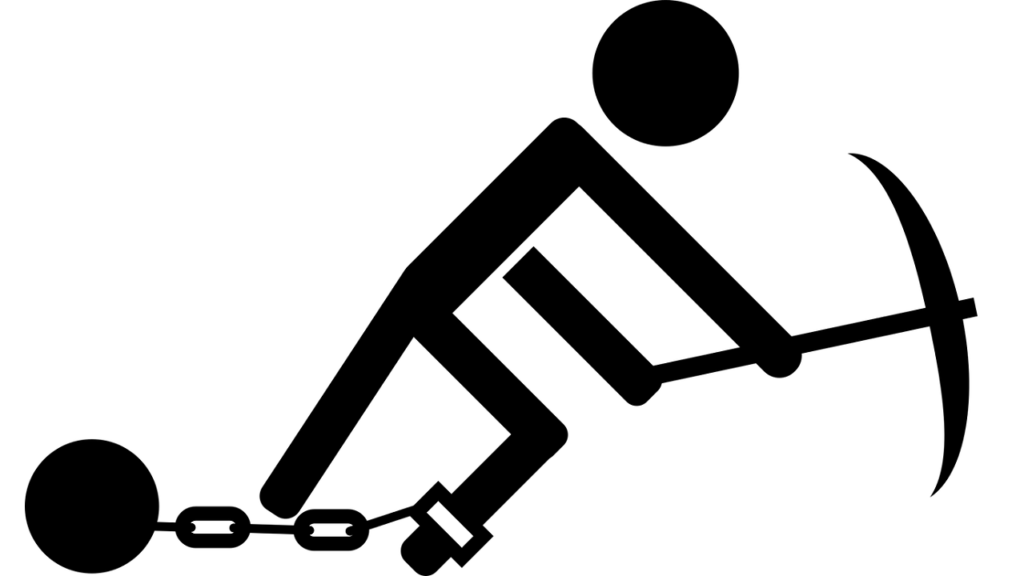

Government “Job Creation” Is a Big Drag on Society

Millions of people are collecting unemployment. Meanwhile, businesses across the country are having a hard time filling positions.

In what kind of world does this make sense?

Only in a world where the government pays big money for people to stay at home.

The fact is, the mess in the labor market is largely a product of government policy. Government shutdowns threw millions out of work. Then the government subsidized the unemployed, making staying home a better deal than going to work.

Now Biden wants to sweep in and help some more.

The theory is that all of these big-spending programs will put people to work. But as economist Gary Gallas argues in a recent article at the Mises Wire, even if the government “puts people to work,” it’s not helping.

Many of the jobs created directly or indirectly by government policies impose costs on society rather than producing benefits. Such job creation worsens rather than improves Americans’ well-being.”

The most obvious example is the thousands of people who work in the “crazy-quilt of federal executive agencies” with all of their mandates, regulations, czars, etc.

Peaceful wealth creation arises from voluntary agreements among people, but the primary activity of the regulatory state is often to interfere with mutually productive jobs, undermining social coordination and destroying wealth. Imposing added constraints on voluntary productive arrangements does create some jobs, but that acts as a massive regulatory tax on jobs that benefit other people.

Professors Susan Dudley and Melinda Warren have studied federal regulatory agencies that explicitly restrict private sector transactions. They found 277,000 such regulators in 2015 (substantially larger than General Motors’ worldwide workforce) and an eighteenfold increase in those agencies’ inflation-adjusted budgets since 1960, to over $57 billion (in 2009 dollars).

Gallas said on top of all the jobs the government creates, a network of parasitic private sector jobs also evolves to support them.

Government’s increasing redistributive power over every wallet also means more lobbyists are hired to help special interests benefit at others’ expense. That, in turn, pushes others to hire more lobbyists to minimize the extent of robbery they will be forced to bear. The expanded fight to control federal government theft creates influence industry jobs, which have dramatically stimulated the economy in Washington, DC, but which produces a negative-sum game that destroys wealth for people everywhere else.

Similarly, when laws or rules of questionable constitutionality or legality are promulgated, it increases the number of lawyers and legal resources government employs. It also increases the number employed by those who would be abused. Such opposition can be one of the most valuable investments for Americans in stopping such inroads on people’s rights, but even fighting them to a standstill leaves Americans no better off than if those overstepping initiatives had not been advanced in the first place.

Yet all of this government “job creation” is sold to us as some great societal good. It isn’t.

Such job creation may boost the employment numbers Biden desires, but they block rather than boost our well-being.”

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run? Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […]

Gold hit a new all-time nominal high, surpassing the previous record set in December of the previous year. The precious metal’s price reached approximately $2,140, indicating a robust and continuing interest in gold as a safe-haven asset, despite a rather peculiar lack of fanfare from the media and retail investors. This latest peak in gold […] The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.

The gold price has been surging, with unprecedented central bank demand gobbling up supply. It has been a force to behold — especially as US monetary policy has been relatively tight since 2022, and 10-year Treasury yields have rocketed up, which generally puts firm downward pressure on gold against USD.  Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]

Total gold demand hit an all-time high in 2023, according to a recent report released by the World Gold Council. Last week, the World Gold Council (WGC) released its Gold Demand Trends report, which tracks developments in the demand for and use of gold around the world. Excluding over-the-counter (OTC) trade, 2023 gold demand fell slightly from 2022 […]