A Snapshot of Global Silver Demand

This post was submitted by Erik Oswald, SchiffGold Precious Metals Specialist.

Sales of the US Silver Eagle are often looked to as the leading indicator of demand for silver bullion coins. It remains the most popular bullion coin among investors both domestically and internationally.

While the Eagle has been in the limelight for nearly a decade among investors, bullion coins from smaller national mints have also seen a dramatic uptick in demand. There has also been a massive increase in ETF purchases of physical silver and substantial industrial demands from the growing solar industry.

Louis Cammarosano from Smaulgld guides us through the growing demand for silver on the industrial and investment fronts.

Silver Supply and Demand

From October 1, 2012 through October 21, 2013 the US Mint sold 476,500 American Gold Eagles and 42,653,000 American Silver Eagles, 100 times more Silver Eagles than Gold Eagles – far exceeding the 2013-2014 gold silver ratio of about 62:1.

Indeed, 2013 was a record year for American Silver Eagles sales, and a record year for overall silver demand. Sales of American Silver Eagles in 2014 are on pace to surpass last year’s record sales.

American Silver Eagle Demand

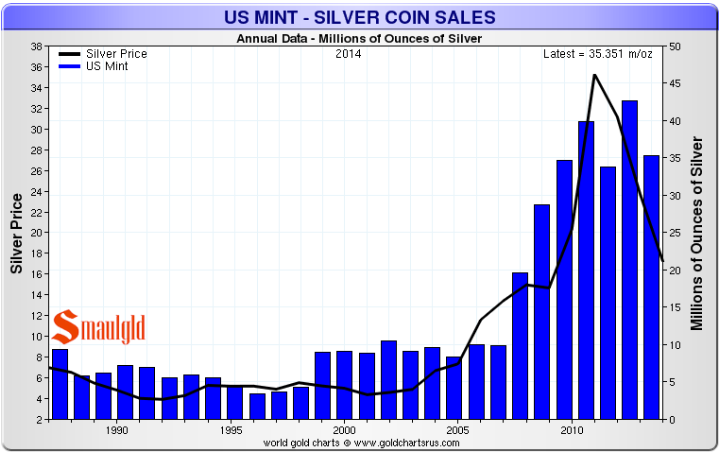

American Silver Eagle Coin Sales 1986-2014

American Silver Eagle coin sales have soared since the financial crisis of 2008.

American Silver Eagle coin sales have soared since the financial crisis of 2008.

Silver Demand

In recent years, the demand for silver has been a little more than 60% industrial, with the remainder divided between jewelry, silverware, and investment. With the recent surge in silver coin and bar sales, industrial silver demand is now closer to 50%.

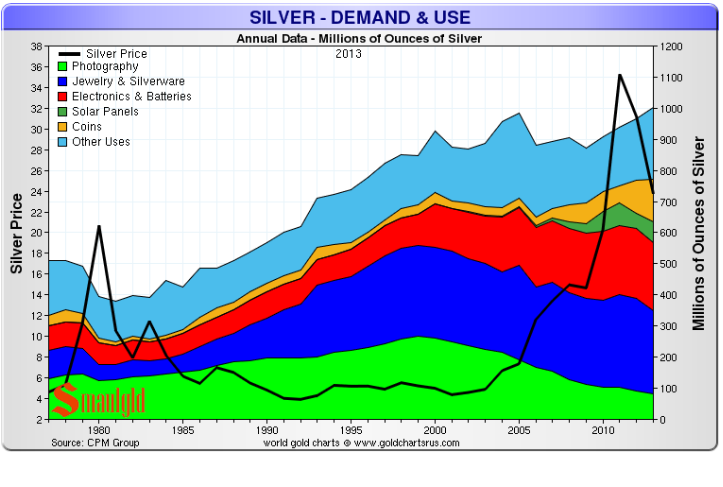

Presented below are charts showing silver demand by uses from data derived from each of the CPM Group and the Silver Institute. Both charts show an increase in demand and a decline in the price of silver.

Silver Demand By Uses 1975-2012 – CPM Group

Silver demand for use in solar panels and silver demand for coin and bar fabrication have offset a decline in silver demand for uses in photography.

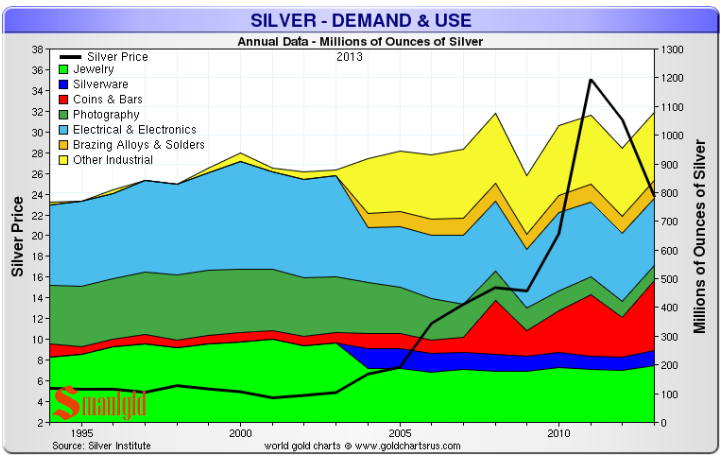

Silver Demand By Uses 1994-2013 – The Silver Institute

Demand for silver continues to grow driven by silver coin and bar sales and new industrial uses.

Demand for silver continues to grow driven by silver coin and bar sales and new industrial uses.

Silver Coins and Bars

Record silver demand in 2013 was led by a 76% increase in demand for silver coins and bars from the prior year. The largest government mints in the Australia, Austria, Canada, China and the United States have seen rapid growth in their coin sales.

Australia

The Perth Mint, founded in 1899 as a branch of the British Royal Mint, produces a wide variety of silver and gold coins usually featuring Australian wildlife (e.g. Crocodiles, Koalas, Kangaroos, and Kookaburra). Silver sales at the Perth Mint have grown steadily the past few years. The Perth Mint sold over 8.6 million ounces of silver in 2013 and is on pace to sell about eight million ounces in 2014.

Austria

The Austrian Mint, a subsidiary of the National Bank of Austria, produces the Austrian Silver Philharmonic coin. This is Europe and Japan’s largest selling silver bullion coin, with sales over 50 million from 2008-2013.

Canada

The Royal Canadian Mint (RCM) produces a variety of silver Maple Leaf coins. The Canadian Silver Maple Leaf coin was introduced by the RCM in 1988 for collectors. The RCM has sold over 125 million Silver Maple Leaf coins since 1988 when it was first minted and sold a record 28 million in 2013.

China

The official mint of the People’s Republic of China has been producing Silver Panda coins since 1983. Approximately 40 million one-ounce Chinese Silver Panda coins have been sold from 1983 to 2014. In the past few years, China has ramped up its annual production of one ounce Chinese Silver Pandas from 600,000 annually to 8,000,000 a year the past three years.

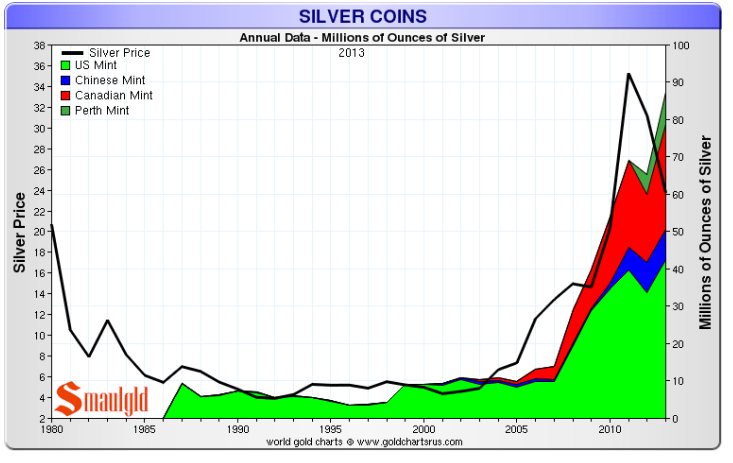

Silver Coin Sales at the US, Chinese, Canadian, and Perth Mints

Silver coin sales from the major government mints continue to surge as the price of silver dips.

Silver coin sales from the major government mints continue to surge as the price of silver dips.

The chart does not include sales of silver rounds and bars from private mints like the Northwest Territorial Mint, Sunshine Minting Inc., and OPM.

What’s Next For Silver?

An Entire Year’s Global Silver Production is Worth Just $14 Billion

The silver market is so small that one extremely wealthy person could buy an entire years’ global mining production worth of silver. In 2013, the total silver mined world wide was 819 million ounces. At a price of $17.50 an ounce that is only approximately $14.3 billion! In a such small market anything can happen quickly.

Will growing demand for physical silver and lower supply relative to that demand eventually manifest itself in higher prices?

Follow us on Twitter to stay up-to-date on Peter Schiff’s latest thoughts: @SchiffGold

Interested in learning about the best ways to buy gold and silver?

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift?

As fiscal imbalances persist, driven by coercive measures and artificial currency creation, the middle class faces erosion and purchasing power dwindles. But as the world hurtles towards a potential reckoning, the lingering question remains: can this precarious balance last, or are we teetering on the brink of a cataclysmic economic shift? Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […]

Since Nayib Bukele became president of El Salvador, El Salvador has been in American media and global political discussion more than ever. While much of the attention focuses on Bukele’s mass incarceration of gang members and a decline in homicide of over 70%, Bukele has also drawn attention to his favoritism towards Bitcoin and how he […] Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy.

Beneath the veneer of headline job gains, the American economy teeters on the brink: native employment dwindles as part-time and immigrant jobs surge. Government hiring camouflages looming recession warnings. Inflation and political blunders worsen the crisis, fueling public outrage at the establishment’s mishandling of the economy. On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […]

On April 5 1933, Franklin D. Roosevelt abandoned the gold standard, wielding questionable legal power amidst America’s dire economic depression. His whimsical approach to monetary policy, including coin flips and lucky numbers, unleashed unprecedented inflation and price increases that have since amounted to nearly 2500%. Our guest commentator explores this tragic history and the legacy […] With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

With gold hitting yet another awe-inspiring all-time high in the wake of Powell’s remarks reassuring markets (more or less) to expect rate cuts in 2024, a few analysts are pointing out risk factors for a correction — so is there really still room to run?

Leave a Reply