Physical silver and gold isn’t just for preserving your savings. It’s also the world’s oldest form of money.

You can bypass the Federal Reserve’s worthless paper dollars by spending precious metals with friends, neighbors, and businesses which accept sound money. We’ve created a brand new Barter Metals page with all of the information you need to get started conducting business using physical gold and silver – and links to our most popular barterable products.

Barter may seem outdated, but as Peter Schiff points out, it has a long history in the US:

USAWatchdog interviewed Nomi Prins, who formerly worked as a managing director at both Goldman-Sachs and Lehman Brothers. She is the author of All the President’s Bankers and a vocal critic of central bank monetary policies. Prins agrees with Peter Schiff that more quantitative easing will come from the Federal Reserve, however, she doesn’t think they will call it that. She believes the easy money may come in the form of currency swaps between central banks.

More importantly, Prins believes that eventually the financial problems in America will become so great that normal US depositors will be forced to “bail-in” the banks one way or another, if they want to keep money in standard accounts. That’s why she recommends holding cash and buying physical gold.

India will soon have its own national gold coins.

Metals and Minerals Trading Corporation (MMTC) will manufacture and market the gold coins, set for release in October.

According to the Times of India, MMTC managing director Ved Prakash said the company plans to produce two gold coins, one weighing 5 grams and the other 10. The coins will feature engravings of Ashok Chakra and the face of Mahatma Gandhi.

While many countries have their national coins, India did not have one. These gold coins will be regarded as the national coin of India.”

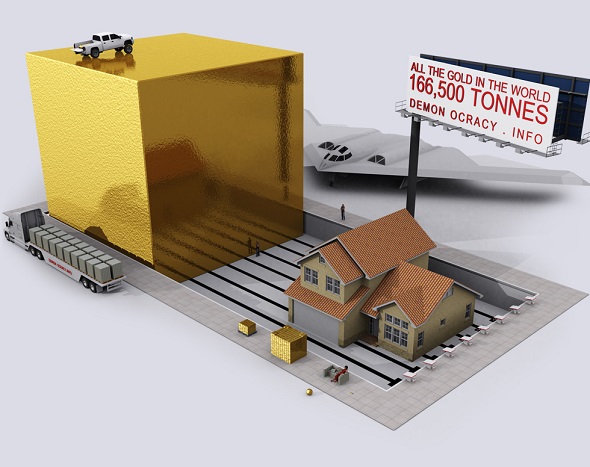

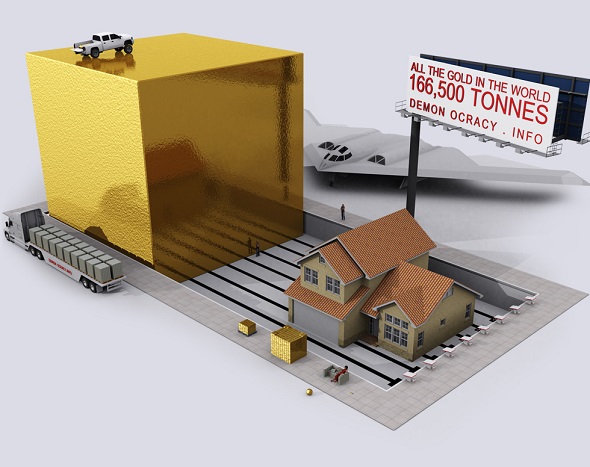

Of course, gold’s value lies in its scarcity.

But just how scarce is it, really? We all have a vague idea, but you will probably still find the reality quite shocking.

A series of 12 stunning visualizations of gold published by Visual Capitalists puts the rarity of gold into vivid perspective.

Demonocracy.info put together this series of 3D visualizations showcasing all of the world’s gold mined thus far using gold bullion bars. (Note: these visualizations are a couple of years old and optimistically have the value of gold pegged at $2,000 per ounce, presumably for the ease of calculations.)

For months, Peter Schiff has argued that the Federal Reserve cannot and will not raise the interest rate.

Most recently, Peter told CNBC Asia the Fed is pulling a “long con” on the global markets when it comes to its monetary policy. The Fed wants people to believe that a rate hike is coming, but Peter argues that we will actually see a fourth round of quantitative easing.

Now we’re beginning to hear echoes of Peter’s position on interest rate hikes from other global analysts.

In August, Peter Schiff was a guest speaker at The Jackson Hole Summit, a gathering of free-market activists warning of the dangers of overreaching central banks and irresponsible monetary policies. The Summit coincided with the official central bank conference held every year in Wyoming.

Peter’s speech was titled “Monetary Roach Motel: There Is No Exit from the Fed’s Stimulus”, and he reprised his consistent message of how the Federal Reserve created the economic problems it is pretending to solve. Peter also spent some time exposing Janet Yellen’s terrible track record as an economic forecaster.

Alex Jones spoke with Peter Schiff for an entire hour on InfoWars yesterday. They had a wide-ranging discussion, including the tragic plight of Peter’s father Irwin, a political prisoner held in poor conditions. They also talked about the Federal Reserve’s monetary policy, the next round of quantitative easing, the Pope’s economic message and visit to America, and the complicated refugee problems in the Middle East.

I think this thing started to unravel in 2008… This is the unwinding of the massive bubble that began in 1971, when we went of the gold standard… Guys like my dad were criticizing it back in the ‘70s. He saw it coming from a mile away… If you go back and read my dad’s book ‘The Biggest Con’, which came out in 1973, 1974… It’s amazing how far into the future my father saw, and how much of what he wrote in that book has happened since he wrote it…”

CNBC Asia spoke with Peter Schiff last night. The anchors acted surprised when Peter suggested the Federal Reserve is pulling a “long con” on the global markets when it comes to its monetary policy. The Fed wants people to believe that a rate hike is coming, but Peter argues that a fourth round of quantitative easing is what we will actually see. How should investors prepare? Buy non-dollar investments and hard assets, like gold and silver.

I’ve been positioning myself in non-dollar investments… I think gold looks like it has probably put in a bottom. We’ll have to see… I do expect a spectacular reversal when people figure this out. It took a while for the people who were buying subprime mortgages to realize that what they were buying was worthless. But eventually the bottom dropped out of the market, and I expect the same thing to happen again when people figure out the truth behind the US economy and what the Federal Reserve is actually going to do – not what they’re pretending they’re going to do.”

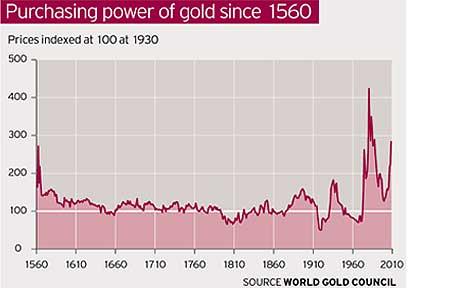

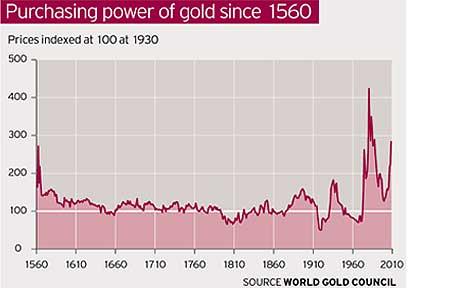

Gold represents stability.

Buying gold makes a lot of sense as historically, gold holds its value. It also maintains a relatively constant level of purchasing power, especially when compared to the US dollar.

In 1976, University of California Professor Roy Jastram completed a long-term analysis of gold’s purchasing power stretching all the way back to 1560 and published his finding in The Golden Constant: The English and American Experience, 1560-1976. He found gold’s purchasing power remained remarkably stable over that period, as reported by the London Telegraph.

Todd “Bubba” Horwitz explained to Kitco the fundamental reasons for buying gold and silver right now. He agrees fully with Peter Schiff that the Fed won’t raise rates anytime soon: