Gold and Silver Being Re-Monetized

The following article was written by Mary Anne and Pamela Aden for the December 2010 edition of Peter Schiff’s Gold Letter.

Silver is skyrocketing far above the maddening crowd. It’s up 65% in just over three months – clearly the best performing asset this decade.

Silver is skyrocketing far above the maddening crowd. It’s up 65% in just over three months – clearly the best performing asset this decade.

Gold is in full gear too, barely looking back over the last two years. It has practically doubled since the heat of the financial crisis (see Chart 1).

Forecast Confirmed

We have been talking about this rise for years. Since the early 2000s, we’ve believed a major shift was starting; then, as the years went by, the ongoing rise in precious metals reinforced this new era.

And now with gold and silver soaring in their tenth year of a bull market, the world is finally taking notice. It’s about time, considering it’s been the longest winning streak since the 1920s.

Johnnies Come Lately, with Doubts

Many didn’t even know the rise was happening, but with this eye opener, they now feel a bubble is here simply because bubbles have been more commonplace over the last 15 years.

From the tech bubble to the real estate bubble to the debt bubble to the bond bubble, it’s become easy to call a rising market a bubble.

We clearly believe that gold and silver are far from being in a bubble. They are slowly reclaiming their place in the monetary system after being totally absent for many decades. This takes time.

Robert Zoellick, the World Bank president and former US Treasury official, in a bold statement earlier this month, said a new system is needed using a basket of currencies and gold as a reserve. This was an incredible breakthrough – a global monetary authority acknowledging that gold is the ultimate reserve currency.

Dollar on the Brink

We are in an extremely unique and dangerous circumstance where the normal is abnormal. Under this umbrella, it’s not unusual to see gold and silver (and the commodity sector) thrive. It’s the perfect storm, with strong demand coinciding with uncertainty and monetary vulnerability, which in turn causes even more demand buying.

“Don’t fight the Fed” has been an age-old piece of wisdom among market-watchers. And it’s even more true today. The Fed is throwing billions out into the world – whatever it takes to push down interest rates.

And thus, the real story lies with the 30-year yield on US Treasuries. Low interest rates have been good for gold because they take away the advantage of holding currencies. Since gold does not pay interest but is immune from the effects of arbitrary inflation, currencies need to offer a certain yield level to compete. Too-low interest rates are the best environment for a strong gold price.

To be clear, rising interest rates can still be bullish for gold, as long as they stay below the level that would stabilize or strengthen the dollar.

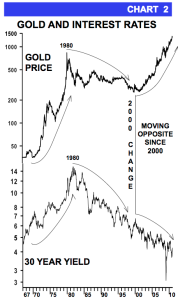

Chart 2 shows you the gold price and the 30-year yield since 1967. Gold and interest rates rose together in the 1970s as the dollar fell. Then, they fell together for the two decades starting in 1980, after the dollar was stabilized.

Now, we’ve entered a new market dynamic where gold is rising but interest rates are falling. This illustrates the level of distortion introduced by China, and now the Fed, buying so many Treasuries. Soon, interest rates will start to rise again; but, in the shadow of a $13.8 trillion national debt, we don’t expect the Fed to raise them enough to break gold’s bull run.

Prices Are Relative, Profits Are Real

We are very happy for our readers who have great profits building. We have been recommending holding a high position in gold and silver since 2002. This hasn’t been easy, we know, because many times you’ve ridden through volatile ups and downs. But we congratulate those of you who have stayed the course.

We also understand the concern of newcomers who constantly ask, “Is it too late to buy now?” The answer is no, it’s not too late to buy. At near-$1400 gold and almost $30 silver, it’s likely soon time for a downward correction. The major bull market, however, has much further to go.

It’s all relative in the end. You may remember when India bought tons of gold a year ago near $1000. The world was surprised they paid such a high price, but now we’d be lucky to buy at $1000.

On this basis, buying gold at $1400 will end up being a good price when gold nears $1800, $2000, or more. Likewise for silver… It was a fair price at $19 just last summer, whereas that’s a super bargain price today.

The point is: don’t get left behind. Buy gradually and hold for several years until the full bull market matures.

Mary Anne and Pamela Aden are authors of The Aden Forecast, an investment newsletter now in its twenty-ninth year. It is one of the longest continually published investment newsletters in the world. They specialize in the precious metals and foreign exchange markets, as well as the US and international equity and credit markets.

Get Peter Schiff’s latest gold market analysis – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […]

Cocoa prices have dumped since rocketing to a dramatic peak last month as an El Nino cycle winds down and traders rush out of the illiquid market. For now, depreciating fiat currencies are still keeping the cocoa price still far above its 2023 levels. Coffee has had a similar rise and subsequent correction — but now, inflation and other factors are conspiring to […] California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […]

California’s government bet that they knew better than the free market. And now millions are paying the price. The story begins in 1919, when the city of Berkley, California instituted legislation setting aside districts that would only allow the construction of single-family housing. The idea spread, and soon much of California’s urban areas had adopted the zoning policy. Today, approximately 40% of the total land in Los Angeles is […] The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […]

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […] Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

Leave a Reply