

These are some of the most popular gold coins for bullion investors to stack. With lower sales of these mainstay coins, the US Mint saw a significant subsequent drop in income.

“Consequently, revenue for American Gold Eagles decreased by 17% to $1.9651 billion, while revenue for American Gold Buffalo coins fell by 15.3% to $738.1 million.”

The past two weeks alone have seen major sales declines compared to the US Mint’s average. According to CoinNews.net’s sales data from the US Mint, silver and gold numismatics took one of the biggest hits from losses. For example, 2024 Commemorative Coins saw a 10% drop in sales of the 2024-S Proof Harriet Tubman Half Dollar, which was one of the most significant declines.

Meanwhile, in Asia, premiums are mixed. They’ve notched up higher in China as the Lunar New Year comes to a close, and bullion sales can resume. But in India, it’s the end of the famously gold-soaked wedding season, which always leads to a relative drop in retail demand since gold is a major cultural component in Indian nuptials. With less demand because of this, premiums in India are down compared to previous weeks.

If the downward sales trend continues at the US Mint, it makes for an even better time to buy gold. Bullish momentum combined with lower premiums gives you more bang for your fiat buck. But if the Mint sees a resurgence, the price of gold could go higher — and this time, spot premiums might go up with it.

Platinum is entering its second year of substantial deficit, according to the Platinum Quarterly report from the World Platinum Investment Council (WPIC).

Platinum is entering its second year of substantial deficit, according to the Platinum Quarterly report from the World Platinum Investment Council (WPIC). American car owners are facing a wall of bad debt to finance vehicles they can’t afford — especially pandemic buyers who took on huge loans to buy overpriced used vehicles that are now depreciating in value. With inflation running hot and poised to get even hotter if the Fed is forced to cut rates, it turns out that Americans can’t afford to insure those cars […]

American car owners are facing a wall of bad debt to finance vehicles they can’t afford — especially pandemic buyers who took on huge loans to buy overpriced used vehicles that are now depreciating in value. With inflation running hot and poised to get even hotter if the Fed is forced to cut rates, it turns out that Americans can’t afford to insure those cars […] Innovation has a silent killer… a scourge that America has aided and abetted for over a century. Innovative activity is the backbone of the economy. Because of Google, Honda, and Netflix, life is easier for billions of people around the globe. A Stanford study found that up to 85% of economic growth is due to innovation. But what if all […]

Innovation has a silent killer… a scourge that America has aided and abetted for over a century. Innovative activity is the backbone of the economy. Because of Google, Honda, and Netflix, life is easier for billions of people around the globe. A Stanford study found that up to 85% of economic growth is due to innovation. But what if all […] In 2009, 140 banks failed, and a recent report from financial consulting firm Klaros Group says that hundreds of banks are at risk of going under this year. It’s being billed mostly as a danger for individuals and communities than for the broader economy, but for stressed lenders across America, a string of small bank failures could quite […]

In 2009, 140 banks failed, and a recent report from financial consulting firm Klaros Group says that hundreds of banks are at risk of going under this year. It’s being billed mostly as a danger for individuals and communities than for the broader economy, but for stressed lenders across America, a string of small bank failures could quite […] Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […]

Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […]