Getting a Handle on the Gold Bull

The following article was written by Mary Anne and Pamela Aden for the February 2011 edition of Peter Schiff’s Gold Letter.

The year ended with a bang – record or multi-year highs in gold, copper, silver, palladium, cotton, tin, cattle, and other commodities. 2010 was a particularly great year for the precious metals, as they beat stocks, bonds, and the dollar. It seems like a perfect moment to take stock of gold’s bull run and forecast where it might go next.

The year ended with a bang – record or multi-year highs in gold, copper, silver, palladium, cotton, tin, cattle, and other commodities. 2010 was a particularly great year for the precious metals, as they beat stocks, bonds, and the dollar. It seems like a perfect moment to take stock of gold’s bull run and forecast where it might go next.

Gold has now closed in on 10 years of consistent yearly rises, gaining 30% in 2010. Silver was even more impressive, gaining 83.5% last year. Yet, with all this bullishness, Americans are just now becoming aware of the lasting power of precious metals. Disbelief is turning into acceptance.

Gold’s Bull Market

If we had to pinpoint a time during the last 10 years when the gold price broke out into a full-on bull market, we’d have to say it was in 2005, when the $500 level was clearly broken. That was a key level at the time and this break out coincided with the launching of gold’s ETF, GLD.

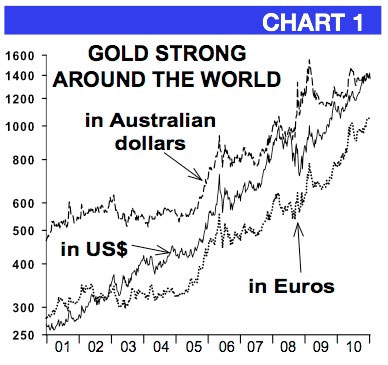

This is when we saw gold really take off in terms of all major currencies (see Chart 1), indicating that a significant monetary shift was underway. Once the bull market started heating up, gold never looked back until it surpassed the 1980 record high in 2008.

Then, the financial crisis pushed gold down in the sharpest correction since the bull market began – yet gold still closed 2008 up on the year. Most impressively, it didn’t take gold but a few months to reach a new high once again.

Gold entered a stronger phase of the bull market along the way in September 2009, and all signs have pointed to a continued run up.

The national debt, for instance, just reached the $14 trillion mark, skyrocketing from $9 trillion in just three years. That’s a 55% rise, which is moving in tandem with gold. They are rising together…

Bull: Time for a Rest

This month, however, the bull has been taking a breather. The question is: has the worst of the correction already past or will it match last February, when gold fell 13.3%? We’ll soon find out, but a correction at this point is not at all unusual. In fact, gold was overdue for a correction after its long and strong rise.

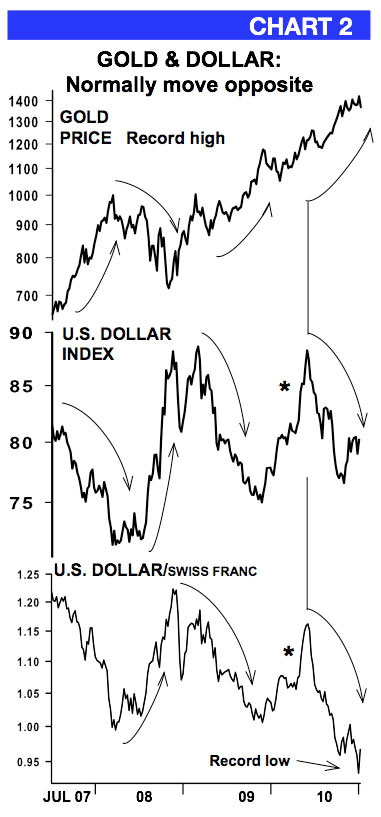

Gold tends to move opposite to the dollar, as you can see on Chart 2. The dollar and other currencies have been volatile compared to gold’s steady rise over the last two years. Readers might note that about a year ago, the dollar rose with the gold price (see asterisk). However, this wasn’t a strong dollar at all, but rather the fallout from the euro crisis. The dollar went on to fall sharply, especially versus the Swiss franc (against which it fell to a record low).

This relationship suggests that gold could correct further as the dollar continues to show strength. While the Fed’s bond buying is very bullish for gold long-term because it’ll eventually lead to inflation, it is also stabilizing the economy in the short-term, which is bolstering the dollar. With the economy looking better and the dollar stabilizing, gold’s safe haven status has taken a back seat… for now.

On top of the macro factors, profit-taking has taken over in a market that went higher than most expected this past year. Investors who let their trades ride through the holidays will typically use January and February to liquidate and re-allocate. We may see a large segment of investors who sold gold stocks come back to buy physical gold, as hope evaporates for a recovery and the US faces a double dip.

For gold, a 10% – 15% decline from last year’s high would be a healthy one and would show overall bull market strength. This means a decline to the $1280-$1200 level is nothing to panic over. This level coincides with the 65-week moving average, the major support level, now at $1220.

Discarding the 30% crisis drop in 2008, the worst decline in this decade-old bull market was in 2006, when gold fell 22%. A similar decline could take gold down to the $1110 level, but this is unlikely. Overall, we think the 65-week moving average could be tested, but last July’s low at $1158 is unlikely to be violated. Use upcoming weakness to buy with both hands.

Mary Anne and Pamela Aden are authors of The Aden Forecast, an investment newsletter now in its thirtieth year. It is one of the longest continually published investment newsletters in the world. They specialize in the precious metals and foreign exchange markets, as well as the US and international equity and credit markets.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […]

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […] Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […] The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

Leave a Reply