The Politicos Trading Gold Stocks

When members of Congress aren’t passing laws, holding committee meetings, or more cynically fundraising endless dollars, some of them choose to pass the time by trading stocks. And for whatever reason, keen insight or perhaps insider trading, members of Congress tend to beat the market.

A report by the website, Unusual Whales, shows that in 2023, Congress beat the market once again, with Democrats doing better at trading stocks than Republicans. And just because politicians in Washington tend to love fiat currency and hate gold, doesn’t mean that they’re averse to trying to make money from gold and other precious metals.

In fact, there are members of Congress who are actively trading stocks related to precious metals, such as shares in gold-mining companies. While not all investments are public, Congress members have to report some financial transactions due to the STOCK Act and transactions can be found online, including from the website, Capitol Trades.

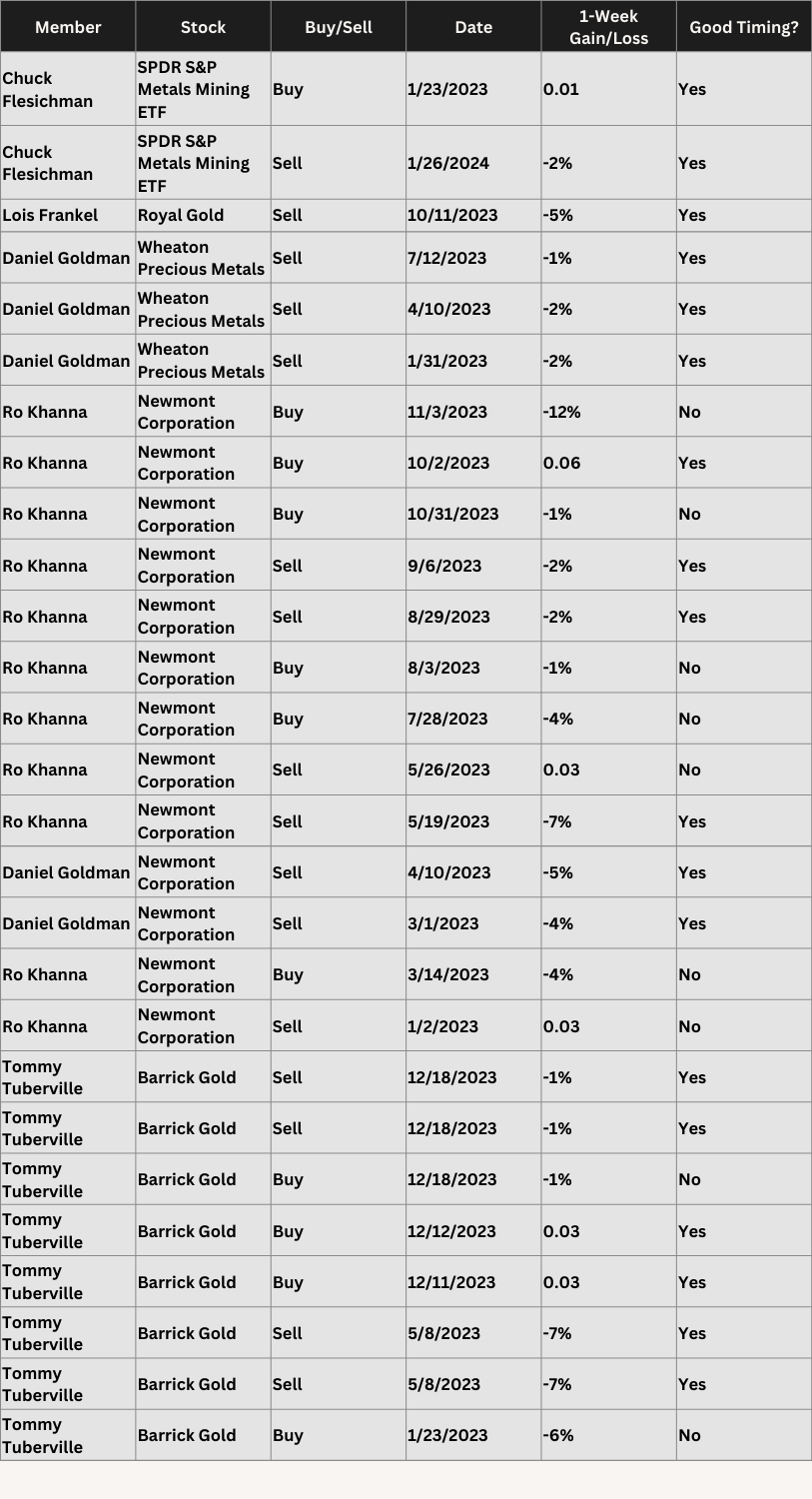

Here is a table of the Congress members who in 2023 or later traded any of these gold and precious metal-related stocks or ETFs. The companies examined are SSR Mining; Sibanye Stillwater; Osiko Gold; B2Gold; Pan American Silver; Royal Gold; Wheaton Precious Metals; Newmont; Agnico; Barrick Gold Corp; and the SPDR S&P Metals Mining ETF. And here’s how much the stock changed in the approximate week following the transaction with data from MarketWatch. (Historical data is sometimes reported weekly and may not be from the exact date of transaction). The final column indicates whether the member appears to have timed their transaction correctly such as selling before a decline or buying before an increase.

Table 1. Congress members trades of precious metal-related securities

One takeaway is that members of Congress look like they’re timing the short-term market fluctuations well. It’s hard to say conclusively since we don’t know the member’s overall investment strategies or the tax implications and so forth. But most of the time the members appear to sell before declines or buy before increases.

It also does not look like transactions of precious metal stocks are timed according to the Federal Reserve’s changing interest rates. The Federal Reserve changed rates four times in 2023 but Congressional transactions are not bunched around them.

But the frequent stock trading of members of Congress, including precious metal stocks does raise a question. Congress members might be happy with volatile fiat currencies and stock market investments, especially because they perform strangely well, but wouldn’t it be better for American workers, families, and investors if our economy were based around a more stable store of value and medium of exchange?

In 2009, 140 banks failed, and a recent report from financial consulting firm Klaros Group says that hundreds of banks are at risk of going under this year. It’s being billed mostly as a danger for individuals and communities than for the broader economy, but for stressed lenders across America, a string of small bank failures could quite […]

In 2009, 140 banks failed, and a recent report from financial consulting firm Klaros Group says that hundreds of banks are at risk of going under this year. It’s being billed mostly as a danger for individuals and communities than for the broader economy, but for stressed lenders across America, a string of small bank failures could quite […] Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […]

Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […] California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […]

California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […] The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […]

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […] Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]