Negative Interest Rates a Sign of Imminent Collapse

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

This article was submitted by Addison Quale, SchiffGold Precious Metals Specialist. Any views expressed are his own and do not necessarily reflect the views of Peter Schiff or SchiffGold.

With apologies to Freddy Mercury and Queen, it looks like another one has just bit the dust.

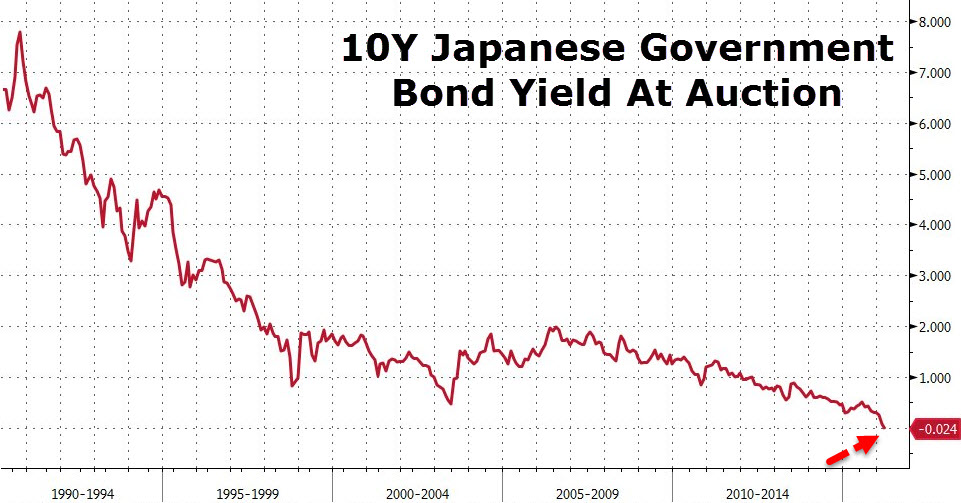

You can now add the Japanese central bank to the list of banks that have ventured deep into negative interest rate territory with the sale of a negative rate bond.

The Swiss are already languishing in that territory with negative rates out on their 20 year bond – if you can believe it. Steve Barrow, a G10 strategist at Standard Bank tells us that there will be others soon enough. He contends that, “Germany will get there as well, and yields will continue falling, going negative where they aren’t negative.”

Negative rates aren’t just the latest strategy to stimulate growth being pulled out of central bankers’ toolboxes. They are the end-game of the international monetary system as it effectively destroys capital.

And negative interest rates are a clear signal that collapse is not only coming, it is imminent.

The gold and libertarian community likes to fixate on inflation as though that’s the key indicator of impending collapse. It is not. Inflation can be affected by a myriad of things – including economic downturn. Just because a hyperinflation isn’t happening doesn’t mean the system isn’t foundering and inching towards destruction. Interest rates are actually a better indicator of this.

You’d like to think that the US Federal Reserve is immune to such influences—except they just tried to raise rates in December, and yields still went down afterwards. In other words, the Fed is not in control. No central bank is.

US interest rates have now been pathologically falling for over three decades and we are past the point of no return.

Be prepared for the worst.

Get Peter Schiff’s most important Gold headlines once per week – click here – for a free subscription to his exclusive weekly email updates.

Interested in learning more about physical gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […]

The yen was once known as a safe-haven currency for investors to protect themselves when broader markets are shaky or other currencies are dropping, but those days are numbered. A stable government and consistent (and low) interest rates have been some of the driving factors, but it’s the unwinding of that ultra-low interest rate policy that will be the yen’s “safe […] Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […]

Whenever an election year rolls around, domestic manufacturing becomes a more central theme of discussion. Candidates from both sides, who seem to disagree on almost everything else, never waver in their commitment to auto manufacturers in Detroit and the steel industry. Republicans and Democrats never forget to remind the American public that they will try […] The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […]

The wizards at the Fed and US Treasury have been forced to acknowledge that their “transitory,” inflation is, in fact, quite “sticky.” And with the inflation elephant now acknowledged by the circus of high finance, Treasury yields keep inching up, recently reaching 4.7% — the highest since November. The Fed is stuck: It needs to raise interest rates to tame inflation and […] The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […]

The solution to a problem shouldn’t make the problem worse. But apparently, California’s policy makers missed that memo. On April 1st, the state instituted a $20 minimum wage for fast food workers, the highest in the US. With California’s absurdly high cost of living, the policy appeared to make life more manageable for low-income residents. Unfortunately, as the adage goes, “If it sounds too […] The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

The monetary battle of the 20th century was gold vs. fiat. But the monetary battle of the 21st century will be gold vs. bitcoin. With Wall Street jumping into the game with bitcoin ETFs, a bitcoin halving recently splitting the block reward for miners in half, and both gold and bitcoin hovering near their all-time highs, it’s a great time for […]

Virtually the gold price remains stable for many centuries

though the quantity of money you need to buy gold

changes from time to time. With the prevailing uncertain economic conditions, many people are seeking ways to invest

in gold as security against negative inflationary activity and

as a safe, high-value investment portfolio haven. Not dumping our men and material down a bottomless fox hole

in Europe (or Korea, Viet Nam, Afghanistan or Iraq for that

matter).