Gold Trudges Forward

The following article was written by Mary Anne and Pamela Aden for the July 2011 edition of Peter Schiff’s Gold Letter.

The answer is no. Even though gold is currently under pressure, the major trend remains up and the fundamentals are still very positive.

Let’s Look at the Facts

We’ve been talking about gold demand for years, and as each year passes, demand gets stronger. China has been a big influence, as it’s been committed to buying gold for several years now.

China has also been encouraging its citizens to buy gold. With its middle class now larger than the total population of the US, demand from its people and government have soared.

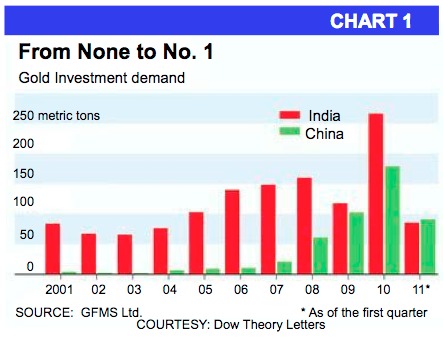

According to the World Gold Council (WGC), gold demand was up 11% in the first quarter of this year, in large part due to China. Chart 1 provides a good example of this:

Note that China’s physical gold demand was only 9% in 2007, while India’s accounted for 61% of the world’s total. This year so far, China surpassed India for the first time ever, as its demand for gold doubled!

China now accounts for 25% of global investment demand versus 23% from India. Its jewelry demand also well outpaced India’s, rising 21% compared to India’s 12%.

If 2011 proves to see robust buying for the rest of the year, as the WGC projects, we’ll probably see China surpass India for the whole year.

Uncertainty Is Key

Uncertainty is the main reason why gold buying will remain strong this year.

This was clearly seen last month as gold coin sales were hitting 2011 highs, even with softening commodities prices. This reinforces that gold’s biggest bull market in decades is still super-strong and the upside is wide open over the long haul.

Coins and bars have been the most popular ways to buy gold, up 52% this year.

Central bank buying jumped up too in Q1, exceeding the combined total of net purchases during the first three quarters in 2010.

This bubbling enthusiasm is starting to spill into the US, with Utah on the cutting edge. Utah was the first state to legalize gold and silver coins as currency last month and it will exempt capital gains tax on coin sales. Utah wants to see the dollar regain its former glory.

This also serves as a protest against the Fed’s monetary policy. Plus, other states, like Minnesota, North Carolina and Idaho, are looking to do something similar.

Gold is a less volatile store of value than silver, which is why central banks mainly buy gold, and in turn it’s why it’s more stable than silver.

New investors, however, have been jumping into silver. They feel it’s cheaper and they believe the fundamentals for owning gold also apply to silver. This is alright, as long as they’re prepared for a more bumpy ride.

A Rest Would Be Normal Now

Some investors are now taking profits and selling gold, which is coinciding with the normally weak summer months. This is normal following such a strong rise.

For now, if the gold price stays below $1492, a downward correction could take it down to possibly test its major support, the 65-week moving average, currently at $1340. If this were to happen, it would be an 14% decline from the record high, which again would be totally normal, providing a great buying opportunity.

Mary Anne and Pamela Aden are authors of The Aden Forecast, an investment newsletter now in its thirtieth year. It is one of the longest continually published investment newsletters in the world. They specialize in the precious metals and foreign exchange markets, as well as the US and international equity and credit markets.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […]

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […] Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […] The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

Leave a Reply